Maryland State Tax Form 502 2017

What is the Maryland State Tax Form 502

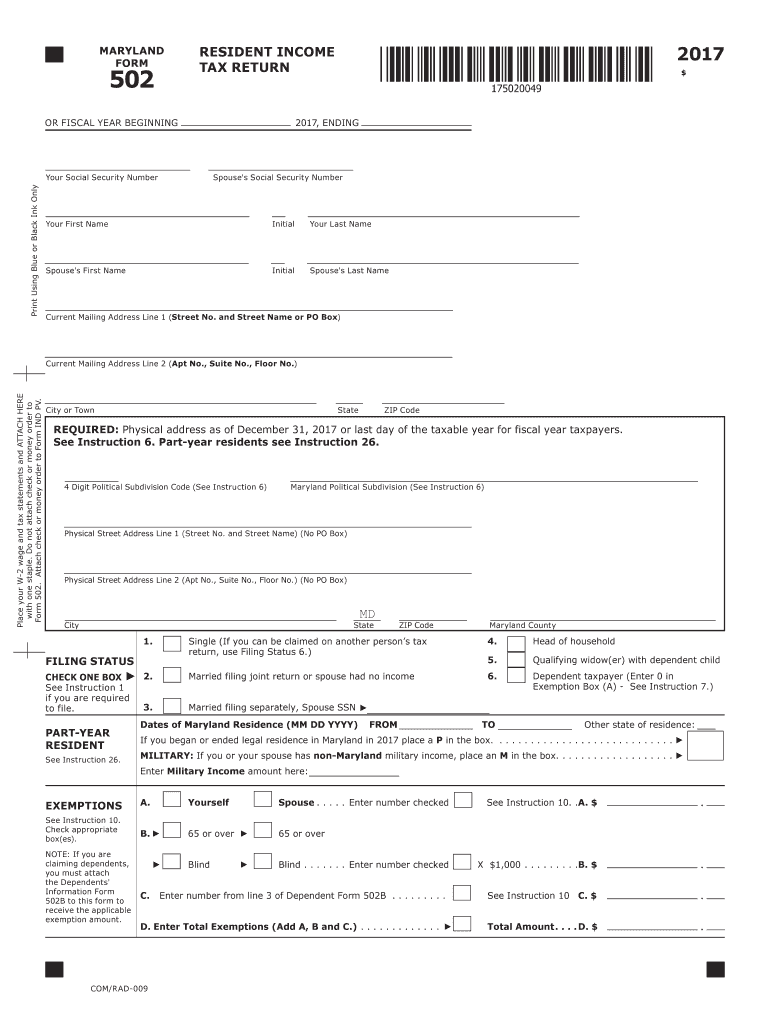

The Maryland State Tax Form 502 is a crucial document used by residents of Maryland to report their individual income tax. This form is specifically designed for taxpayers who are filing their state income taxes and is essential for accurately calculating the amount of tax owed or the refund due. The form collects various financial information, including income, deductions, and credits, which are necessary for the state to assess tax liability. Understanding this form is vital for ensuring compliance with state tax regulations.

How to use the Maryland State Tax Form 502

Using the Maryland State Tax Form 502 involves several steps to ensure that all required information is accurately reported. First, gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, fill out the form by entering your personal information, income details, and any applicable deductions or credits. It is important to review the form for accuracy before submission. Once completed, the form can be filed electronically or mailed to the appropriate state tax authority.

Steps to complete the Maryland State Tax Form 502

Completing the Maryland State Tax Form 502 can be streamlined by following these steps:

- Gather all necessary documents, including income statements and deduction records.

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income from all sources, ensuring to include wages, dividends, and other earnings.

- Claim any deductions and credits that apply to your situation, such as those for education or healthcare expenses.

- Calculate your total tax liability based on the provided tax tables.

- Review the form for accuracy and completeness before signing and dating it.

Key elements of the Maryland State Tax Form 502

The Maryland State Tax Form 502 includes several key elements that are essential for accurate tax reporting. These elements consist of personal identification information, total income, adjustments to income, deductions, and tax credits. Additionally, the form requires taxpayers to provide information regarding any taxes already withheld or estimated payments made throughout the year. Understanding these components is crucial for ensuring that the form is filled out correctly and that all eligible deductions and credits are claimed.

Filing Deadlines / Important Dates

Filing deadlines for the Maryland State Tax Form 502 are typically aligned with federal tax deadlines. Generally, individual income tax returns must be filed by April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to stay informed about any changes to the filing schedule, as well as any extensions that may be available for specific circumstances. Missing the deadline can result in penalties and interest on any unpaid taxes.

Form Submission Methods (Online / Mail / In-Person)

The Maryland State Tax Form 502 can be submitted through various methods, providing flexibility for taxpayers. The form can be filed electronically using the Maryland Comptroller's online portal, which is a convenient option that allows for quicker processing and confirmation of receipt. Alternatively, taxpayers can print the completed form and mail it to the appropriate address for the Maryland Comptroller. In some cases, in-person submissions may be possible at designated tax offices, though this option is less common.

Quick guide on how to complete maryland state tax form 502 2017 2018

Your assistance manual on how to prepare your Maryland State Tax Form 502

If you wish to understand how to create and submit your Maryland State Tax Form 502, here are some brief guidelines to simplify the tax declaration process.

