Form 941 V Payment Voucher for Paying Balance Due 2022

What is the Form 941 V Payment Voucher for Paying Balance Due

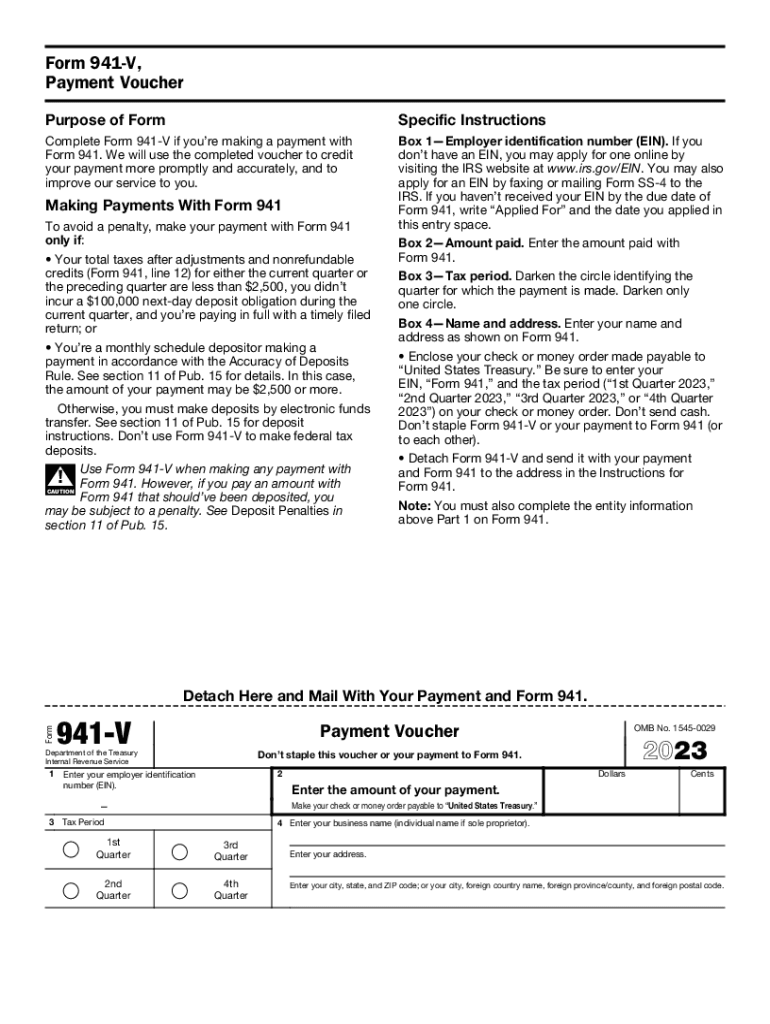

The Form 941 V Payment Voucher is a crucial document used by employers to remit their balance due for federal payroll taxes. This form is specifically designed for those who file Form 941, which reports income taxes withheld from employee wages, Social Security tax, and Medicare tax. The 941 V voucher allows for a streamlined payment process, ensuring that payments are correctly applied to the employer's account with the IRS. It is important for businesses to use this form when they owe taxes, as it helps to avoid delays and ensures compliance with federal tax obligations.

How to Use the Form 941 V Payment Voucher for Paying Balance Due

To use the Form 941 V Payment Voucher effectively, employers should first complete their Form 941 to determine the amount of tax owed. Once the amount is calculated, the employer should fill out the 941 V voucher, providing necessary details such as the employer's name, address, and the amount being paid. This voucher should be submitted along with the payment, whether it is made via check or electronic payment. By including the voucher, the IRS can easily match the payment to the correct tax return, facilitating accurate processing.

Steps to Complete the Form 941 V Payment Voucher for Paying Balance Due

Completing the Form 941 V Payment Voucher involves several straightforward steps:

- Obtain the Form 941 V from the IRS website or through tax software.

- Fill in your business name, address, and Employer Identification Number (EIN).

- Indicate the payment amount due, as calculated on your Form 941.

- Review the information for accuracy to prevent processing delays.

- Attach the voucher to your payment and submit it to the IRS.

Key Elements of the Form 941 V Payment Voucher for Paying Balance Due

The Form 941 V includes several key elements that are essential for proper submission:

- Employer Information: Name, address, and EIN must be clearly stated.

- Payment Amount: The exact amount owed should be entered accurately.

- Tax Period: Indicate the quarter for which the payment is being made.

- Signature: Although not required on the voucher itself, ensure that the payment method is authorized.

IRS Guidelines for the Form 941 V Payment Voucher

The IRS provides specific guidelines for using the Form 941 V Payment Voucher. It is essential to follow these guidelines to ensure compliance and avoid penalties. Employers should submit the voucher along with their payment by the due date specified for their Form 941. The IRS recommends using the voucher to help ensure that payments are processed accurately and promptly. Additionally, employers should keep a copy of the voucher and payment for their records, as this documentation may be necessary for future reference or audits.

Filing Deadlines for the Form 941 V Payment Voucher

Employers must adhere to specific filing deadlines for submitting the Form 941 and the accompanying 941 V Payment Voucher. Generally, Form 941 is due on the last day of the month following the end of each quarter. For example, the due date for the first quarter (January through March) is April 30. Payments made using the 941 V voucher should be submitted by these deadlines to avoid interest and penalties. It is advisable to check the IRS website for any updates or changes to these deadlines.

Quick guide on how to complete form 941 v payment voucher for paying balance due

Prepare Form 941 V Payment Voucher For Paying Balance Due effortlessly on any device

Online document management has gained traction with businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage Form 941 V Payment Voucher For Paying Balance Due on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to edit and electronically sign Form 941 V Payment Voucher For Paying Balance Due with ease

- Obtain Form 941 V Payment Voucher For Paying Balance Due and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 941 V Payment Voucher For Paying Balance Due and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 941 v payment voucher for paying balance due

Create this form in 5 minutes!

How to create an eSignature for the form 941 v payment voucher for paying balance due

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process to e file 941 using airSlate SignNow?

To e file 941 using airSlate SignNow, start by creating your 941 form within our platform. Once your document is ready, you can electronically sign it and submit it directly to the IRS through our integrated e-filing system, ensuring compliance and a hassle-free experience.

-

Is there a cost to e file 941 with airSlate SignNow?

Yes, there is a cost associated with e filing 941 through airSlate SignNow. However, our pricing plans are designed to be budget-friendly, especially for small businesses, ensuring you get an affordable and efficient way to manage your payroll forms.

-

What features does airSlate SignNow offer for e file 941?

airSlate SignNow offers a variety of features for e filing 941, including customizable templates, electronic signatures, secure document storage, and automatic notifications. These features streamline the filing process, making it easy for users to manage their tax documents.

-

What are the benefits of using airSlate SignNow to e file 941?

Using airSlate SignNow to e file 941 provides several benefits, such as increased efficiency, reduced paperwork, and enhanced security for your sensitive tax information. Our platform is specifically designed to simplify the e-filing process and save you valuable time.

-

Can I integrate airSlate SignNow with my existing accounting software for e filing 941?

Yes, airSlate SignNow can be easily integrated with various accounting software systems to facilitate seamless e filing 941. This integration allows for a smoother workflow and ensures that all your tax documents are accurately filed on time.

-

Is airSlate SignNow user-friendly for e filing 941?

Absolutely! airSlate SignNow is designed to be user-friendly, making the e filing 941 process intuitive and straightforward for users of all experience levels. Our platform includes helpful guides and customer support to assist you whenever needed.

-

How secure is airSlate SignNow for e file 941?

Security is a top priority at airSlate SignNow. When e filing 941, your documents are encrypted, and we comply with industry standards to protect sensitive information. You can trust us to keep your tax data safe and secure.

Get more for Form 941 V Payment Voucher For Paying Balance Due

- Medical record release form university of utah health care healthcare utah

- J 1 insurance verification form for insurance companies

- Staff emergency fund application and guidelines form

- Psychological testing request form providers amerigroup

- Infertility injectable medication precertification form

- Pharmacy prior authorization form medical necessity health net

- Order a testdiagnostic laboratoriesadx national jewish form

- Printable client intake form for zoning appeal development application

Find out other Form 941 V Payment Voucher For Paying Balance Due

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself