Mw508 Form

What is the Mw508 Form

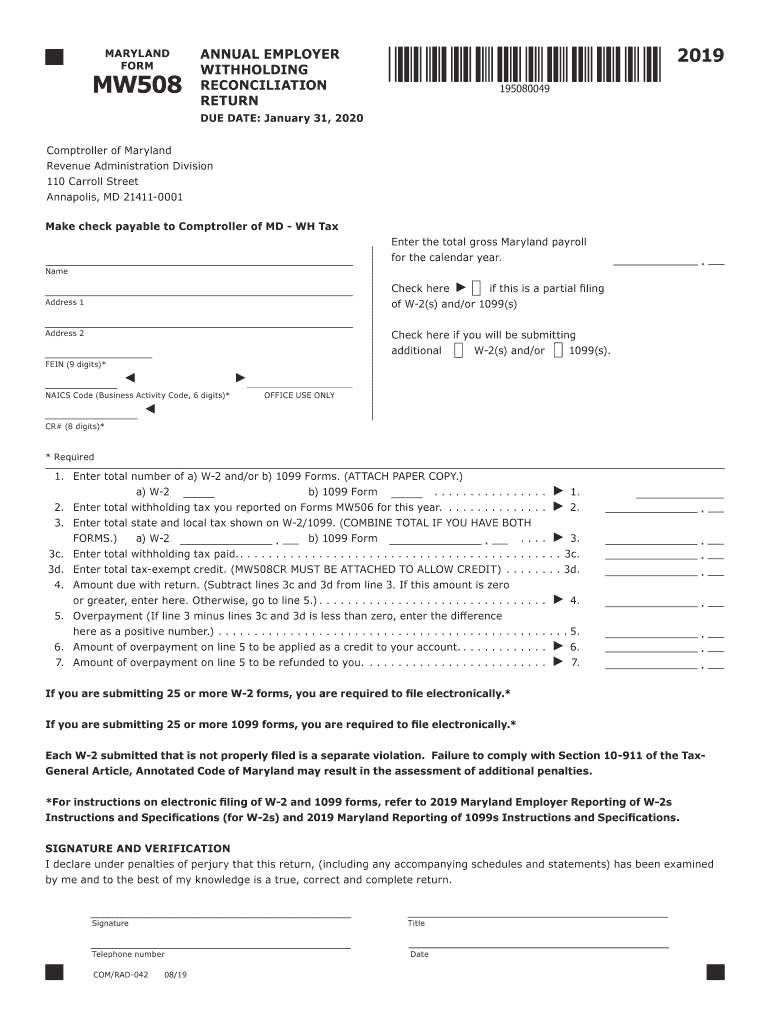

The 2019 form mw508 is an annual withholding reconciliation form used by employers in Maryland. This form is essential for reporting the total income tax withheld from employees throughout the year. It helps ensure that the correct amount of tax has been remitted to the state and is a crucial part of maintaining compliance with Maryland tax laws. The form is typically submitted to the Comptroller of Maryland and is required for all employers who withhold state income tax from their employees' wages.

How to use the Mw508 Form

To effectively use the mw508 form 2019, employers must accurately compile all necessary data regarding employee withholdings. This includes total wages paid, the amount of state income tax withheld, and any adjustments that may apply. The completed form serves as a summary of withholding activities for the year and must be filed with the appropriate state agency. Employers should also keep a copy for their records, as it may be needed for future reference or audits.

Steps to complete the Mw508 Form

Completing the 2019 form mw508 involves several key steps:

- Gather all payroll records for the year, including total wages and tax withholdings.

- Fill in the employer information, including name, address, and federal employer identification number (FEIN).

- Report total wages paid and the total amount of Maryland income tax withheld.

- Include any adjustments or corrections from previous filings, if applicable.

- Review the completed form for accuracy before submission.

Legal use of the Mw508 Form

The 2019 mw508 form is legally binding when completed and submitted according to Maryland state regulations. Employers must ensure that the information reported is accurate to avoid potential penalties. Compliance with this form helps maintain transparency in tax reporting and ensures that employees' tax withholdings are correctly accounted for. It is crucial for employers to understand the legal implications of inaccuracies or non-compliance with the filing requirements.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing the mw508 form. Typically, the form is due by January 31 of the year following the tax year being reported. For the 2019 form mw508, this means it should be submitted by January 31, 2020. Employers should also stay informed about any updates or changes to filing deadlines to ensure timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The 2019 form mw508 can be submitted through various methods to accommodate different preferences. Employers can file the form online through the Comptroller of Maryland's website, which offers a convenient and efficient option. Alternatively, the form can be printed and mailed to the appropriate address or submitted in person at local Comptroller offices. It is important to choose a submission method that ensures timely delivery and compliance with state regulations.

Quick guide on how to complete maryland publishes revised withholding forms and

Accomplish Mw508 Form effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to craft, edit, and eSign your documents quickly without interruptions. Handle Mw508 Form on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign Mw508 Form with ease

- Find Mw508 Form and then click Get Form to begin.

- Utilize the features we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal significance as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Alter and eSign Mw508 Form and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the maryland publishes revised withholding forms and

How to create an electronic signature for the Maryland Publishes Revised Withholding Forms And in the online mode

How to create an electronic signature for the Maryland Publishes Revised Withholding Forms And in Google Chrome

How to generate an eSignature for signing the Maryland Publishes Revised Withholding Forms And in Gmail

How to create an eSignature for the Maryland Publishes Revised Withholding Forms And from your smartphone

How to make an eSignature for the Maryland Publishes Revised Withholding Forms And on iOS devices

How to create an electronic signature for the Maryland Publishes Revised Withholding Forms And on Android OS

People also ask

-

What is the 2019 form mw508 used for?

The 2019 form mw508 is used for reporting certain tax information in Maryland. It is a critical form for businesses that need to comply with state tax regulations and ensure proper withholding from employee paychecks. Using airSlate SignNow simplifies the process of sending and eSigning the 2019 form mw508 securely.

-

How can I fill out the 2019 form mw508 using airSlate SignNow?

You can easily fill out the 2019 form mw508 with airSlate SignNow's user-friendly interface. Simply upload the form, input the required information, and utilize our editing tools to make changes. Once completed, you can send it for eSignature, making the entire process quick and efficient.

-

Is airSlate SignNow compatible with the 2019 form mw508?

Yes, airSlate SignNow is fully compatible with the 2019 form mw508. Our platform supports various document formats, including tax forms, allowing for seamless editing and signing. You can trust that your documents will be processed in compliance with all regulatory requirements.

-

What features does airSlate SignNow offer for managing the 2019 form mw508?

airSlate SignNow offers several features for managing the 2019 form mw508, including secure eSigning, document tracking, and customizable templates. These tools ensure you can monitor the status of your forms and have full control over the signing process. This ultimately enhances efficiency in your workflow.

-

What are the pricing options for using airSlate SignNow for the 2019 form mw508?

airSlate SignNow offers competitive pricing plans to suit various business needs when managing documents like the 2019 form mw508. You can choose from different subscription tiers based on the features required. Visit our pricing page to find the best option for your team.

-

Can I integrate airSlate SignNow with other tools for handling the 2019 form mw508?

Absolutely! airSlate SignNow integrates seamlessly with various applications, allowing for efficient handling of the 2019 form mw508. Whether you use CRMs, project management tools, or cloud storage services, our integration options help enhance your overall workflow.

-

What benefits does airSlate SignNow provide for eSigning the 2019 form mw508?

Using airSlate SignNow to eSign the 2019 form mw508 offers multiple benefits, such as reducing the time spent on manual paperwork and improving the security of confidential information. With our platform, you can eSign documents from anywhere, saving both time and resources for your business.

Get more for Mw508 Form

- Building permit application city of kamloops kamloops form

- Whitby campus form

- Application for new zealand citizenship by descent govt nz form

- Group lottery contract template form

- Group project team contract template form

- Group project contract template 787751943 form

- Group therapy contract template form

- Group travel contract template form

Find out other Mw508 Form

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form

- How Do I eSign Hawaii Construction Form

- How To eSign Florida Doctors Form

- Help Me With eSign Hawaii Doctors Word

- How Can I eSign Hawaii Doctors Word

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document