Form 990 Schedule D

What is the Form 990 Schedule D

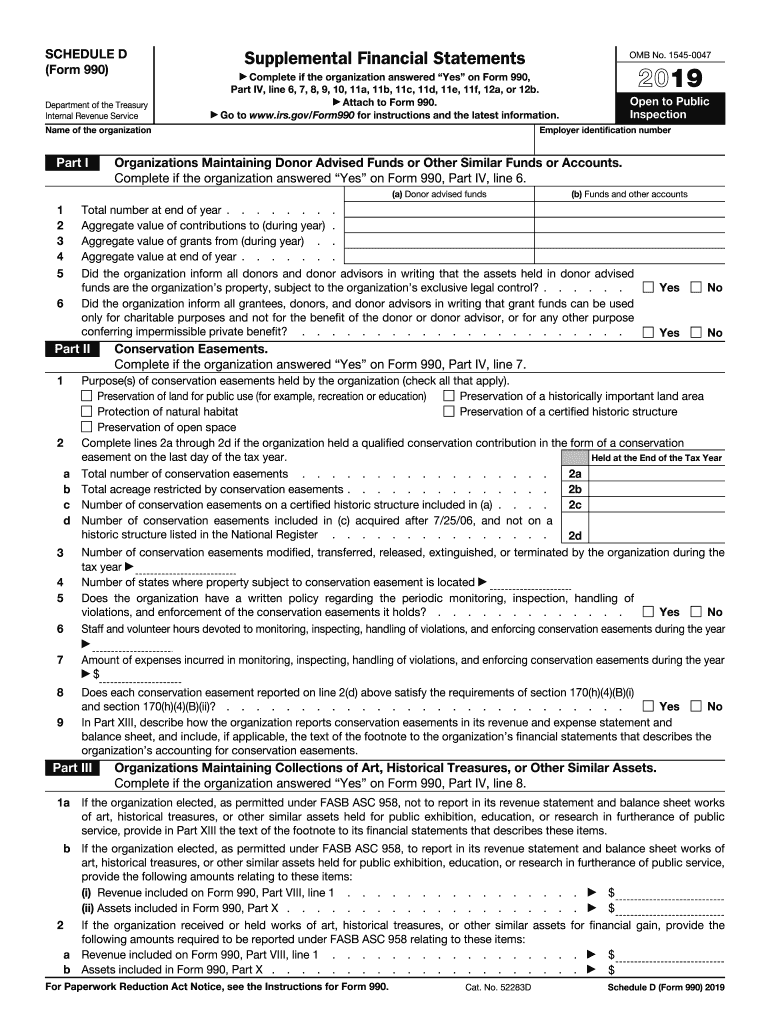

The Form 990 Schedule D is an essential document used by tax-exempt organizations in the United States to provide additional information regarding their financial statements. This schedule supplements the main Form 990, which is filed annually with the IRS. Schedule D specifically focuses on the organization’s governance, policies, and financial management practices, ensuring transparency and accountability. It includes details about the organization’s endowment funds, investment policies, and the handling of financial transactions.

How to use the Form 990 Schedule D

To effectively use the Form 990 Schedule D, organizations must first complete the main Form 990. Once that is done, they can fill out Schedule D to disclose relevant financial information. It is important to accurately report any changes in governance or financial management practices. The information provided in this schedule helps the IRS assess compliance with tax-exempt regulations and provides stakeholders with insight into the organization’s financial health.

Steps to complete the Form 990 Schedule D

Completing the Form 990 Schedule D involves several key steps:

- Gather financial records, including balance sheets and income statements.

- Review governance policies and ensure they are up-to-date.

- Fill out each section of Schedule D, providing detailed information about financial management practices.

- Ensure that all figures align with those reported in the main Form 990.

- Review the completed schedule for accuracy and completeness before submission.

Key elements of the Form 990 Schedule D

Several key elements must be included in the Form 990 Schedule D:

- Governance: Information about the organization’s governing body and policies.

- Financial Statements: Details on the organization’s financial performance, including assets, liabilities, and net assets.

- Investment Policies: Descriptions of how the organization manages its investments and endowment funds.

