Nebraska Form 10

What is the Nebraska Form 10

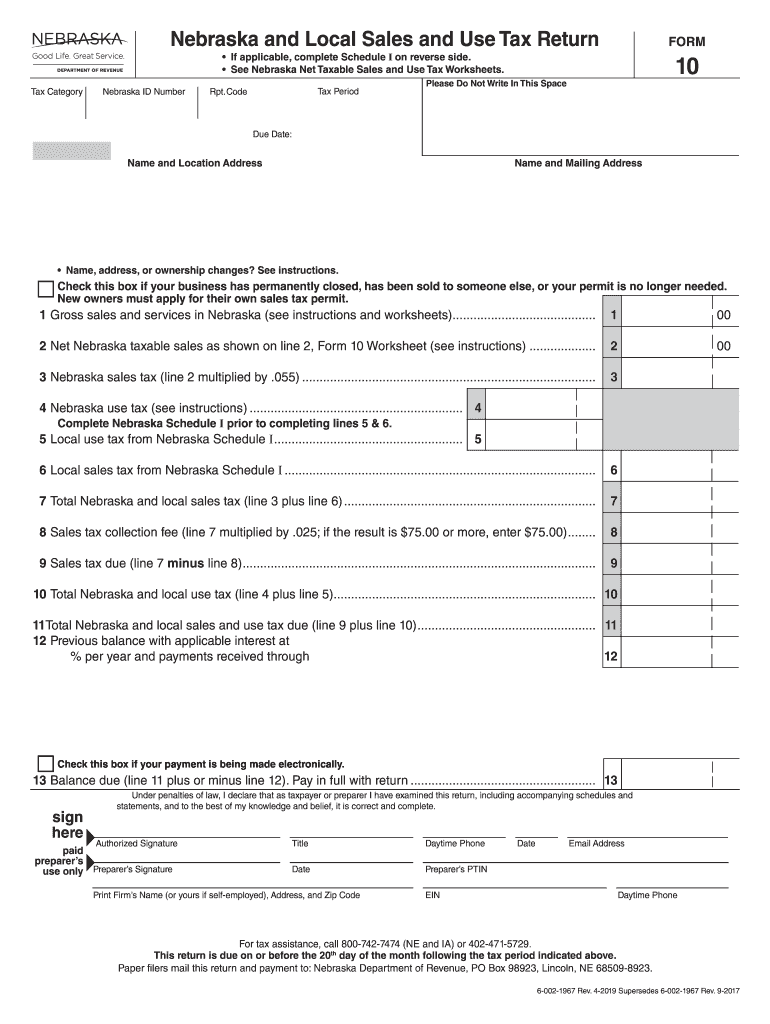

The Nebraska Form 10 is a sales use tax return used by businesses and individuals to report and remit sales and use tax to the state of Nebraska. This form is essential for ensuring compliance with state tax regulations. It is specifically designed for those who have made taxable purchases or sales within the state and need to account for the appropriate tax amounts. Understanding the purpose of this form is crucial for accurate tax reporting and avoiding potential penalties.

Steps to complete the Nebraska Form 10

Completing the Nebraska Form 10 involves several straightforward steps to ensure accuracy and compliance. Begin by gathering all necessary financial records, including receipts and invoices related to taxable sales and purchases. Next, fill out the form by providing your business information, including name, address, and tax identification number. Carefully calculate the total sales and use tax owed based on your transactions, ensuring that all figures are accurate. Finally, review the completed form for any errors before submitting it to the appropriate state department.

How to obtain the Nebraska Form 10

The Nebraska Form 10 can be obtained directly from the Nebraska Department of Revenue's website or through authorized tax professionals. It is available in both digital and printable formats. For those who prefer to complete the form online, digital access allows for easier data entry and submission. Ensure you have the latest version of the form to comply with any recent changes in tax regulations.

Legal use of the Nebraska Form 10

The legal use of the Nebraska Form 10 is governed by state tax laws, which outline the requirements for filing and remitting sales and use tax. To ensure that the form is legally binding, it must be completed accurately and submitted by the designated deadlines. Compliance with these regulations helps avoid penalties and ensures that businesses remain in good standing with state tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Nebraska Form 10 are typically set on a quarterly or annual basis, depending on the volume of sales and use tax a business generates. It is essential to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important dates, including when the form is due and when payments must be made, can help businesses maintain compliance and avoid unnecessary complications.

Form Submission Methods (Online / Mail / In-Person)

The Nebraska Form 10 can be submitted through various methods, including online filing, mailing a hard copy, or in-person submission at designated state offices. Online filing is often the most efficient option, allowing for quicker processing times and immediate confirmation of receipt. For those who prefer traditional methods, mailing the form requires attention to ensure it is sent to the correct address and postmarked by the deadline.

Penalties for Non-Compliance

Failure to file the Nebraska Form 10 on time or accurately can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action by the state. Understanding the consequences of non-compliance emphasizes the importance of timely and correct submissions. Businesses should prioritize maintaining accurate records and adhering to filing requirements to mitigate the risk of penalties.

Quick guide on how to complete sales and use tax formsnebraska department of revenue

Complete Nebraska Form 10 effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can obtain the correct version and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Nebraska Form 10 on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Nebraska Form 10 seamlessly

- Find Nebraska Form 10 and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Nebraska Form 10 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax formsnebraska department of revenue

How to generate an electronic signature for your Sales And Use Tax Formsnebraska Department Of Revenue in the online mode

How to generate an electronic signature for your Sales And Use Tax Formsnebraska Department Of Revenue in Chrome

How to generate an electronic signature for putting it on the Sales And Use Tax Formsnebraska Department Of Revenue in Gmail

How to create an electronic signature for the Sales And Use Tax Formsnebraska Department Of Revenue from your mobile device

How to create an eSignature for the Sales And Use Tax Formsnebraska Department Of Revenue on iOS devices

How to create an eSignature for the Sales And Use Tax Formsnebraska Department Of Revenue on Android devices

People also ask

-

What is the 10 sales use tax and how does it affect my business?

The 10 sales use tax refers to the tax applied to sales of tangible personal property and certain services that occur within a jurisdiction. Understanding this tax is crucial for businesses to ensure compliance and avoid penalties. Integrating a robust eSigning solution like airSlate SignNow can help centralize your documentation associated with tax obligations.

-

How can airSlate SignNow help with 10 sales use tax documentation?

AirSlate SignNow offers an efficient platform for sending and eSigning documents related to the 10 sales use tax. Automated workflows allow for easier tracking and management of tax-related documents. This helps in maintaining accurate records, which is essential for tax filings and audits.

-

Is airSlate SignNow cost-effective for managing 10 sales use tax forms?

Yes, airSlate SignNow is a cost-effective solution that can streamline your 10 sales use tax documentation process. Compared to traditional methods, it reduces labor costs and improves efficiency. By eliminating the need for physical paperwork, businesses can save on resources and focus on growth.

-

What features does airSlate SignNow offer to handle 10 sales use tax requirements?

AirSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage that are beneficial for managing 10 sales use tax forms. These features simplify the process of gathering necessary signatures and ensure that your documents are stored securely for future reference.

-

Does airSlate SignNow integrate with accounting software for 10 sales use tax tracking?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions, enhancing the tracking of 10 sales use tax obligations. This integration ensures that your tax data remains consistent across platforms, making it easier to comply with regulations while reducing manual entry errors.

-

Can airSlate SignNow serve businesses across multiple states dealing with different 10 sales use tax rates?

Absolutely! AirSlate SignNow is designed to accommodate businesses operating in multiple states, each potentially having different 10 sales use tax rates. The platform allows you to customize templates and workflows based on the specific tax rates and regulations of each jurisdiction, ensuring you remain compliant.

-

What are the benefits of using airSlate SignNow for 10 sales use tax-related contracts?

Using airSlate SignNow for 10 sales use tax-related contracts offers benefits like faster processing times, enhanced security, and easy access to documents anytime, anywhere. This means that you can get contracts signed more quickly, reducing delays in transactions and improving cash flow management.

Get more for Nebraska Form 10

- A 2005 form

- Lb0792 form

- U4 form

- Online pfs review for contractors license tennessee 2011 form

- Application for gubernatorial appointment to a board or commission tennessee form

- Application of member for refund of accumulated contributions solidated retirement system form

- Form mo 2210 underpayment of estimated tax by

- I 050 form 1npr nonresident ampamp part year resident wisconsin income tax 794892695

Find out other Nebraska Form 10

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF