Form 1098

What is the Form 1098

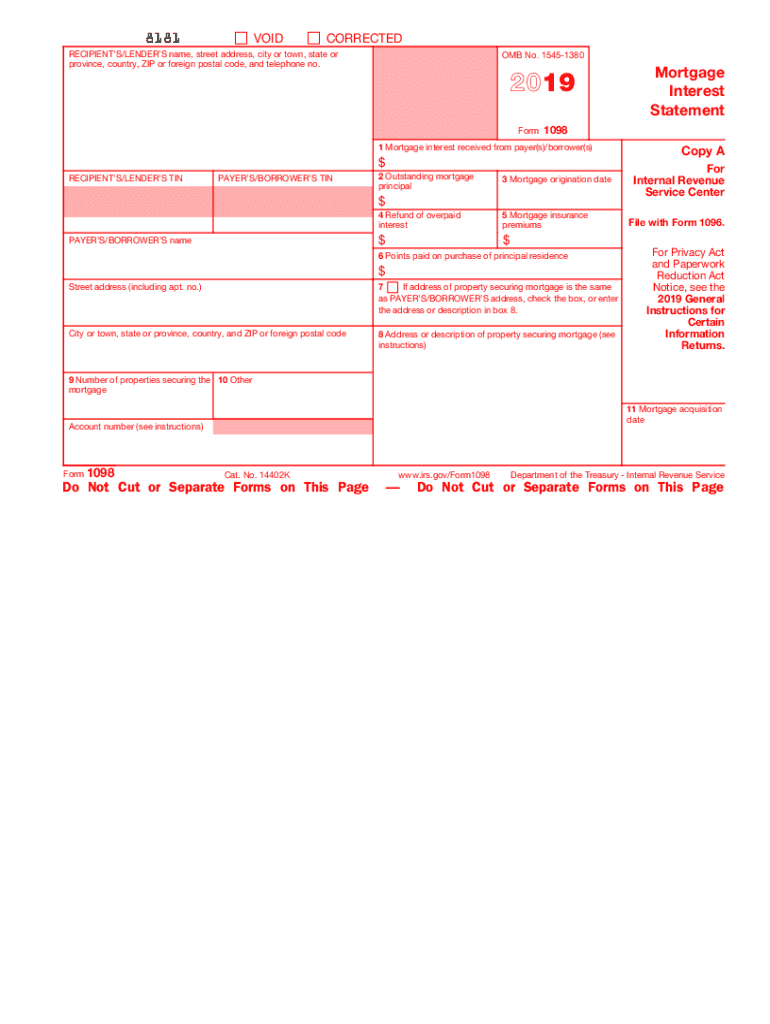

The Form 1098 is a tax document used in the United States to report mortgage interest paid by a borrower to a lender. This form is crucial for taxpayers who want to claim the mortgage interest deduction on their federal tax returns. The lender is responsible for issuing the Form 1098 to the borrower and the IRS, providing essential information such as the amount of interest paid during the tax year, the outstanding mortgage balance, and the property address. Understanding this form is vital for accurately reporting your tax obligations and maximizing potential deductions.

How to use the Form 1098

Using the Form 1098 involves several steps to ensure that you accurately report your mortgage interest on your tax return. First, review the information provided on the form, including the total interest paid and any additional details. This information will help you determine the amount you can deduct. When filing your tax return, you will typically report this deduction on Schedule A of Form 1040 if you itemize your deductions. It is essential to keep the Form 1098 for your records, as the IRS may request it in case of an audit.

Steps to complete the Form 1098

Completing the Form 1098 requires careful attention to detail. Start by entering your personal information, including your name, address, and taxpayer identification number. Next, input the lender's information, including their name and address. Then, provide the total amount of mortgage interest paid during the tax year, as well as any points paid on the mortgage. Make sure to double-check the accuracy of all entries before submitting the form to ensure compliance with IRS regulations.

IRS Guidelines

The IRS has specific guidelines regarding the use of Form 1098 for reporting mortgage interest. According to IRS regulations, lenders must provide the form to borrowers by January 31 of the following tax year. Borrowers should receive the form in time to prepare their tax returns accurately. Additionally, the IRS requires that the information reported on Form 1098 must match the lender's records. Any discrepancies can lead to delays in processing your tax return or potential audits.

Filing Deadlines / Important Dates

Filing deadlines for Form 1098 are crucial for both lenders and borrowers. Lenders must send the Form 1098 to borrowers by January 31 each year. Borrowers should ensure they have received their form before filing their tax returns. The deadline for filing individual tax returns is typically April 15, although this date may vary slightly each year. Being aware of these deadlines helps ensure that you can claim your mortgage interest deduction without any issues.

Who Issues the Form

The Form 1098 is issued by the lender or mortgage servicer who receives the mortgage payments. This can include banks, credit unions, or other financial institutions. It is the lender's responsibility to provide accurate information regarding the total interest paid by the borrower during the tax year. If you have multiple mortgages, each lender will issue a separate Form 1098 for each loan, which you will need to compile when preparing your tax return.

Quick guide on how to complete about form 1098 internal revenue service irsgov

Complete Form 1098 seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Handle Form 1098 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Form 1098 effortlessly

- Find Form 1098 and click on Get Form to begin.

- Make use of the tools we provide to submit your form.

- Mark important parts of your documents or obscure sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

No more concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your needs in document management in just a few clicks from any preferred device. Modify and eSign Form 1098 and maintain exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 1098 internal revenue service irsgov

How to make an eSignature for your About Form 1098 Internal Revenue Service Irsgov online

How to create an electronic signature for the About Form 1098 Internal Revenue Service Irsgov in Google Chrome

How to make an eSignature for signing the About Form 1098 Internal Revenue Service Irsgov in Gmail

How to make an electronic signature for the About Form 1098 Internal Revenue Service Irsgov from your smart phone

How to create an eSignature for the About Form 1098 Internal Revenue Service Irsgov on iOS devices

How to generate an eSignature for the About Form 1098 Internal Revenue Service Irsgov on Android

People also ask

-

What is the 1098 2019 form, and why do I need it?

The 1098 2019 form is used to report mortgage interest that individuals can claim on their tax returns. You need the 1098 2019 to ensure you're accurately reporting your mortgage interest to benefit from potential tax deductions.

-

How can airSlate SignNow help me with my 1098 2019 form?

airSlate SignNow provides an efficient platform to digitally sign and send your 1098 2019 forms securely. By using our service, you can streamline your document workflow, ensuring that your tax forms are handled quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for the 1098 2019?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for occasional users and businesses. You can choose a plan that fits your budget while still allowing you to manage your 1098 2019 efficiently.

-

Can I integrate airSlate SignNow with other software for managing my 1098 2019?

Absolutely! airSlate SignNow integrates seamlessly with numerous applications to enhance your document management capabilities. This allows you to handle your 1098 2019 forms within your existing workflows, making the process even more efficient.

-

What features does airSlate SignNow offer for signing 1098 2019 forms?

Our platform includes features such as electronic signatures, document templates, and secure sharing options. These tools make it simple to obtain signatures for your 1098 2019 forms without the hassle of traditional paper methods.

-

How secure is the process of handling 1098 2019 forms through airSlate SignNow?

airSlate SignNow prioritizes security and compliance, employing industry-standard encryption to protect your 1098 2019 forms. You can trust that your sensitive information is safe during the signing and sharing process.

-

What are the benefits of using airSlate SignNow for my 1098 2019 forms?

Using airSlate SignNow for your 1098 2019 forms provides numerous benefits, including time savings, enhanced accuracy, and the convenience of remote signing. This leads to a smoother tax preparation process overall.

Get more for Form 1098

- Admission orders form

- Taxpayer information update form 645094344

- State of california franchise tax board tax information center

- Transmittal department record cards and per capita tax calegion form

- Mw5 withholding tax depositpayment voucher form

- Application for vendor tax clearance certificate form

- Ifta quarterly fuel tax schedule ifta 101 form

- If federal i form

Find out other Form 1098

- How Can I Electronic signature Pennsylvania Legal Last Will And Testament

- Electronic signature Rhode Island Legal Last Will And Testament Simple

- Can I Electronic signature Rhode Island Legal Residential Lease Agreement

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure