990 Ez C 2017

What is the 990 EZ C

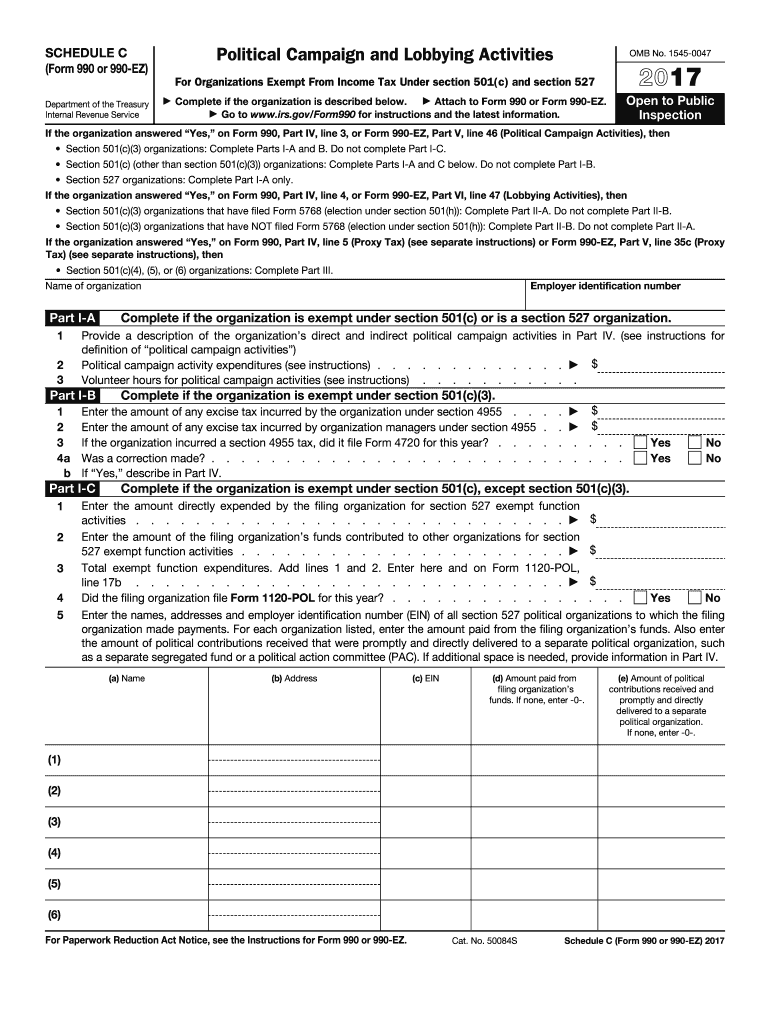

The 990 EZ C form is a simplified version of the standard IRS Form 990, designed for smaller tax-exempt organizations. This form allows eligible organizations to report their financial activities, governance, and compliance with federal tax regulations. It is specifically tailored for organizations that meet certain income and asset thresholds, making it easier to file while still providing necessary information to the IRS and the public.

How to use the 990 EZ C

Using the 990 EZ C involves several key steps. First, organizations must determine their eligibility based on gross receipts and total assets. Once confirmed, they can download the form from the IRS website or obtain a physical copy. After filling out the required sections, organizations must ensure all necessary attachments are included, such as schedules that provide additional details on revenue and expenses. Finally, the completed form must be submitted by the designated deadline to avoid penalties.

Steps to complete the 990 EZ C

Completing the 990 EZ C requires careful attention to detail. Begin by gathering all relevant financial documents, including income statements and balance sheets. Next, fill in the organization’s basic information, such as name, address, and Employer Identification Number (EIN). Proceed to report revenue, expenses, and net assets. Be sure to complete any applicable schedules that provide further details on specific income sources or expenditures. After reviewing the form for accuracy, the final step is to sign and date it before submission.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the 990 EZ C to remain compliant. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the form would be due on May 15 of the following year. Extensions may be available, but organizations must file the appropriate request before the original deadline to avoid late penalties.

Required Documents

When preparing to file the 990 EZ C, several documents are essential. Organizations should collect financial statements that detail income and expenses, as well as any supporting documentation for revenue sources. Additionally, records of governance, such as board meeting minutes and policies, may be required to demonstrate compliance with IRS regulations. Ensuring all necessary documents are ready will facilitate a smooth filing process.

Penalties for Non-Compliance

Failing to file the 990 EZ C on time or submitting incomplete information can lead to significant penalties. The IRS may impose fines based on the organization’s gross receipts, with increasing penalties for continued non-compliance. Additionally, organizations that neglect to file for three consecutive years may lose their tax-exempt status, which can have serious implications for their operations and funding.

