Schedule F Form 1 Profit or Loss from Farming 2022

What is the Schedule F Form 1 Profit Or Loss From Farming

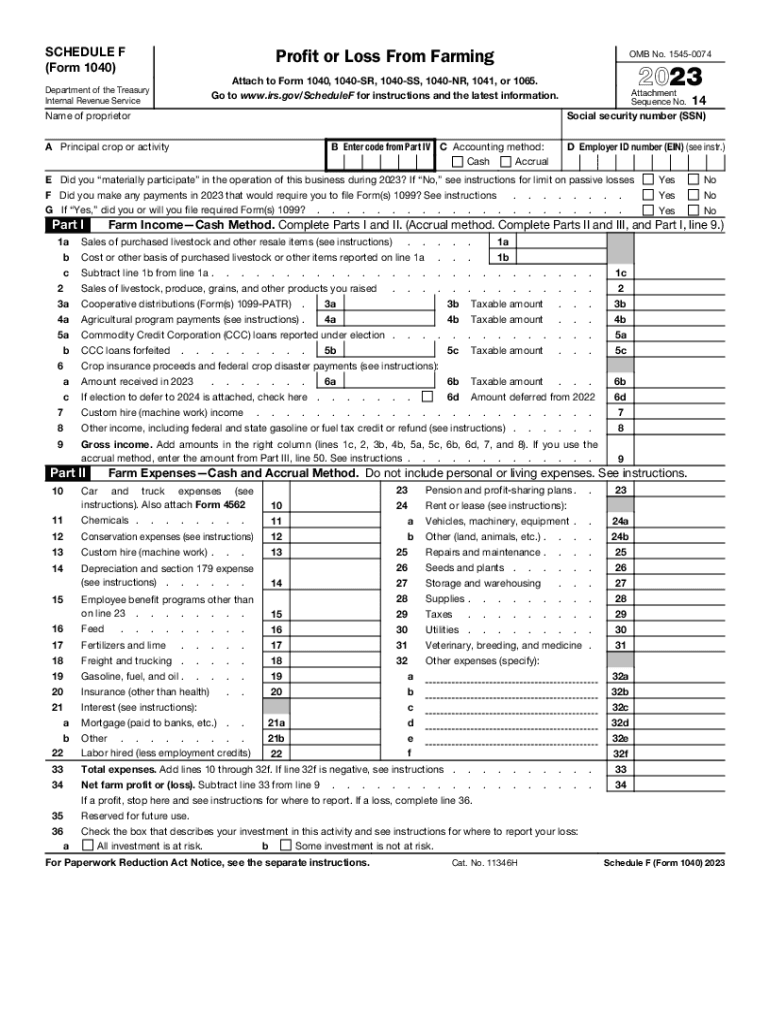

The Schedule F form, officially known as the Profit or Loss From Farming, is a tax form used by farmers in the United States to report their income and expenses from farming activities. This form is essential for individuals who operate a farm as a sole proprietorship or as part of a partnership. It allows farmers to calculate their net profit or loss, which is then reported on their IRS Form 1040. Understanding the purpose of Schedule F is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Schedule F Form 1 Profit Or Loss From Farming

Using the Schedule F form involves several steps to ensure accurate reporting of farming income and expenses. Farmers begin by gathering all relevant financial records, including receipts for expenses and documentation of income received from farming activities. The form requires detailed entries of various income sources, such as sales of livestock, crops, and other farm products. Additionally, farmers must report their operating expenses, which can include costs for seeds, fertilizers, equipment, and labor. Properly filling out Schedule F helps in determining the taxable income and ensures compliance with tax obligations.

Steps to complete the Schedule F Form 1 Profit Or Loss From Farming

Completing the Schedule F form involves a systematic approach:

- Gather financial records: Collect all income and expense documentation related to farming activities.

- Fill in income details: Report all sources of income from farming, including sales and any government payments.

- List expenses: Itemize all deductible expenses associated with farming operations, such as feed, maintenance, and utilities.

- Calculate net profit or loss: Subtract total expenses from total income to determine the net profit or loss for the tax year.

- Transfer to Form 1040: Report the net profit or loss on the appropriate line of the IRS Form 1040.

