Form Ct 1041 2017

What is the Form CT-1041

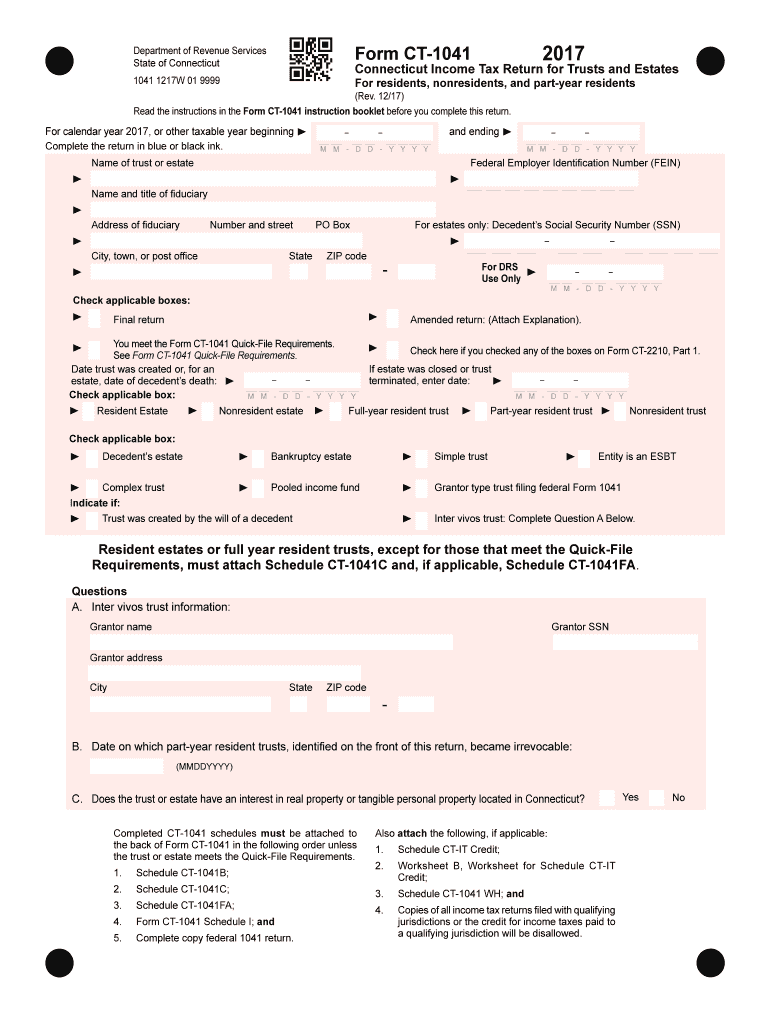

The Form CT-1041 is a tax return form used by estates and trusts in Connecticut to report income, deductions, and tax liability. This form is essential for fiduciaries who manage the financial affairs of estates or trusts, ensuring compliance with state tax regulations. By accurately completing this form, fiduciaries can determine the taxable income of the estate or trust and calculate the amount of tax owed to the state of Connecticut.

How to use the Form CT-1041

Using the Form CT-1041 involves several key steps. First, gather all necessary financial documents related to the estate or trust, including income statements, expense records, and prior tax returns. Next, fill out the form by entering the required information in the designated fields, ensuring accuracy to avoid penalties. Once completed, the form must be signed by the fiduciary and submitted to the Connecticut Department of Revenue Services. It is important to retain copies of the form and all supporting documents for your records.

Steps to complete the Form CT-1041

Completing the Form CT-1041 requires careful attention to detail. Follow these steps for accurate completion:

- Gather all relevant financial documents, including income and expense records.

- Enter the estate or trust's identifying information, including the name, address, and federal employer identification number (EIN).

- Report all sources of income, including interest, dividends, and rental income.

- Deduct allowable expenses, such as administrative costs and distributions to beneficiaries.

- Calculate the total taxable income and the corresponding tax liability.

- Sign and date the form, ensuring it is submitted by the due date.

Filing Deadlines / Important Dates

The filing deadline for the Form CT-1041 typically aligns with the federal tax return deadlines. For estates and trusts, this is generally the fifteenth day of the fourth month following the close of the tax year. For example, if the tax year ends on December 31, the form is due by April 15 of the following year. It is crucial to be aware of these deadlines to avoid late filing penalties and interest on unpaid taxes.

Required Documents

To successfully complete the Form CT-1041, certain documents are necessary. These include:

- Financial statements detailing income and expenses of the estate or trust.

- Prior year tax returns for the estate or trust, if applicable.

- Documentation of any distributions made to beneficiaries.

- Records of any deductions claimed, such as administrative expenses.

Legal use of the Form CT-1041

The Form CT-1041 must be used in accordance with Connecticut state tax laws. It is legally binding and must be completed accurately to reflect the financial activities of the estate or trust. Failure to comply with the legal requirements can result in penalties, including fines and interest on unpaid taxes. Therefore, it is advisable to consult with a tax professional or legal advisor to ensure compliance and proper filing.

Quick guide on how to complete 2015 form ct 1041 2017 2018

Your assistance manual on how to prepare your Form Ct 1041

If you’re wondering how to fill out and submit your Form Ct 1041, here are a few brief instructions on how to streamline tax submission.

To begin, you simply need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an exceptionally intuitive and powerful document solution that enables you to modify, generate, and finalize your tax paperwork effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and revert to update details where necessary. Simplify your tax administration with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to finalize your Form Ct 1041 in no time:

- Create your account and start editing PDFs swiftly.

