Nebraska Form

What is the Nebraska Form

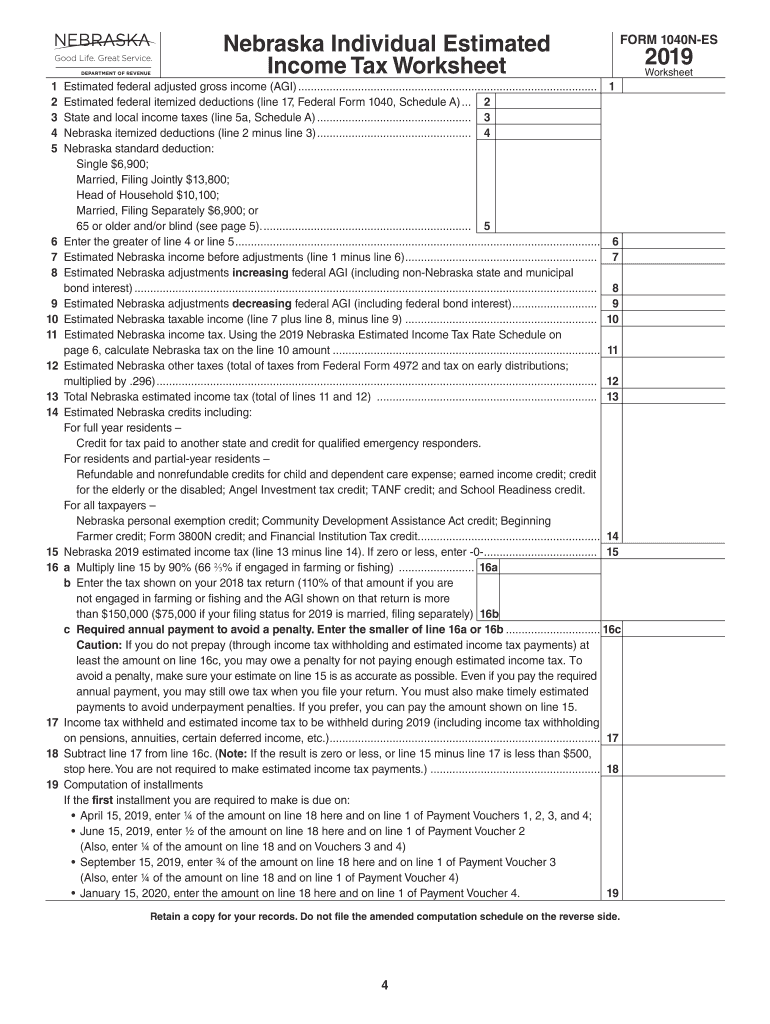

The Nebraska Form, specifically the 2019 Nebraska tax form, is a crucial document for individuals filing their state income taxes. This form is used to report income, calculate tax liability, and determine any potential refunds or amounts owed to the state. The 2019 Nebraska tax form includes various schedules and sections that cater to different types of income and deductions, ensuring that taxpayers can accurately represent their financial situation. It is essential for individuals residing in Nebraska or those who earn income within the state to complete this form in compliance with state tax laws.

Steps to complete the Nebraska Form

Completing the 2019 Nebraska tax form involves several key steps:

- Gather necessary documents: Collect all relevant financial documents, including W-2s, 1099s, and any records of deductions or credits.

- Fill out personal information: Enter your name, address, and Social Security number accurately at the top of the form.

- Report income: Include all sources of income, such as wages, interest, and dividends, in the appropriate sections.

- Calculate deductions: Identify and input any applicable deductions that may reduce your taxable income.

- Determine tax liability: Use the tax tables provided with the form to calculate the amount of tax owed based on your taxable income.

- Review and sign: Double-check all entries for accuracy, then sign and date the form before submission.

Legal use of the Nebraska Form

The 2019 Nebraska tax form is legally recognized as a binding document when completed and submitted according to state regulations. To ensure its legal validity, taxpayers must adhere to specific guidelines, including providing accurate information and signing the form. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce (ESIGN) Act. Using a reliable eSignature solution can enhance the security and validity of the submission process.

Filing Deadlines / Important Dates

Timely submission of the 2019 Nebraska tax form is crucial to avoid penalties. The primary deadline for filing is typically April 15 of the following year. However, taxpayers may request an extension, which allows for additional time to file, but any taxes owed must still be paid by the original deadline to avoid interest and penalties. It is essential to stay informed about any changes to deadlines or specific dates that may affect your filing obligations.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the 2019 Nebraska tax form:

- Online: Many taxpayers choose to file electronically using approved e-filing software, which can streamline the process and reduce errors.

- Mail: The form can be printed and mailed to the designated state tax office. Ensure that you send it to the correct address based on your location.

- In-Person: Some individuals may opt to deliver their forms in person at local tax offices, which can provide immediate confirmation of receipt.

Required Documents

To accurately complete the 2019 Nebraska tax form, taxpayers need to gather several key documents:

- W-2 forms: These documents report wages and tax withholdings from employers.

- 1099 forms: These are necessary for reporting various types of income, such as freelance work or interest earned.

- Receipts for deductions: Keep records of any expenses that may qualify for deductions, such as medical expenses or charitable contributions.

- Previous year’s tax return: This can provide a reference for completing the current year’s form.

Quick guide on how to complete tax year 2016 income tax forms nebraska department of revenue

Effortlessly Prepare Nebraska Form on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It presents a superb eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents quickly and efficiently. Handle Nebraska Form on any platform using airSlate SignNow's Android or iOS applications, and streamline any document-related process today.

How to Edit and eSign Nebraska Form with Ease

- Obtain Nebraska Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive data using the tools that airSlate SignNow particularly offers for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to finalize your changes.

- Select how you wish to deliver your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or missing files, tedious form searching, or mistakes that necessitate reprinting documents. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Nebraska Form while ensuring effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax year 2016 income tax forms nebraska department of revenue

How to create an electronic signature for your Tax Year 2016 Income Tax Forms Nebraska Department Of Revenue online

How to make an electronic signature for your Tax Year 2016 Income Tax Forms Nebraska Department Of Revenue in Google Chrome

How to create an electronic signature for putting it on the Tax Year 2016 Income Tax Forms Nebraska Department Of Revenue in Gmail

How to generate an electronic signature for the Tax Year 2016 Income Tax Forms Nebraska Department Of Revenue straight from your mobile device

How to generate an eSignature for the Tax Year 2016 Income Tax Forms Nebraska Department Of Revenue on iOS devices

How to make an eSignature for the Tax Year 2016 Income Tax Forms Nebraska Department Of Revenue on Android devices

People also ask

-

What documents are essential for filing my 2019 Nebraska tax return?

To file your 2019 Nebraska tax return, you will need essential documents such as your W-2 forms from employers, 1099 forms for any additional income, and records of deductions. Having this documentation ready ensures a smooth filing process for your 2019 Nebraska tax.

-

How does airSlate SignNow help with 2019 Nebraska tax filing?

airSlate SignNow streamlines the document management process by allowing you to easily send, eSign, and collaborate on tax documents required for your 2019 Nebraska tax filing. With its user-friendly interface, you can ensure all necessary paperwork is efficiently organized and ready for submission.

-

What are the pricing options for using airSlate SignNow for 2019 Nebraska tax documents?

airSlate SignNow offers various pricing plans tailored to meet the needs of different businesses. Our solutions are cost-effective, ensuring you can securely eSign and manage your 2019 Nebraska tax documents without overspending.

-

Are there any integration options when using airSlate SignNow for 2019 Nebraska tax?

Yes, airSlate SignNow integrates seamlessly with popular applications like Google Drive, Dropbox, and Microsoft Office. This allows you to access and manage all your 2019 Nebraska tax documents in one place, enhancing productivity and compliance.

-

Can I use airSlate SignNow for multiple years of tax documents, including 2019 Nebraska tax?

Absolutely! airSlate SignNow is designed for multi-year use, allowing users to manage and eSign multiple years of tax documents, including your 2019 Nebraska tax forms. This flexibility makes it easier to maintain your financial records over time.

-

What benefits does airSlate SignNow provide for my 2019 Nebraska tax preparation?

Using airSlate SignNow offers numerous benefits for 2019 Nebraska tax preparation, such as improved efficiency, reduced errors, and enhanced security for sensitive information. Our platform ensures your tax documents are signed and shared quickly and safely.

-

Is airSlate SignNow compliant with the 2019 Nebraska tax regulations?

Yes, airSlate Sign Now is fully compliant with current regulations, including those related to the 2019 Nebraska tax. Our platform ensures all eSigned documents meet legal standards, providing you with peace of mind during tax season.

Get more for Nebraska Form

- Tn tpa form

- Application to residence homestead texas form

- Ap 192 application for seller training certification window texas form

- Sales tax permit form

- Application for charitable organization property tax exemption fillable form

- Application for charitable organizations improving property for low income housing property tax exemption window texas form

- Texas tcfp form

- The state of texas application for employment form

Find out other Nebraska Form

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later