Key elements of the Schedule F Form 1 Profit Or Loss From Farming

Several key elements are essential for completing the Schedule F form accurately:

- Income Section: This includes all revenue generated from farming activities.

- Expenses Section: Detailed categorization of all farming-related expenses, which can be divided into direct and indirect costs.

- Net Profit or Loss Calculation: A critical calculation that determines the overall financial outcome of farming operations for the year.

- Signature and Date: The form must be signed and dated by the taxpayer to validate the information provided.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule F form. These guidelines outline what constitutes farm income and what expenses are deductible. Farmers should refer to the IRS instructions for Schedule F to ensure compliance with current tax laws. Understanding these guidelines can help farmers maximize their deductions and minimize their tax liabilities. It's important to stay updated on any changes in tax regulations that may affect the completion of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule F form align with the general tax filing deadlines for individual taxpayers. Typically, the deadline for filing Form 1040, along with Schedule F, is April 15 of the following year. If additional time is needed, taxpayers can file for an extension, which extends the deadline to October 15. However, it is crucial to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete schedule f form 1 profit or loss from farming

Effortlessly prepare Schedule F Form 1 Profit Or Loss From Farming on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Schedule F Form 1 Profit Or Loss From Farming on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Schedule F Form 1 Profit Or Loss From Farming seamlessly

- Obtain Schedule F Form 1 Profit Or Loss From Farming and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs with just a few clicks from your chosen device. Modify and eSign Schedule F Form 1 Profit Or Loss From Farming while ensuring excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule f form 1 profit or loss from farming

Create this form in 5 minutes!

How to create an eSignature for the schedule f form 1 profit or loss from farming

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the airSlate SignNow solution for handling f farming pdf documents?

airSlate SignNow offers an intuitive platform that enables users to easily send and eSign f farming pdf documents. Our solution streamlines the signing process, allowing for quick approvals and efficient workflows. By reducing paperwork, businesses can focus on their core tasks while ensuring compliance with electronic signature laws.

-

How does airSlate SignNow ensure the security of f farming pdf documents?

The security of your f farming pdf documents is paramount at airSlate SignNow. We employ advanced encryption standards, ensuring that all data is protected during transmission and storage. Additionally, our platform adheres to various regulatory compliance standards, further safeguarding sensitive information.

-

What pricing plans are available for the airSlate SignNow service when working with f farming pdf files?

We offer flexible pricing plans tailored to various business needs for handling f farming pdf files. Whether you are a small business or a large enterprise, our plans provide cost-effective solutions with different features. You can choose a plan that fits your budget and requirements, allowing you to leverage all the capabilities of our platform.

-

Can I integrate airSlate SignNow with other software applications for managing f farming pdf documents?

Absolutely! airSlate SignNow seamlessly integrates with a variety of popular software applications, enhancing your workflow when it comes to managing f farming pdf documents. Whether it's CRM systems or cloud storage providers, our integrations ensure a streamlined process, thus improving overall efficiency.

-

What are the key features of airSlate SignNow when it comes to f farming pdf documents?

Key features of airSlate SignNow for f farming pdf documents include electronic signatures, document templates, and real-time tracking. These features not only simplify the signing process but also provide transparency and ease of use, enabling businesses to manage their documents effectively. Additionally, our platform supports custom branding, enhancing your professional image.

-

How can airSlate SignNow benefit my business in managing f farming pdf files?

By utilizing airSlate SignNow for your f farming pdf files, your business can benefit from increased efficiency and reduced turnaround time. The platform allows for easy access to documents, quick electronic signing, and eliminates the need for printing. This not only saves time but also reduces costs associated with physical document management.

-

Is airSlate SignNow user-friendly for managing f farming pdf documents?

Yes, airSlate SignNow is designed with user experience in mind, making it user-friendly for managing f farming pdf documents. The interface is intuitive, enabling even those with minimal tech experience to navigate easily. Comprehensive tutorials and customer support are also available to ensure a smooth onboarding experience.

Get more for Schedule F Form 1 Profit Or Loss From Farming

Find out other Schedule F Form 1 Profit Or Loss From Farming

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free