- Utilize our directory to obtain any IRS tax form; navigate through editions and schedules.

- Click Get form to access your Form Ct 1041 in our editor.

- Complete the necessary fillable areas with your details (text, numbers, checkmarks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and correct any mistakes.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to electronically submit your taxes with airSlate SignNow. Be aware that submitting on paper can increase return errors and delay refunds. Naturally, before e-filing your taxes, check the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2015 form ct 1041 2017 2018

FAQs

-

How do I fill out the NTSE form 2017- 2018 Jharkhand online?

You cannot gove NTSE online or at your own level you have to belong to a school which is conducting ntse. Then download the form online from the page of ntse, fill it and submit it to your school along with fee. If your school is not conducting ntse, sorry to say but you cannot give ntse. It can only be given through, no institutions are allowed to conduct thos exam.

-

What is the link of the official website to fill out the IBPS RRB 2017-2018 form?

Hello,The notification of IBPS RRB 2017–18 is soon going to be announce by the Officials.With this news, the candidates are now looking for the official links to apply for the IBPS RRB Exam and the complete Step by step procedure of how to apply online.The link of Official website to apply is given below:Welcome to IBPS ::Below are the steps to apply online for the exam.Firstly, visit the official link mentioned above.After click on the link ‘CWE RRB’ at the left side of the page.As soon as the official sources will release the IBPS RRB Notification 2017, the candidates will be able to see another link ‘Common Written Examination – Regional Rural Banks Phase VI’ on the page.After clicking on this link, you can start your IBPS RRB Online Application process.Enter all the required details and upload scanned photographs and signature to proceed with the registration process.After entering all these details, candidates will get a registration number and password through which they can login anytime and make changes in IBPS RRB Online Application.For the final submission, fee payment is required.Application Fee for Officer Scale (I, II & III) and Office Assistant – INR 100 for ST/SC/PWD Candidates and INR 600 for all others.The payment can be made by using Debit Cards (RuPay/ Visa/ MasterCard/ Maestro), Credit Cards, Internet Banking, IMPS, Cash Cards/ Mobile Wallets by providing information as asked on the screen.8. Check all the details before you finally submit the form.9. Take a print out of the form for future use.Hope the above information is useful for you!Thankyou!

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

Can we fill out the NEET application form (2018) in general after filling in SC (2017)?

Yes, you may do so. The details of the previous year shall not be carried forward in the current year. However, it can only be confirmed once the application form will be released.

-

Is it possible for me to fill out the CMA foundation form now for Dec 2017 and appear in June 2018?

Get full detail information about cma foundation registration from the following link. cma foundation registration process

-

If I was unable to fill SSC Cgl 2017, can I fill SSC Cgl 2018 form?

Don’t wait till the last date, apply your form well in advance. If still you are unable to fill your form, you may fill in 2018.

Create this form in 5 minutes!

How to create an eSignature for the 2015 form ct 1041 2017 2018

How to create an electronic signature for the 2015 Form Ct 1041 2017 2018 in the online mode

How to make an electronic signature for the 2015 Form Ct 1041 2017 2018 in Chrome

How to generate an electronic signature for putting it on the 2015 Form Ct 1041 2017 2018 in Gmail

How to create an electronic signature for the 2015 Form Ct 1041 2017 2018 straight from your smartphone

How to make an electronic signature for the 2015 Form Ct 1041 2017 2018 on iOS

How to generate an eSignature for the 2015 Form Ct 1041 2017 2018 on Android devices

People also ask

-

What is Form Ct 1041 and who needs it?

Form Ct 1041 is the Connecticut Income Tax Return for Estates and Trusts, required for reporting income that estates or trusts earn. If you manage an estate or trust in Connecticut, you are obligated to file this form. Utilizing tools like airSlate SignNow can streamline the eSigning process for your Form Ct 1041, ensuring compliance and efficiency.

-

How can airSlate SignNow help with filing Form Ct 1041?

AirSlate SignNow simplifies the process of filling out and submitting Form Ct 1041 by offering an intuitive eSignature platform. You can quickly send the form for signatures, track its status, and securely store completed documents. This ensures that your filings are not only accurate but also submitted on time.

-

Is airSlate SignNow cost-effective for small businesses needing to file Form Ct 1041?

Yes, airSlate SignNow is a cost-effective solution for small businesses that need to manage various documents, including Form Ct 1041. With its affordable pricing plans, you can access powerful features that enhance document management and eSigning without breaking the bank.

-

Can I integrate airSlate SignNow with accounting software for Form Ct 1041 preparation?

Absolutely! AirSlate SignNow offers seamless integrations with various accounting software, making it easier to prepare and file Form Ct 1041. By linking your existing tools, you can enhance productivity and ensure that all necessary documents are readily available for eSigning.

-

What features does airSlate SignNow offer for managing Form Ct 1041?

AirSlate SignNow provides features like customizable templates, automated workflows, and real-time tracking for managing Form Ct 1041. These features help you streamline the eSigning process and ensure that all parties can quickly and easily sign the document.

-

How secure is the eSigning process for Form Ct 1041 with airSlate SignNow?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption protocols to protect your Form Ct 1041 and any other sensitive documents. You can sign and send documents with confidence, knowing that your information is secure and compliant.

-

What are the benefits of using airSlate SignNow for Form Ct 1041?

Using airSlate SignNow for Form Ct 1041 offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced collaboration. With easy-to-use eSigning tools, you can manage your documentation process from anywhere, making it perfect for busy professionals.

Get more for Form Ct 1041

Find out other Form Ct 1041

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy