Form 1040 V Payment Voucher 2022

What is the Form 1040 V Payment Voucher

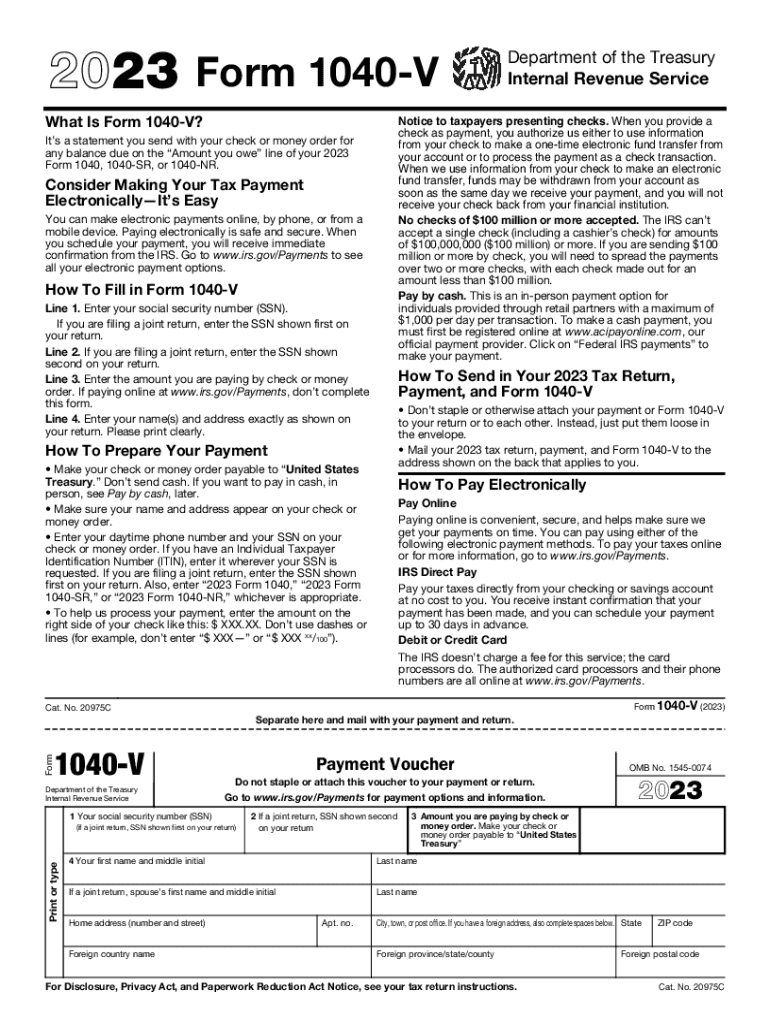

The Form 1040 V is a payment voucher used by individuals to submit their tax payments to the Internal Revenue Service (IRS) when filing their federal income tax returns. This form is particularly important for taxpayers who owe additional taxes and wish to ensure that their payments are properly credited to their accounts. The 1040 V serves as a cover sheet for payments made with a paper return or as a standalone payment method for those who file electronically.

How to Use the Form 1040 V Payment Voucher

To effectively use the Form 1040 V, taxpayers should first complete their tax return to determine the amount owed. Once the amount is established, the taxpayer should fill out the 1040 V with their personal information, including name, address, and Social Security number. It is essential to include the payment amount and ensure that the form is signed. After completing the form, taxpayers can submit it along with their payment to the IRS, either by mail or electronically, depending on their filing method.

Steps to Complete the Form 1040 V Payment Voucher

Completing the Form 1040 V involves several straightforward steps:

- Obtain the Form 1040 V from the IRS website or through tax preparation software.

- Fill in your personal information, including your name, address, and Social Security number.

- Indicate the payment amount you are submitting.

- Sign and date the form to validate your submission.

- Attach your payment, if applicable, and ensure all documents are securely included.

- Submit the completed form and payment to the IRS by mail or through the appropriate electronic method.

Legal Use of the Form 1040 V Payment Voucher

The Form 1040 V is legally recognized by the IRS as a valid means for submitting tax payments. It is crucial for taxpayers to use this form correctly to avoid any potential issues with their tax accounts. Proper use of the 1040 V helps ensure that payments are processed efficiently and credited accurately, which is essential for maintaining compliance with federal tax laws.

Key Elements of the Form 1040 V Payment Voucher

The Form 1040 V includes several key elements that taxpayers must complete:

- Name: The taxpayer’s full name as it appears on their tax return.

- Address: The current mailing address of the taxpayer.

- Social Security Number: The taxpayer's Social Security number or Employer Identification Number.

- Payment Amount: The total amount being submitted for payment.

- Signature: The taxpayer’s signature to authorize the payment.

Filing Deadlines / Important Dates

Taxpayers should be aware of the filing deadlines associated with the Form 1040 V. Typically, the deadline for submitting tax payments coincides with the due date of the federal income tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to check the IRS guidelines for any updates or changes to these dates to avoid late penalties.

Quick guide on how to complete form 1040 v payment voucher

Effortlessly Prepare Form 1040 V Payment Voucher on Any Device

Managing documents online has gained traction with both organizations and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed forms, allowing you to locate the necessary template and securely save it online. airSlate SignNow equips you with all the resources essential to swiftly create, modify, and eSign your documents without delays. Manage Form 1040 V Payment Voucher on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The Easiest Method to Modify and eSign Form 1040 V Payment Voucher Without Effort

- Locate Form 1040 V Payment Voucher and click on Get Form to initiate the process.

- Utilize the features we offer to fill out your document.

- Highlight key sections of the documents or obscure sensitive data using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign feature, which takes just seconds and carries the same legal validity as an ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invite link, or download it to your PC.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Form 1040 V Payment Voucher while ensuring effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 v payment voucher

Create this form in 5 minutes!

How to create an eSignature for the form 1040 v payment voucher

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a payment voucher?

A payment voucher is a document used to authorize a payment, confirming that a service or product has been received. It typically includes details such as the date, amount, payee information, and transaction purpose, providing a clear record for both the payer and the recipient.

-

How does airSlate SignNow help with managing payment vouchers?

airSlate SignNow streamlines the process of creating and signing payment vouchers electronically. It allows businesses to generate custom templates, ensuring accurate and quick documentation that can be easily sent for eSignature.

-

What features does airSlate SignNow offer for payment vouchers?

With airSlate SignNow, users can create workflows that automate the routing and signing of payment vouchers. Additionally, it provides features like document tracking, reminders, and analytics, ensuring your payment processes are efficient and organized.

-

Are there any costs associated with using airSlate SignNow for payment vouchers?

Yes, while airSlate SignNow offers a free trial, there is a pricing structure based on the features and the number of users. This makes it a cost-effective solution for businesses looking to streamline their financial documentation, including payment vouchers.

-

Can I integrate airSlate SignNow with other tools for managing payment vouchers?

Absolutely! airSlate SignNow offers integrations with various applications, including accounting software and CRM systems. This allows you to manage payment vouchers seamlessly alongside your existing business processes.

-

What are the benefits of using airSlate SignNow for payment vouchers?

Using airSlate SignNow for payment vouchers enhances efficiency, reduces paper usage, and ensures compliance by providing a secure digital platform for document management. It also speeds up the payment process, allowing businesses to manage finances more effectively.

-

Is it secure to use airSlate SignNow for payment vouchers?

Yes, airSlate SignNow prioritizes security with features like encryption, two-factor authentication, and secure storage. This ensures that your payment vouchers and sensitive information are protected throughout the signing process.

Get more for Form 1040 V Payment Voucher

Find out other Form 1040 V Payment Voucher

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free