To begin, all you need is to set up your airSlate SignNow account to revolutionize how you manage documents online. airSlate SignNow is a highly user-friendly and effective document solution that enables you to modify, draft, and complete your tax forms effortlessly. With its editor, you can switch among text, checkboxes, and eSignatures, and return to alter information as necessary. Optimize your tax handling with advanced PDF editing, eSigning, and accessible sharing options.

Follow the instructions below to complete your Maryland State Tax Form 502 in just a few minutes:

- Establish your account and start working on PDFs in minutes.

- Utilize our catalog to locate any IRS tax form; explore different versions and schedules.

- Click Retrieve form to access your Maryland State Tax Form 502 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and rectify any errors.

- Save changes, print a copy, submit it to your intended recipient, and download it to your device.

Refer to this guide to file your taxes electronically with airSlate SignNow. Keep in mind that submitting paper forms can lead to increased errors and delays in refunds. Of course, prior to e-filing your taxes, please check the IRS website for filing regulations applicable in your state.

Create this form in 5 minutes or less

Find and fill out the correct maryland state tax form 502 2017 2018

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

Do I need to fill out the state admission form to participate in state counselling in the NEET UG 2018?

There is two way to participate in state counseling》Fill the state quota counseling admission form(for 15% quota) and give the preference to your own state with this if your marks are higher and if you are eligible to get admission in your state then you will get the college.》Fill out the form for state counseling like karnataka state counseling has started and Rajasthan counseling will start from 18th june.In 2nd way you will fill the form for 85% state quota and has higher chances to get college in your own state.NOTE= YOU WILL GET COLLEGE IN OTHER STATE (IN 15% QUOTA) WHEN YOU WILL CROSS THE PARTICULAR CUT OFF OF THE NEET AND THAT STATE.BEST OF LUCK.PLEASE DO FOLLOW ME ON QUORA.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

Create this form in 5 minutes!

How to create an eSignature for the maryland state tax form 502 2017 2018

How to generate an electronic signature for the Maryland State Tax Form 502 2017 2018 in the online mode

How to make an eSignature for the Maryland State Tax Form 502 2017 2018 in Chrome

How to create an electronic signature for signing the Maryland State Tax Form 502 2017 2018 in Gmail

How to generate an eSignature for the Maryland State Tax Form 502 2017 2018 straight from your smartphone

How to generate an eSignature for the Maryland State Tax Form 502 2017 2018 on iOS devices

How to create an electronic signature for the Maryland State Tax Form 502 2017 2018 on Android OS

People also ask

-

What is the Maryland State Tax Form 502 used for?

The Maryland State Tax Form 502 is used by residents to report their income and calculate their state tax liability. This form is essential for filing your personal income tax return in Maryland and ensures that you comply with state tax laws. By accurately completing the Maryland State Tax Form 502, you can maximize your deductions and credits.

-

How can airSlate SignNow help with the Maryland State Tax Form 502?

airSlate SignNow offers a streamlined solution for electronically signing and sending the Maryland State Tax Form 502. With our platform, you can easily upload the form, gather necessary signatures, and send it securely to the Maryland tax authorities. This simplifies the filing process and saves you time.

-

Is there a cost associated with using airSlate SignNow for the Maryland State Tax Form 502?

Yes, airSlate SignNow operates on a subscription model with various pricing tiers to fit your needs. Each tier offers different features, including unlimited document signing, which can be particularly beneficial when handling the Maryland State Tax Form 502. You can choose a plan that best suits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Maryland State Tax Form 502?

airSlate SignNow provides various features to enhance the management of the Maryland State Tax Form 502, such as customizable templates, secure storage, and real-time tracking of document status. These features not only simplify the signing process but also ensure that you can easily access and manage your tax documents whenever needed.

-

Can I integrate airSlate SignNow with other software for filing the Maryland State Tax Form 502?

Absolutely! airSlate SignNow integrates seamlessly with numerous software applications, allowing you to connect your accounting or tax preparation software with our platform. This integration makes it easier to gather the necessary information for the Maryland State Tax Form 502 and ensures a smooth workflow.

-

What are the benefits of using airSlate SignNow for the Maryland State Tax Form 502?

Using airSlate SignNow for the Maryland State Tax Form 502 provides several benefits, including faster document turnaround times and enhanced security features. Our platform allows you to sign documents from anywhere, reducing the hassle of printing and mailing. This efficiency can lead to timely submissions and potentially faster refunds.

-

Is airSlate SignNow user-friendly for completing the Maryland State Tax Form 502?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to complete the Maryland State Tax Form 502. Our intuitive interface guides you through the signing process, ensuring that you can fill out and submit your tax form without any technical difficulties.

Get more for Maryland State Tax Form 502

Find out other Maryland State Tax Form 502

- eSign Missouri Work Order Computer

- eSign Hawaii Electrical Services Contract Safe

- eSign Texas Profit Sharing Agreement Template Safe

- eSign Iowa Amendment to an LLC Operating Agreement Myself

- eSign Kentucky Amendment to an LLC Operating Agreement Safe

- eSign Minnesota Affidavit of Identity Now

- eSign North Dakota Affidavit of Identity Free

- Help Me With eSign Illinois Affidavit of Service

- eSign North Dakota Affidavit of Identity Simple

- eSign Maryland Affidavit of Service Now

- How To eSign Hawaii Affidavit of Title

- How Do I eSign New Mexico Affidavit of Service

- How To eSign Texas Affidavit of Title

- How Do I eSign Texas Affidavit of Service

- eSign California Cease and Desist Letter Online

- eSign Colorado Cease and Desist Letter Free

- How Do I eSign Alabama Hold Harmless (Indemnity) Agreement

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement