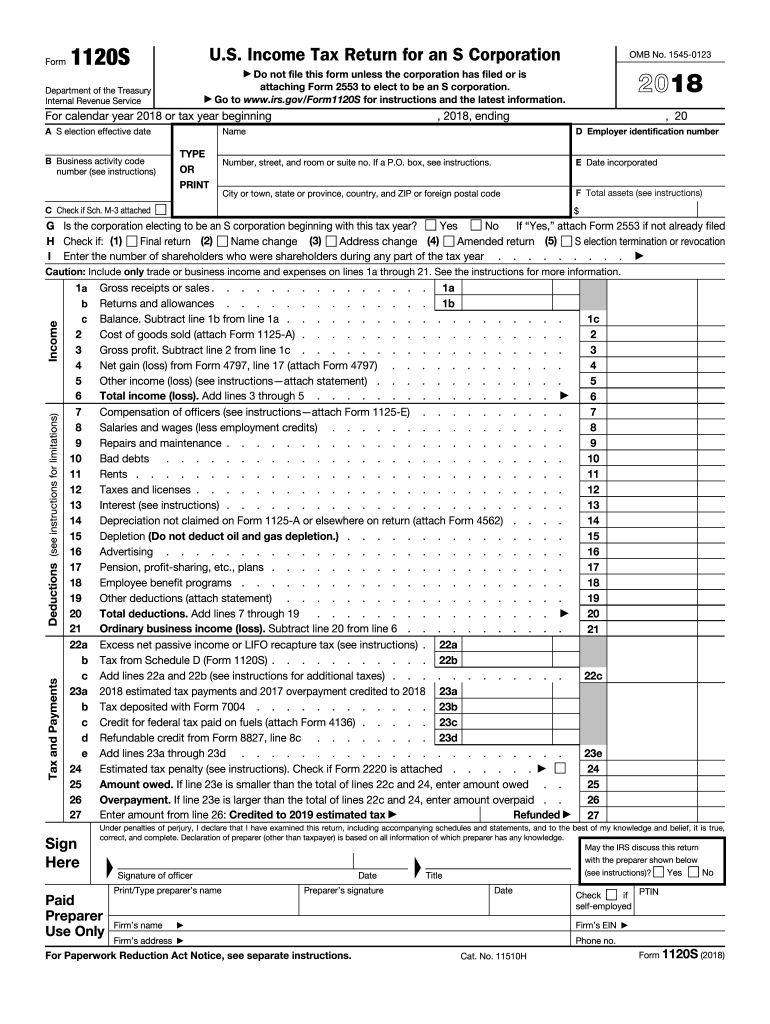

1120s Form 2018

What is the 1120s Form

The 1120s form is an essential tax document used by S corporations in the United States to report income, gains, losses, deductions, and credits. This form allows S corporations to pass income directly to shareholders, avoiding double taxation at the corporate level. It is crucial for the accurate reporting of financial information to the IRS, ensuring compliance with federal tax laws.

How to use the 1120s Form

To effectively use the 1120s form, businesses must first gather all necessary financial records, including income statements, balance sheets, and details of deductions. The form must be filled out accurately, reflecting the corporation's financial activities for the tax year. After completing the form, it should be signed by an authorized officer of the corporation before submission to the IRS.

Steps to complete the 1120s Form

Completing the 1120s form involves several key steps:

- Gather financial statements and documentation, including income and expenses.

- Fill out the form, ensuring all sections are completed accurately.

- Attach any required schedules and forms, such as Schedule K-1 for shareholder distributions.

- Review the form for accuracy and completeness.

- Sign the form and file it with the IRS by the deadline.

Filing Deadlines / Important Dates

It is important to adhere to the filing deadlines for the 1120s form to avoid penalties. Typically, the form is due on the fifteenth day of the third month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by March 15. Extensions may be available, but they must be filed on time to avoid late fees.

Required Documents

When preparing to file the 1120s form, certain documents are necessary to ensure accurate reporting. These include:

- Income statements detailing revenue and expenses.

- Balance sheets outlining assets, liabilities, and equity.

- Schedule K-1 forms for each shareholder, reporting their share of income and deductions.