Quick guide on how to complete if the organization answered yes on form 990 part iv line 3 or form 990 ez part v line 46 political campaign activities then irs

Discover the most efficient method to complete and sign your 990 Ez C

Are you still spending time preparing your official documents in hard copy instead of online? airSlate SignNow provides a superior way to complete and sign your 990 Ez C and other forms for public services. Our advanced eSignature solution offers all the tools you need to manage documents swiftly and in compliance with official standards - robust PDF editing, managing, safeguarding, signing, and sharing capabilities available through an intuitive interface.

Only a few steps are required to fill out and sign your 990 Ez C:

- Upload the editable template to the editor using the Get Form button.

- Check what information you need to provide in your 990 Ez C.

- Navigate between the fields using the Next option to avoid missing anything.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Blackout sections that are no longer relevant.

- Press Sign to generate a legally valid eSignature using your preferred method.

- Add the Date next to your signature and finalize your work with the Done button.

Store your completed 990 Ez C in the Documents folder within your profile, download it, or send it to your preferred cloud storage. Our solution also offers flexible form sharing options. There’s no need to print your templates when you can submit them to the relevant public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Experience it today!

Create this form in 5 minutes or less

Find and fill out the correct if the organization answered yes on form 990 part iv line 3 or form 990 ez part v line 46 political campaign activities then irs

Create this form in 5 minutes!

How to create an eSignature for the if the organization answered yes on form 990 part iv line 3 or form 990 ez part v line 46 political campaign activities then irs

How to generate an electronic signature for the If The Organization Answered Yes On Form 990 Part Iv Line 3 Or Form 990 Ez Part V Line 46 Political Campaign Activities Then Irs in the online mode

How to generate an electronic signature for your If The Organization Answered Yes On Form 990 Part Iv Line 3 Or Form 990 Ez Part V Line 46 Political Campaign Activities Then Irs in Chrome

How to create an eSignature for putting it on the If The Organization Answered Yes On Form 990 Part Iv Line 3 Or Form 990 Ez Part V Line 46 Political Campaign Activities Then Irs in Gmail

How to generate an eSignature for the If The Organization Answered Yes On Form 990 Part Iv Line 3 Or Form 990 Ez Part V Line 46 Political Campaign Activities Then Irs from your mobile device

How to make an eSignature for the If The Organization Answered Yes On Form 990 Part Iv Line 3 Or Form 990 Ez Part V Line 46 Political Campaign Activities Then Irs on iOS

How to generate an eSignature for the If The Organization Answered Yes On Form 990 Part Iv Line 3 Or Form 990 Ez Part V Line 46 Political Campaign Activities Then Irs on Android OS

People also ask

-

What is 990 Ez C and how does it work?

The 990 Ez C is an innovative eSignature solution offered by airSlate SignNow, designed to streamline the document signing process for businesses. With its user-friendly interface, you can easily upload documents, add signers, and send them for eSignature in just a few clicks. This efficient method ensures that you can manage your documents securely and effectively.

-

What are the main features of the 990 Ez C?

The 990 Ez C includes a variety of features such as customizable templates, real-time tracking, and secure cloud storage. Users can also enjoy multi-party signing, which allows multiple stakeholders to sign documents simultaneously. These features make the 990 Ez C a comprehensive solution for all your eSignature needs.

-

How much does the 990 Ez C cost?

Pricing for the 990 Ez C varies depending on the plan you choose. airSlate SignNow offers flexible pricing tiers to accommodate businesses of all sizes, ensuring you get the best value for your eSignature needs. For detailed pricing information, visit our pricing page or contact our sales team.

-

Is the 990 Ez C secure for sensitive documents?

Absolutely! The 990 Ez C prioritizes the security of your documents by employing advanced encryption and secure data storage protocols. With airSlate SignNow, you can confidently send and eSign sensitive documents knowing that your information is protected at all times.

-

Can I integrate the 990 Ez C with other software?

Yes, the 990 Ez C offers seamless integrations with popular business applications like Google Drive, Salesforce, and Microsoft Office. This allows you to enhance your workflow and save time by managing all your documents in one place. Explore our integrations page to see the full list of compatible software.

-

What are the benefits of using the 990 Ez C for my business?

Utilizing the 990 Ez C can signNowly enhance your business operations by reducing the time spent on manual paperwork and improving overall efficiency. It also helps in minimizing errors associated with traditional signing methods, thereby increasing productivity. This easy-to-use solution is perfect for businesses looking to modernize their document management.

-

Can I access the 990 Ez C on mobile devices?

Yes! The 990 Ez C is fully optimized for mobile devices, allowing you to send and eSign documents on the go. Whether you are using a smartphone or tablet, you can manage your documents conveniently from anywhere, making it perfect for busy professionals.

Get more for 990 Ez C

Find out other 990 Ez C

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement