New Mexico Form ACD 31102 Tax Information 2020

What is the New Mexico Form ACD 31102 Tax Information

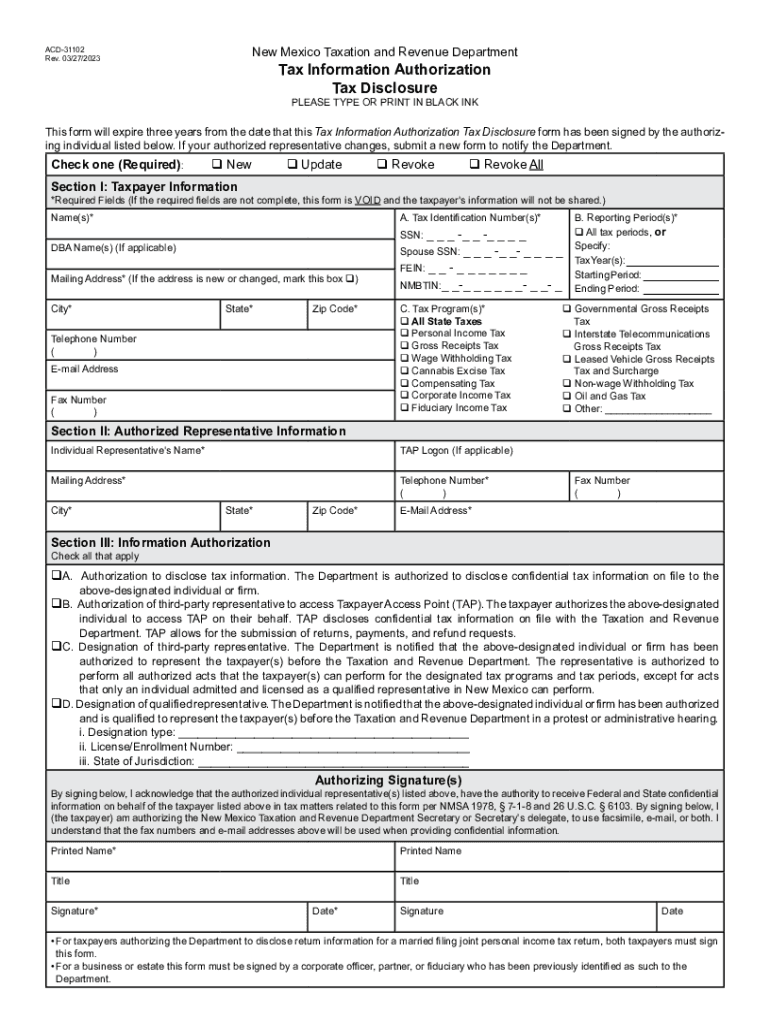

The New Mexico Form ACD 31102 Tax Information is a crucial document used by taxpayers in New Mexico to provide pertinent tax-related information. This form is typically utilized for reporting various tax obligations to the state, ensuring compliance with state tax laws. It serves as a means for individuals and businesses to communicate necessary details regarding their tax status, income, and deductions to the New Mexico Taxation and Revenue Department.

How to use the New Mexico Form ACD 31102 Tax Information

Using the New Mexico Form ACD 31102 involves several steps to ensure accurate completion and submission. Taxpayers should first gather all relevant financial documents, including income statements and previous tax returns. After obtaining the form, individuals can fill it out by providing their personal information, income details, and any applicable deductions. Once completed, the form must be submitted according to the guidelines provided by the New Mexico Taxation and Revenue Department.

Steps to complete the New Mexico Form ACD 31102 Tax Information

Completing the New Mexico Form ACD 31102 requires careful attention to detail. Here are the key steps:

- Obtain the form from the New Mexico Taxation and Revenue Department’s website or office.

- Fill in your personal information, including name, address, and Social Security number.

- Report your total income for the tax year, including wages, self-employment income, and other sources.

- List any deductions or credits you are eligible for, ensuring you have supporting documentation.

- Review the form for accuracy and completeness before submission.

Key elements of the New Mexico Form ACD 31102 Tax Information

The New Mexico Form ACD 31102 includes several key elements that are essential for proper tax reporting. These elements typically consist of:

- Taxpayer Information: Personal details such as name, address, and identification numbers.

- Income Reporting: Sections dedicated to reporting various types of income, including wages and business earnings.

- Deductions and Credits: Areas to claim eligible deductions that can reduce tax liability.

- Signature Line: A section where the taxpayer must sign and date the form to certify its accuracy.

Filing Deadlines / Important Dates

Filing deadlines for the New Mexico Form ACD 31102 are crucial for compliance. Generally, the form must be submitted by April 15 of the following year for individual taxpayers. However, specific deadlines may vary based on individual circumstances or extensions. It is advisable to check the New Mexico Taxation and Revenue Department’s website for any updates or changes to these dates.

Form Submission Methods

Taxpayers have several options for submitting the New Mexico Form ACD 31102. The form can be submitted:

- Online: Through the New Mexico Taxation and Revenue Department’s online portal, if available.

- By Mail: Sent directly to the appropriate address provided by the department.

- In-Person: Delivered to a local office of the New Mexico Taxation and Revenue Department.

Quick guide on how to complete new mexico form acd 31102 tax information

Prepare New Mexico Form ACD 31102 Tax Information effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with everything necessary to create, edit, and electronically sign your documents promptly without delays. Handle New Mexico Form ACD 31102 Tax Information on any device using airSlate SignNow’s Android or iOS applications and streamline any document-driven process today.

How to edit and electronically sign New Mexico Form ACD 31102 Tax Information effortlessly

- Find New Mexico Form ACD 31102 Tax Information and click Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize important portions of the documents or redact sensitive information using instruments that airSlate SignNow provides specifically for that function.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred delivery method for the form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tiresome form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign New Mexico Form ACD 31102 Tax Information to ensure exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new mexico form acd 31102 tax information

Create this form in 5 minutes!

How to create an eSignature for the new mexico form acd 31102 tax information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the New Mexico Form ACD 31102 Tax Information?

The New Mexico Form ACD 31102 Tax Information is a tax form used to report various tax-related data to the state's taxation department. This form is essential for businesses in New Mexico to ensure compliance with state tax regulations. Utilizing airSlate SignNow can simplify the process of completing and submitting this form efficiently.

-

How can airSlate SignNow help me with the New Mexico Form ACD 31102 Tax Information?

airSlate SignNow provides an easy-to-use platform to fill out, sign, and manage the New Mexico Form ACD 31102 Tax Information digitally. With its user-friendly interface, you can expedite the completion of tax forms, ensuring you meet all deadlines without hassle. Additionally, you can save time and resources, allowing your business to focus on core operations.

-

Is airSlate SignNow cost-effective for handling the New Mexico Form ACD 31102 Tax Information?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing various documents, including the New Mexico Form ACD 31102 Tax Information. By reducing paper usage and streamlining the eSigning process, you can lower operational costs signNowly. The pricing plans are tailored to fit businesses of all sizes, ensuring you get great value.

-

What features does airSlate SignNow offer for managing the New Mexico Form ACD 31102 Tax Information?

airSlate SignNow offers a range of features to facilitate the management of the New Mexico Form ACD 31102 Tax Information, including templates, eSigning, and secure document storage. These features ensure that your forms are filled correctly, signed quickly, and stored securely for easy access. Additionally, the platform allows collaboration with your team or clients, enhancing workflow efficiency.

-

Can I integrate airSlate SignNow with other software for the New Mexico Form ACD 31102 Tax Information?

Absolutely! airSlate SignNow offers integrations with popular software systems that can be beneficial for managing the New Mexico Form ACD 31102 Tax Information. You can seamlessly sync your documents with CRM software, cloud storage, and other tools to streamline your workflow. This flexibility ensures that you can work within your existing systems while using airSlate SignNow.

-

What are the benefits of using airSlate SignNow for the New Mexico Form ACD 31102 Tax Information?

Using airSlate SignNow for the New Mexico Form ACD 31102 Tax Information provides numerous benefits, such as increased efficiency, reduced paper waste, and enhanced security. It simplifies the process of document management and eSigning, allowing businesses to focus on their core activities. Moreover, the platform ensures compliance with state regulations, reducing the risk of errors in submission.

-

Is technical support available if I need help with the New Mexico Form ACD 31102 Tax Information?

Yes, airSlate SignNow offers comprehensive technical support for users dealing with the New Mexico Form ACD 31102 Tax Information. You can access resources like tutorials, FAQs, and live customer support to address any questions or issues you encounter. This ensures that you can resolve problems quickly and efficiently, with the assistance you need at your fingertips.

Get more for New Mexico Form ACD 31102 Tax Information

- Life on the inside georgetown law georgetown university law georgetown form

- Form updated 041218

- Precollege summer institute incident report form

- Electronic fillable vanderbilt form

- Doctors visit claim form

- Network health admission surgery notification form

- Precertification aetna sample fill online printable form

- Meritain form

Find out other New Mexico Form ACD 31102 Tax Information

- How To Sign Oregon Healthcare / Medical Living Will

- How Can I Sign South Carolina Healthcare / Medical Profit And Loss Statement

- Sign Tennessee Healthcare / Medical Business Plan Template Free

- Help Me With Sign Tennessee Healthcare / Medical Living Will

- Sign Texas Healthcare / Medical Contract Mobile

- Sign Washington Healthcare / Medical LLC Operating Agreement Now

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online