Department of the Treasury Internal Revenue Service Austin 2021

IRS Guidelines

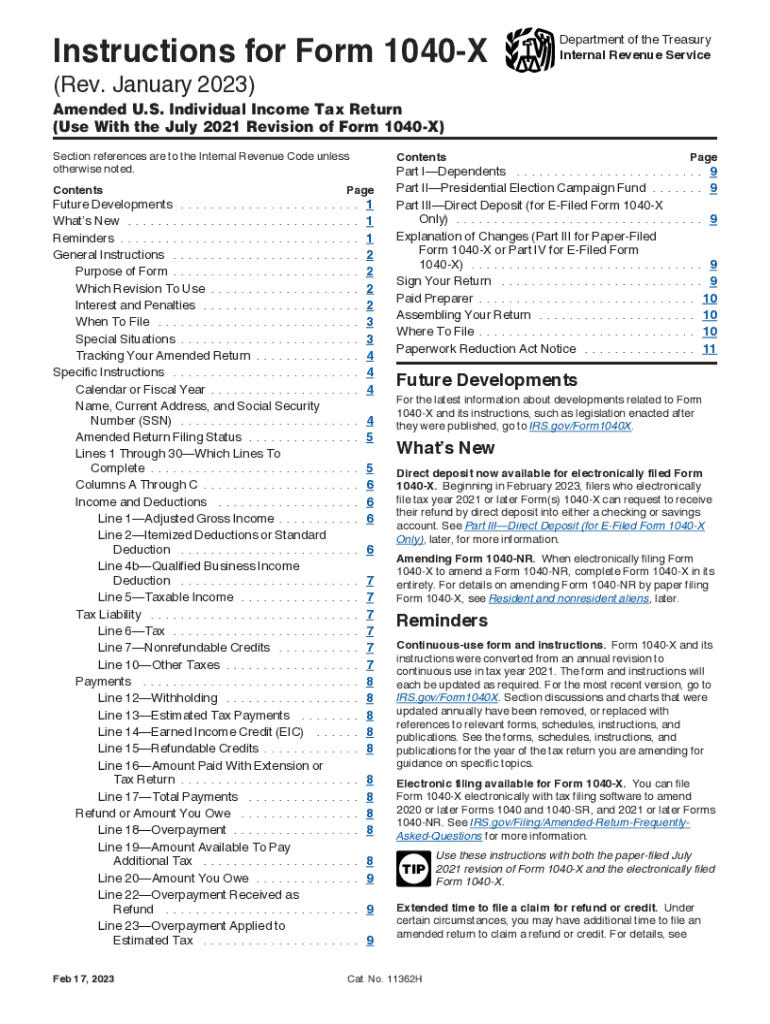

The Internal Revenue Service (IRS) provides comprehensive guidelines for individuals and businesses regarding tax forms and filing procedures. Understanding these guidelines is essential for compliance and to avoid penalties. The IRS outlines specific instructions for various forms, including the 1040, W-2, and 1099, detailing how to fill them out accurately. Each form comes with its own set of rules regarding eligibility, required information, and submission methods. Familiarizing yourself with these guidelines can help ensure that your tax filings are correct and timely.

Filing Deadlines / Important Dates

Staying aware of filing deadlines is crucial for taxpayers. The IRS sets specific dates for various forms, including the annual tax return deadline, which typically falls on April 15. Extensions may be available, but they must be requested before the original deadline. Additionally, estimated tax payment deadlines are important for self-employed individuals or those with additional income sources. Missing these deadlines can result in penalties and interest on unpaid taxes, making it essential to mark these dates on your calendar.

Required Documents

When preparing to file your taxes, gathering the necessary documents is vital. Commonly required documents include W-2 forms from employers, 1099 forms for freelance or contract work, and receipts for deductible expenses. Additionally, personal identification information, such as Social Security numbers, is required for accurate filing. Ensuring you have all required documents at hand can streamline the filing process and reduce the likelihood of errors.

Form Submission Methods (Online / Mail / In-Person)

The IRS offers multiple methods for submitting tax forms, catering to different preferences and needs. Taxpayers can file online using approved e-filing software, which often provides a user-friendly interface and instant confirmation of submission. Alternatively, forms can be mailed directly to the IRS, although this method may result in longer processing times. Some taxpayers may also choose to file in person at designated IRS offices, which can provide immediate assistance and guidance.

Penalties for Non-Compliance

Understanding the potential penalties for non-compliance with IRS regulations is essential for all taxpayers. Failing to file a tax return or pay taxes owed can lead to significant penalties, including fines and interest on unpaid amounts. The IRS may also impose additional penalties for inaccuracies or fraudulent filings. Being aware of these consequences can motivate timely and accurate tax submissions, helping to avoid unnecessary financial burdens.

Digital vs. Paper Version

Choosing between digital and paper versions of IRS forms can impact the filing experience. Digital forms often allow for easier completion, automatic calculations, and faster submission. They also typically provide a confirmation of receipt from the IRS. On the other hand, paper forms may be preferred by those who are less comfortable with technology. However, paper submissions can take longer to process, and tracking the status of a mailed form can be more challenging.

Quick guide on how to complete department of the treasury internal revenue service austin

Complete Department Of The Treasury Internal Revenue Service Austin effortlessly on any device

Online document organization has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without interruptions. Manage Department Of The Treasury Internal Revenue Service Austin on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The simplest way to edit and electronically sign Department Of The Treasury Internal Revenue Service Austin with ease

- Locate Department Of The Treasury Internal Revenue Service Austin and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searching, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Department Of The Treasury Internal Revenue Service Austin to ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct department of the treasury internal revenue service austin

Create this form in 5 minutes!

How to create an eSignature for the department of the treasury internal revenue service austin

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are 'forms IRS' and how can airSlate SignNow help with them?

Forms IRS refer to the various tax forms required by the Internal Revenue Service. airSlate SignNow streamlines the process of preparing and signing these forms, allowing you to eSign documents securely and efficiently. This reduces the time spent on paperwork and ensures compliance with IRS regulations.

-

Is airSlate SignNow suitable for businesses that frequently deal with forms IRS?

Yes, airSlate SignNow is highly suitable for businesses that regularly handle forms IRS. Our platform provides an intuitive interface for creating, editing, and signing these forms, ensuring users can manage their tax documentation without hassle. This simplifies the compliance process and enhances productivity.

-

What pricing options are available for using airSlate SignNow for forms IRS?

airSlate SignNow offers a variety of pricing plans tailored to different business needs, including those focused on handling forms IRS. Our plans are designed to be cost-effective while providing robust features necessary for efficient document management. You can choose a plan that aligns with your volume of form submissions and eSignatures.

-

Can I integrate airSlate SignNow with other software for managing forms IRS?

Absolutely! airSlate SignNow supports integrations with numerous applications, allowing for seamless management of forms IRS alongside your existing software solutions. This flexibility ensures that you can incorporate eSigning into your current workflows without disruptions.

-

What features does airSlate SignNow offer specifically for handling forms IRS?

airSlate SignNow includes features such as custom templates, automated reminders, and secure cloud storage, all optimized for managing forms IRS. These capabilities not only enhance the efficiency of document signing but also ensure that sensitive tax information is managed securely. Users can quickly access and submit their IRS forms anytime.

-

How does using airSlate SignNow benefit my business when dealing with forms IRS?

Using airSlate SignNow leverages electronic signatures, reducing the time and costs associated with printing and mailing forms IRS. This digital transformation not only accelerates the signing process but also increases accuracy by minimizing human errors in form completion. Ultimately, this boosts your operational efficiency and compliance.

-

What support does airSlate SignNow offer for users managing forms IRS?

airSlate SignNow provides comprehensive support for users dealing with forms IRS, including access to an extensive knowledge base, tutorials, and customer support. Our team is ready to assist with any questions about the platform’s features or IRS compliance. This ensures you are never alone in navigating your document signing needs.

Get more for Department Of The Treasury Internal Revenue Service Austin

- Sample email templates to professors for research funding form

- Anthem questionnaire form

- Lincoln distribution formpdf pinnacle financial services

- Can you fax upmc personal rep form

- Cobra application form

- Pulmonary arterial hypertension infusible inhalation or injectable medication precertification request pulmonary arterial form

- Immunology laboratory 800 form

- Anthem case form

Find out other Department Of The Treasury Internal Revenue Service Austin

- Share eSign Presentation Online

- Edit eSign PDF Online

- Share eSign Presentation Simple

- Edit eSign PDF Free

- Edit eSign Word Online

- Edit eSign Word Computer

- Edit eSign Document Online

- How Do I Edit eSign Document

- Edit eSign PPT Online

- How To Submit eSign PDF

- Submit eSign Form Android

- Convert eSign PDF Online

- Convert eSign PDF Mobile

- Convert eSign PDF Free

- Print eSign Word Free

- How Do I Print eSign PDF

- Print eSign PDF Free

- How To Print eSign Document

- Print eSign Form Mobile

- Download eSign PDF Free