- Any additional supporting documentation required by the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing and filing the 1120s form. These guidelines include instructions on how to report various types of income and deductions, as well as compliance requirements. It is essential for corporations to familiarize themselves with these guidelines to ensure accurate and compliant tax reporting.

Quick guide on how to complete 1120 s 2016 2018 form

Discover the simplest method to complete and endorse your 1120s Form

Are you still spending time generating your official paperwork on physical copies instead of handling it online? airSlate SignNow presents a superior approach to finalize and endorse your 1120s Form and comparable forms for public services. Our advanced electronic signature solution equips you with all the tools necessary to process documents swiftly and comply with official standards - robust PDF editing, management, safeguarding, signing, and sharing utilities all accessible within an intuitive interface.

Only a few steps are needed to finish filling out and signing your 1120s Form:

- Insert the editable template into the editor using the Get Form button.

- Review the information you are required to enter in your 1120s Form.

- Move through the fields with the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill the blanks with your information.

- Modify the content with Text boxes or Images from the upper toolbar.

- Emphasize what is important or Blackout sections that are no longer signNow.

- Select Sign to create a legally valid electronic signature using any option you choose.

- Add the Date next to your signature and finish your tasks with the Done button.

Store your completed 1120s Form in the Documents folder of your profile, download it, or export it to your preferred cloud storage. Our service also offers versatile file sharing. There’s no need to print your templates when submitting them to the appropriate public office - utilize email, fax, or request a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct 1120 s 2016 2018 form

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

Create this form in 5 minutes!

How to create an eSignature for the 1120 s 2016 2018 form

How to make an eSignature for your 1120 S 2016 2018 Form online

How to generate an eSignature for your 1120 S 2016 2018 Form in Chrome

How to create an eSignature for signing the 1120 S 2016 2018 Form in Gmail

How to make an electronic signature for the 1120 S 2016 2018 Form right from your mobile device

How to generate an electronic signature for the 1120 S 2016 2018 Form on iOS

How to create an electronic signature for the 1120 S 2016 2018 Form on Android OS

People also ask

-

What is the 1120s Form and who needs to file it?

The 1120s Form is a tax document used by S Corporations to report income, deductions, and credits to the IRS. If your business is classified as an S Corporation, you will need to file this form annually. It is essential for ensuring compliance with federal tax regulations.

-

How can airSlate SignNow help me with my 1120s Form?

airSlate SignNow streamlines the process of preparing and signing your 1120s Form by providing an easy-to-use platform for document management. You can quickly upload, edit, and send the form for eSignature, ensuring that you meet your filing deadlines with ease.

-

Is there a cost associated with using airSlate SignNow for the 1120s Form?

Yes, airSlate SignNow offers various pricing plans to suit different business needs, including options for handling the 1120s Form. By choosing the right plan, you can access features that simplify the eSignature process and enhance your document workflows.

-

What features does airSlate SignNow offer for managing the 1120s Form?

With airSlate SignNow, you can easily create, edit, and send the 1120s Form for signature. Key features include customizable templates, automated workflows, and secure cloud storage, all designed to make your tax filing process efficient and straightforward.

-

Can I integrate airSlate SignNow with other software for my 1120s Form?

Yes, airSlate SignNow offers seamless integrations with various accounting and business software, making it easy to manage your 1120s Form alongside your other financial documents. This interoperability enhances your workflow and ensures all your data is synchronized across platforms.

-

Is eSignature legally valid for the 1120s Form?

Absolutely! eSignatures provided through airSlate SignNow are legally valid and compliant with the ESIGN Act and UETA. This means you can confidently use eSignatures for your 1120s Form without worrying about legal implications.

-

What are the benefits of using airSlate SignNow for my 1120s Form?

Using airSlate SignNow for your 1120s Form offers numerous benefits, including time savings, increased accuracy, and enhanced security. The platform allows you to track the status of your documents in real-time and ensures that sensitive information is protected throughout the eSignature process.

Get more for 1120s Form

- Bbt directpdffillercom form

- For crfoo2 in ga form

- Alaska employer registration form 2007

- Form il 941 a 2008

- Lexington fayette urban county net profits license fee return fillable 2008 form

- Authorization to release protected nuway form

- Mail renewal application for driver license class d and cdl form 21 1900a

- Graduation requirements form

Find out other 1120s Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors