Form 4972 Instructions

What is the Form 4972?

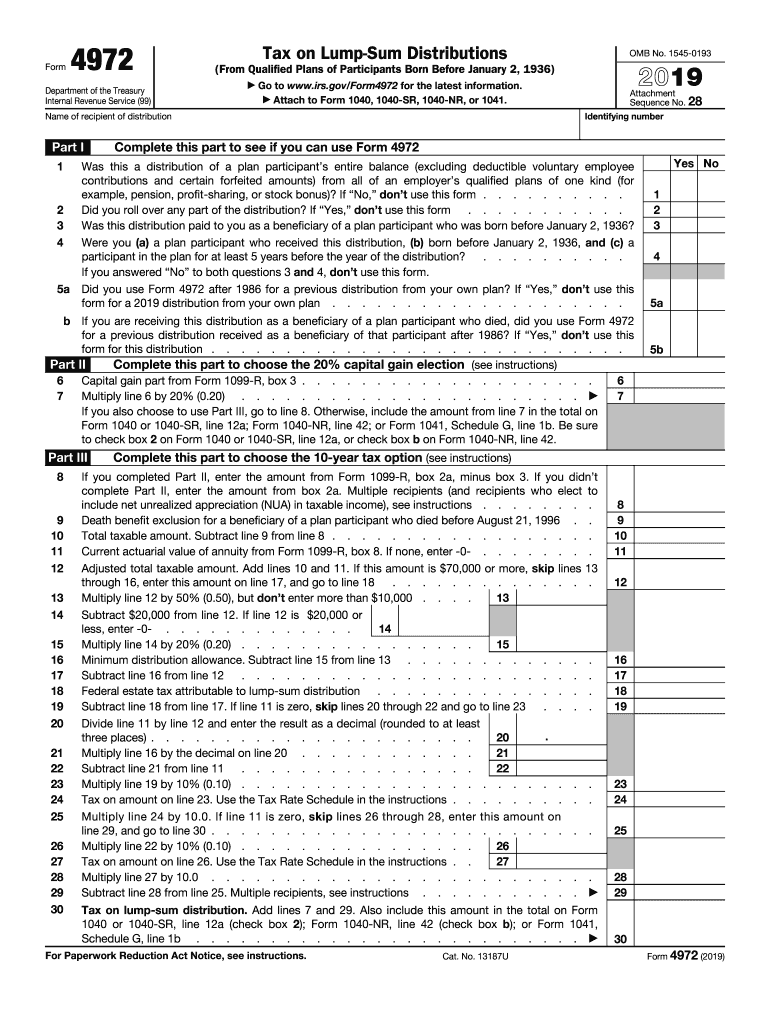

The Form 4972 is used to report a lump-sum distribution from a qualified retirement plan. A lump-sum distribution refers to the total payout of a retirement account, typically occurring when an individual retires, becomes disabled, or passes away. This form is essential for taxpayers who receive such distributions, as it helps determine the tax implications associated with the lump-sum payment. Understanding the specifics of Form 4972 is crucial for ensuring compliance with IRS regulations and accurately reporting income for the tax year.

Steps to Complete the Form 4972

Completing Form 4972 involves several key steps to ensure accuracy and compliance with IRS guidelines. First, gather all necessary documentation regarding the lump-sum distribution, including the amount received and the type of retirement plan. Next, fill out the taxpayer information section, which includes your name, Social Security number, and filing status. Then, report the total amount of the distribution and calculate any applicable tax using the worksheet provided in the form instructions. Finally, review the completed form for accuracy before submitting it with your tax return.

Legal Use of the Form 4972

Form 4972 is legally binding when completed accurately and submitted in accordance with IRS regulations. To ensure its legal validity, it is important to follow the instructions precisely and provide truthful information. The form must be signed and dated by the taxpayer to certify that the information is correct. Additionally, using a reliable eSignature solution, like signNow, can enhance the legal standing of the completed form by providing an electronic certificate that verifies the signer’s identity and compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for Form 4972 align with the general tax return deadlines set by the IRS. Typically, individual tax returns are due on April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial to submit Form 4972 by this deadline to avoid penalties and interest on any taxes owed. Taxpayers may also consider filing for an extension if they need additional time to gather necessary documentation.

Required Documents

To complete Form 4972 accurately, several documents are required. These include the statement from the retirement plan administrator detailing the lump-sum distribution, Form 1099-R, which reports the distribution amount, and any relevant tax documents that provide information about previous contributions or rollovers. Having these documents on hand will streamline the process and help ensure that all information reported on the form is accurate and complete.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 4972. These guidelines include instructions on how to report the distribution, calculate potential taxes owed, and determine eligibility for special tax treatments, such as the ten-year averaging method. It is essential to refer to the latest IRS publications and instructions for Form 4972 to ensure compliance with current tax laws and regulations. Staying informed about any changes can help taxpayers avoid errors and penalties.

Quick guide on how to complete 2019 form 4972 tax on lump sum distributions

Effortlessly Prepare Form 4972 Instructions on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents swiftly without delays. Manage Form 4972 Instructions on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to edit and eSign Form 4972 Instructions with ease

- Obtain Form 4972 Instructions and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign tool, which only takes seconds and has the same legal standing as a traditional ink signature.

- Verify the information and click the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Form 4972 Instructions and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 4972 tax on lump sum distributions

How to generate an electronic signature for the 2019 Form 4972 Tax On Lump Sum Distributions online

How to make an eSignature for the 2019 Form 4972 Tax On Lump Sum Distributions in Chrome

How to make an eSignature for signing the 2019 Form 4972 Tax On Lump Sum Distributions in Gmail

How to make an electronic signature for the 2019 Form 4972 Tax On Lump Sum Distributions from your smart phone

How to create an electronic signature for the 2019 Form 4972 Tax On Lump Sum Distributions on iOS devices

How to generate an eSignature for the 2019 Form 4972 Tax On Lump Sum Distributions on Android OS

People also ask

-

What is the 4972 2019 search and how does it work?

The 4972 2019 search refers to a specific IRS tax form that can be integral for certain tax situations. With airSlate SignNow, you can easily prepare and eSign documents related to the 4972 2019 search, streamlining the filing process and ensuring compliance with tax regulations.

-

How much does airSlate SignNow cost for handling 4972 2019 search documents?

airSlate SignNow offers various pricing plans designed to fit different business needs. Whether you are handling the 4972 2019 search or other documents, you can choose a cost-effective plan that provides the essential features for your workflow.

-

What features does airSlate SignNow offer for document management during the 4972 2019 search?

airSlate SignNow includes features like document templates, customizable workflows, and real-time tracking to facilitate the 4972 2019 search process. These tools ensure that documents are managed efficiently, making it easier for businesses to stay organized.

-

Can I integrate airSlate SignNow with other tools for the 4972 2019 search?

Yes, airSlate SignNow integrates seamlessly with numerous third-party applications. This functionality allows you to connect tools that assist in the 4972 2019 search, enhancing your productivity and streamlining your document workflow.

-

How does airSlate SignNow enhance the eSigning experience for the 4972 2019 search?

With airSlate SignNow, the eSigning process for the 4972 2019 search is simplified and secure. Users can sign documents quickly on any device, ensuring a smooth and efficient experience without the hassle of printing or scanning.

-

Are there any templates available for the 4972 2019 search in airSlate SignNow?

Absolutely! airSlate SignNow offers a variety of templates that can be used for the 4972 2019 search. These templates help expedite document preparation and ensure accuracy, giving you peace of mind.

-

What benefits can I expect from using airSlate SignNow for the 4972 2019 search?

Using airSlate SignNow for the 4972 2019 search can save your business time and reduce errors in document handling. The platform’s user-friendly interface and efficient workflow management contribute to a more productive and organized process.

Get more for Form 4972 Instructions

Find out other Form 4972 Instructions

- How Do I Sign Oregon Bank Loan Proposal Template

- Help Me With Sign Oregon Bank Loan Proposal Template

- Sign Michigan Gift Affidavit Mobile

- How To Sign North Carolina Gift Affidavit

- How Do I Sign Oregon Financial Affidavit

- Sign Maine Revocation of Power of Attorney Online

- Sign Louisiana Mechanic's Lien Online

- How To Sign New Mexico Revocation of Power of Attorney

- How Can I Sign Ohio Revocation of Power of Attorney

- Sign Michigan Mechanic's Lien Easy

- How To Sign Texas Revocation of Power of Attorney

- Sign Virginia Revocation of Power of Attorney Easy

- Can I Sign North Carolina Mechanic's Lien

- Sign Maine Payment Guaranty Myself

- Help Me With Sign Oklahoma Mechanic's Lien

- Sign Oregon Mechanic's Lien Simple

- How To Sign Utah Mechanic's Lien

- How To Sign Washington Mechanic's Lien

- Help Me With Sign Washington Mechanic's Lien

- Sign Arizona Notice of Rescission Safe