- Audit Information: Disclosure of whether the organization has undergone an independent audit.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 990 Schedule D. Organizations must adhere to these guidelines to ensure compliance with federal tax regulations. Key guidelines include accurate reporting of financial data, maintaining transparency in governance practices, and ensuring that the information is consistent with other filed documents. Organizations are encouraged to consult IRS publications or seek professional advice to navigate complex requirements.

Filing Deadlines / Important Dates

Organizations must file the Form 990 Schedule D along with their main Form 990 by the due date, which is typically the 15th day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May 15. Extensions may be available, but it is crucial to file timely to avoid penalties.

Penalties for Non-Compliance

Failure to file the Form 990 Schedule D or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions or incomplete information. In severe cases, non-compliance can jeopardize an organization’s tax-exempt status. It is essential for organizations to prioritize accurate and timely filing to maintain their compliance with IRS regulations.

Quick guide on how to complete 08 department of the treasury internal revenue service

Easily Create Form 990 Schedule D on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal sustainable alternative to traditional printed and signed documents, as you can access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, amend, and eSign your documents promptly without any delays. Manage Form 990 Schedule D on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Easiest Way to Edit and eSign Form 990 Schedule D Effortlessly

- Obtain Form 990 Schedule D and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form—via email, text message (SMS), or a shareable link, or download it to your computer.

Say goodbye to lost or mislaid files, frustrating document searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign Form 990 Schedule D and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 08 department of the treasury internal revenue service

How to create an eSignature for your 08 Department Of The Treasury Internal Revenue Service in the online mode

How to create an eSignature for your 08 Department Of The Treasury Internal Revenue Service in Google Chrome

How to create an eSignature for putting it on the 08 Department Of The Treasury Internal Revenue Service in Gmail

How to create an eSignature for the 08 Department Of The Treasury Internal Revenue Service from your smart phone

How to make an electronic signature for the 08 Department Of The Treasury Internal Revenue Service on iOS devices

How to generate an electronic signature for the 08 Department Of The Treasury Internal Revenue Service on Android devices

People also ask

-

What is Form 990 Schedule D and why is it important?

Form 990 Schedule D is an essential part of the IRS Form 990, which nonprofit organizations must file annually. It provides detailed information about the organization’s fund balances, investments, and other financial assets. Understanding and accurately completing Form 990 Schedule D is crucial for transparency and compliance with federal regulations.

-

How does airSlate SignNow assist with completing Form 990 Schedule D?

airSlate SignNow streamlines the process of completing Form 990 Schedule D by allowing organizations to easily send, sign, and manage their documents electronically. With its intuitive interface and eSignature capabilities, users can ensure that all necessary signatures are collected efficiently, making the filing process more straightforward.

-

What features does airSlate SignNow offer for managing Form 990 Schedule D?

airSlate SignNow offers various features such as document templates, secure cloud storage, and audit trails that are particularly useful for managing Form 990 Schedule D. These tools help nonprofits maintain accurate records and ensure that all required documentation is readily accessible when it’s time to file.

-

Is airSlate SignNow cost-effective for nonprofits filing Form 990 Schedule D?

Yes, airSlate SignNow is a cost-effective solution for nonprofits needing to file Form 990 Schedule D. With flexible pricing plans tailored for organizations of all sizes, it allows nonprofits to manage their eSigning needs without straining their budgets, ensuring compliance without high costs.

-

Can airSlate SignNow integrate with other software used for Form 990 Schedule D?

Absolutely! airSlate SignNow offers integrations with various accounting and nonprofit management software that can help you seamlessly manage Form 990 Schedule D. This integration ensures that your financial data flows smoothly between systems, reducing the risk of errors and saving time.

-

What are the benefits of using airSlate SignNow for Form 990 Schedule D?

Using airSlate SignNow for Form 990 Schedule D provides several benefits, including enhanced security for sensitive financial information, reduced processing time, and improved collaboration among team members. Additionally, the platform’s user-friendly design simplifies the signing process, making compliance easier for nonprofit organizations.

-

How secure is the information shared in airSlate SignNow when filing Form 990 Schedule D?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and security protocols to protect all information shared during the filing of Form 990 Schedule D. This ensures that sensitive data remains confidential and secure throughout the signing and management process.

Get more for Form 990 Schedule D

Find out other Form 990 Schedule D

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document