NON CASH CHARITABLE CONTRIBUTIONS WORKSHEET Tax Year Form

Understanding the Non Cash Charitable Contributions Worksheet

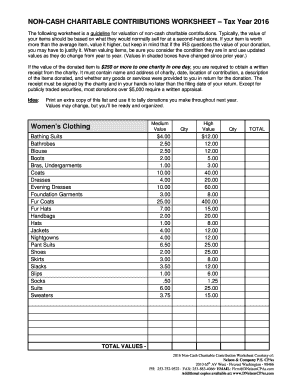

The Non Cash Charitable Contributions Worksheet is a vital document for taxpayers in the United States who wish to claim deductions for non-cash donations made to qualified charitable organizations. This worksheet is essential for accurately reporting the fair market value of items donated, which can include clothing, household goods, and other personal property. By using this worksheet, individuals can ensure they comply with IRS regulations and maximize their potential tax benefits.

Steps to Complete the Non Cash Charitable Contributions Worksheet

Completing the Non Cash Charitable Contributions Worksheet involves several key steps:

- Gather all relevant documentation, including receipts and records of the donated items.

- Assess the fair market value of each item, which is the price at which the item would sell on the open market.

- Fill out the worksheet by listing each item, its description, fair market value, and the date of the donation.

- Ensure that you have the necessary proof of donation, such as a receipt from the charity.

By following these steps, taxpayers can accurately report their non-cash charitable contributions and support their claims during tax filing.

IRS Guidelines for Non Cash Charitable Contributions

The IRS provides specific guidelines regarding non-cash charitable contributions. Taxpayers must ensure that:

- The charity is a qualified organization as defined by the IRS.

- Donations of items valued over five hundred dollars require additional documentation, including Form 8283.

- Items must be in good condition or better to qualify for a deduction.

Adhering to these guidelines is crucial for compliance and can help avoid issues during audits.

Examples of Non Cash Charitable Contributions

Common examples of non-cash charitable contributions include:

- Clothing and shoes donated to thrift stores or shelters.

- Household items such as furniture, appliances, and electronics.

- Vehicles donated to charities that accept them for resale or use in their programs.

Each of these items must be evaluated for fair market value to complete the worksheet accurately.

Required Documents for Filing

When filing the Non Cash Charitable Contributions Worksheet, taxpayers should have the following documents ready:

- Receipts or written acknowledgments from the charities for donations made.

- Documentation that establishes the fair market value of the donated items.

- Form 8283 if the total deduction for non-cash contributions exceeds five hundred dollars.

Having these documents organized can streamline the filing process and ensure compliance with IRS requirements.

Legal Use of the Non Cash Charitable Contributions Worksheet

The Non Cash Charitable Contributions Worksheet is legally recognized by the IRS as a means to substantiate non-cash charitable donations. Proper use of this worksheet helps taxpayers document their contributions, ensuring that they can claim the appropriate deductions on their tax returns. Failure to maintain adequate records or to use the worksheet correctly can lead to disallowed deductions and potential penalties.

Quick guide on how to complete non cash charitable contributions worksheet tax year

Complete NON CASH CHARITABLE CONTRIBUTIONS WORKSHEET Tax Year effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents rapidly without delays. Handle NON CASH CHARITABLE CONTRIBUTIONS WORKSHEET Tax Year on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign NON CASH CHARITABLE CONTRIBUTIONS WORKSHEET Tax Year without any hassle

- Locate NON CASH CHARITABLE CONTRIBUTIONS WORKSHEET Tax Year and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Mark important sections of your documents or hide sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign NON CASH CHARITABLE CONTRIBUTIONS WORKSHEET Tax Year and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the non cash charitable contributions worksheet tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a non cash charitable contributions worksheet?

A non cash charitable contributions worksheet is a tool used to document and calculate the value of non-cash donations for tax purposes. This worksheet helps ensure that you accurately report your contributions, maximizing your potential tax deductions. Utilizing airSlate SignNow can streamline this process by allowing you to eSign and send your completed worksheets securely.

-

How can airSlate SignNow help with non cash charitable contributions worksheets?

airSlate SignNow simplifies the process of creating and managing non cash charitable contributions worksheets. With our platform, you can easily fill out, eSign, and share your worksheets, ensuring that all necessary information is captured accurately. This efficiency not only saves time but also enhances the accuracy of your tax documentation.

-

Is there a cost associated with using airSlate SignNow for non cash charitable contributions worksheets?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Our plans are designed to be cost-effective, providing you with the tools necessary to manage non cash charitable contributions worksheets without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing non cash charitable contributions worksheets?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing non cash charitable contributions worksheets. These features ensure that your documents are not only professional but also compliant with tax regulations. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Can I integrate airSlate SignNow with other tools for my non cash charitable contributions worksheets?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when managing non cash charitable contributions worksheets. Whether you use accounting software or CRM systems, our platform can connect seamlessly to enhance your productivity and document management.

-

What are the benefits of using airSlate SignNow for non cash charitable contributions worksheets?

Using airSlate SignNow for your non cash charitable contributions worksheets provides numerous benefits, including increased efficiency, enhanced accuracy, and secure document handling. Our platform allows you to quickly prepare and eSign your worksheets, reducing the risk of errors and ensuring compliance with tax laws. This ultimately leads to a smoother tax filing process.

-

Is airSlate SignNow user-friendly for creating non cash charitable contributions worksheets?

Yes, airSlate SignNow is designed with user experience in mind, making it easy for anyone to create non cash charitable contributions worksheets. Our intuitive interface guides you through the process, ensuring that you can complete your worksheets quickly and efficiently. Even those with minimal technical skills can navigate our platform with ease.

Get more for NON CASH CHARITABLE CONTRIBUTIONS WORKSHEET Tax Year

Find out other NON CASH CHARITABLE CONTRIBUTIONS WORKSHEET Tax Year

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter