Form 3520

What is the Form 3520

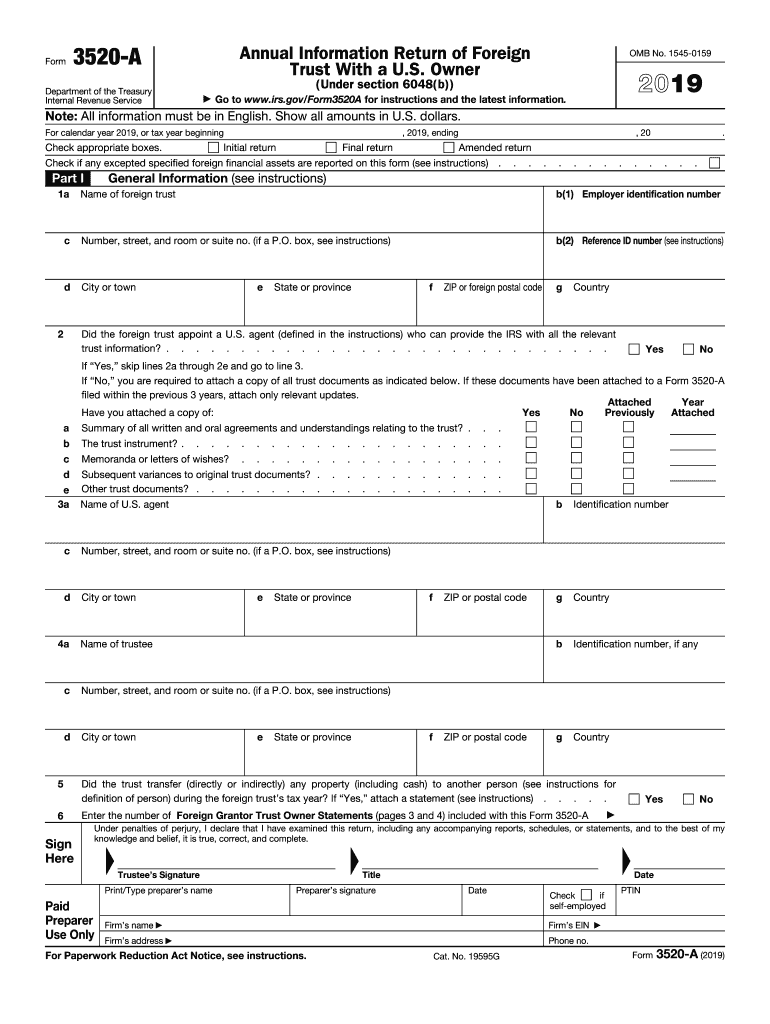

The Form 3520 is a tax document required by the Internal Revenue Service (IRS) for U.S. taxpayers who engage in certain transactions with foreign trusts or foreign gifts. Specifically, it is used to report the receipt of large gifts or bequests from foreign individuals or entities, as well as transactions involving foreign trusts. This form helps the IRS track foreign financial activities and ensures compliance with U.S. tax laws.

How to use the Form 3520

To use the Form 3520, taxpayers must accurately report any foreign gifts or bequests that exceed the annual exclusion amount set by the IRS. The form also requires reporting any transactions with foreign trusts. It is essential to fill out the form completely and accurately to avoid penalties. Taxpayers can obtain the form from the IRS website or through tax preparation software that supports IRS forms.

Steps to complete the Form 3520

Completing the Form 3520 involves several steps:

- Gather necessary information, including details about the foreign gift or trust.

- Fill out the identification section, including your name, address, and taxpayer identification number.

- Report the details of the foreign gift or trust transactions in the appropriate sections of the form.

- Review the completed form for accuracy and completeness.

- Submit the form to the IRS by the specified deadline.

Filing Deadlines / Important Dates

The Form 3520 is typically due on the same date as your income tax return, including extensions. For most taxpayers, this means it is due on April fifteenth. However, if you file for an extension, the due date for the Form 3520 will also extend to October fifteenth. It is crucial to adhere to these deadlines to avoid penalties.

Penalties for Non-Compliance

Failing to file the Form 3520 or providing inaccurate information can result in significant penalties. The IRS may impose a penalty of five percent of the amount of the foreign gift or bequest for each month the form is late, up to a maximum of twenty-five percent. Additionally, failure to report foreign trusts can lead to even steeper penalties, emphasizing the importance of compliance.

Legal use of the Form 3520

The legal use of the Form 3520 is vital for maintaining compliance with U.S. tax regulations. This form serves as a declaration to the IRS about foreign financial activities, ensuring that taxpayers are transparent about their international dealings. Properly filing the Form 3520 helps protect taxpayers from legal issues related to unreported foreign income or gifts.

Quick guide on how to complete f3520apdf form 3520 a department of the treasury

Effortlessly Prepare Form 3520 on Any Device

Digital document management has gained signNow traction among enterprises and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Form 3520 on any system with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Form 3520 with Ease

- Obtain Form 3520 and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred delivery method for the form: via email, text message (SMS), an invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 3520 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f3520apdf form 3520 a department of the treasury

How to create an eSignature for the F3520apdf Form 3520 A Department Of The Treasury online

How to create an electronic signature for the F3520apdf Form 3520 A Department Of The Treasury in Chrome

How to generate an eSignature for putting it on the F3520apdf Form 3520 A Department Of The Treasury in Gmail

How to make an eSignature for the F3520apdf Form 3520 A Department Of The Treasury from your smartphone

How to make an eSignature for the F3520apdf Form 3520 A Department Of The Treasury on iOS devices

How to make an eSignature for the F3520apdf Form 3520 A Department Of The Treasury on Android OS

People also ask

-

What is the 2019 3520 compress form and why is it important?

The 2019 3520 compress form is a vital document used for reporting foreign gifts or transfers to the IRS. It's important for U.S. taxpayers receiving signNow foreign gifts to ensure compliance with tax laws. Using the 2019 3520 compress helps prevent penalties and ensures timely submission.

-

How can airSlate SignNow help with the 2019 3520 compress form?

airSlate SignNow provides a streamlined process for completing and eSigning the 2019 3520 compress form. The platform’s user-friendly interface allows for easy document editing and collaboration, ensuring you can efficiently manage your filing. Stay organized and compliant with airSlate SignNow's digital solutions.

-

What are the pricing options for airSlate SignNow services concerning the 2019 3520 compress?

airSlate SignNow offers flexible pricing plans that cater to different business needs for managing documents like the 2019 3520 compress form. Plans range from individual to enterprise solutions, allowing users to choose based on features and usage needs. Check our website for the most current pricing details.

-

Does airSlate SignNow provide templates for the 2019 3520 compress?

Yes, airSlate SignNow offers customizable templates for the 2019 3520 compress form. These templates assist users in filling out the required information accurately and efficiently. With our templates, you can save time and ensure that you meet all IRS requirements.

-

What benefits does airSlate SignNow offer for eSigning the 2019 3520 compress?

Using airSlate SignNow for eSigning the 2019 3520 compress provides a secure and legally binding signature process. This not only saves time but also makes it easy to track document status and approvals. Enjoy peace of mind knowing your documents are protected and accessible.

-

Can I integrate airSlate SignNow with my existing software for the 2019 3520 compress?

Yes, airSlate SignNow supports various integrations with existing business applications to streamline the process of managing the 2019 3520 compress form. Whether it’s CRM tools or document management software, our platform can easily connect. This ensures that your workflow remains uninterrupted and efficient.

-

Is airSlate SignNow compliant with legal standards for the 2019 3520 compress?

Absolutely, airSlate SignNow adheres to the highest legal standards for eSigning, ensuring that your submission of the 2019 3520 compress is compliant with IRS regulations. Our platform is designed to protect user data in accordance with industry best practices. Feel confident in your eSigning process with airSlate SignNow.

Get more for Form 3520

Find out other Form 3520

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer

- How To Sign Michigan Banking Living Will

- Sign Michigan Banking Moving Checklist Mobile

- Sign Maine Banking Limited Power Of Attorney Simple

- Sign Michigan Banking Moving Checklist Free

- Sign Montana Banking RFP Easy