Md 502up Form

What is the Md 502up Form

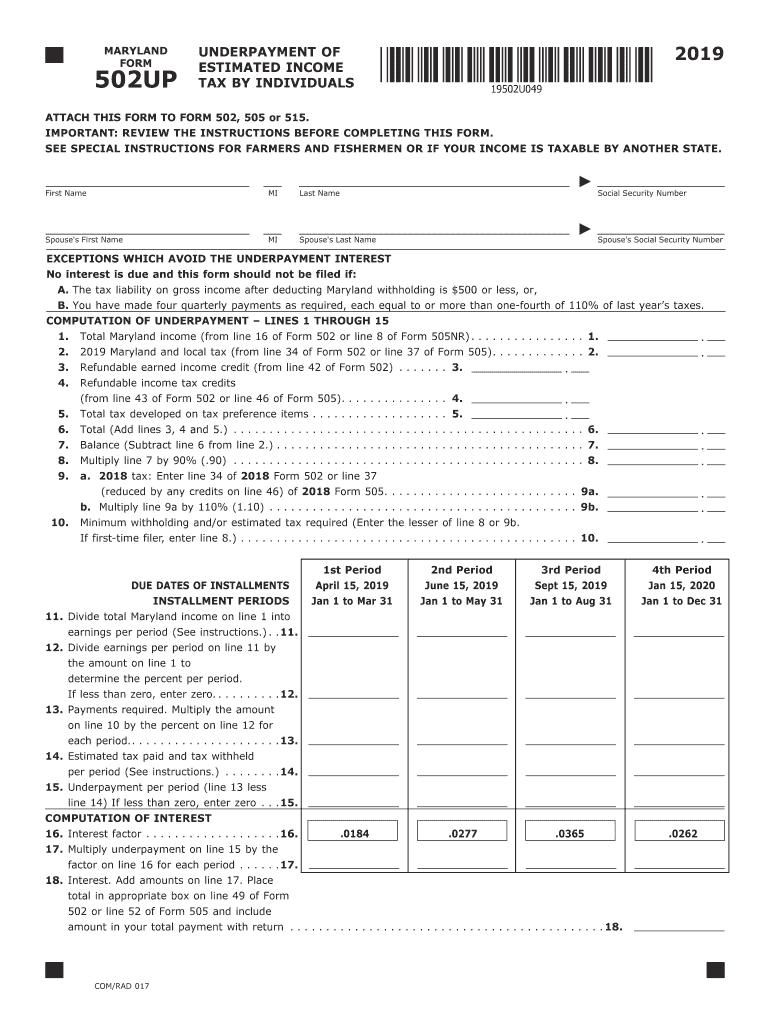

The Md 502up form, also known as the Maryland Underpayment Tax form, is used by individuals and businesses in Maryland to report underpayment of estimated taxes. This form is essential for taxpayers who might not have withheld enough tax from their income throughout the year. It helps ensure that individuals meet their tax obligations and avoid penalties associated with underpayment. The form calculates the amount owed based on the taxpayer's income and estimated tax liability.

How to use the Md 502up Form

To effectively use the Md 502up form, taxpayers must first gather relevant financial information, including income sources and previous tax payments. The form requires details about estimated tax payments made throughout the year and any credits that may apply. After completing the form, taxpayers can submit it to the Maryland Comptroller's office either electronically or by mail. It is crucial to keep a copy for personal records and ensure compliance with state tax regulations.

Steps to complete the Md 502up Form

Completing the Md 502up form involves several key steps:

- Gather necessary documents, including income statements and previous tax returns.

- Calculate total estimated income for the year.

- Determine the total tax liability based on the income.

- Subtract any tax payments already made to find the underpayment amount.

- Fill out the Md 502up form with the calculated figures.

- Review the form for accuracy before submission.

Filing Deadlines / Important Dates

It is important for taxpayers to be aware of the filing deadlines associated with the Md 502up form. Typically, the form must be submitted by the due date of the Maryland income tax return, which is usually April 15 for individuals. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Timely submission helps avoid penalties and interest on any underpaid taxes.

Penalties for Non-Compliance

Failing to file the Md 502up form or underpaying estimated taxes can result in penalties. Maryland imposes interest on unpaid taxes, and additional penalties may apply for late submission. Taxpayers should be aware that these penalties can accumulate, leading to a significant financial burden. It is advisable to address any underpayment issues promptly to mitigate potential penalties.

Form Submission Methods (Online / Mail / In-Person)

The Md 502up form can be submitted through various methods to accommodate taxpayer preferences. Options include:

- Online Submission: Taxpayers can file electronically through the Maryland Comptroller's website, which is often the fastest method.

- Mail: The completed form can be printed and mailed to the appropriate address provided by the Maryland Comptroller.

- In-Person: Taxpayers may also choose to submit the form in person at designated Comptroller offices.

Quick guide on how to complete personal tax payment voucher for form 502505

Effortlessly Prepare Md 502up Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents swiftly without unnecessary delays. Handle Md 502up Form on any device using the airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

The Easiest Way to Edit and Electronically Sign Md 502up Form Effortlessly

- Find Md 502up Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of the documents or obscure confidential information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Modify and electronically sign Md 502up Form and ensure outstanding communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the personal tax payment voucher for form 502505

How to make an eSignature for your Personal Tax Payment Voucher For Form 502505 online

How to generate an electronic signature for your Personal Tax Payment Voucher For Form 502505 in Google Chrome

How to make an eSignature for signing the Personal Tax Payment Voucher For Form 502505 in Gmail

How to generate an eSignature for the Personal Tax Payment Voucher For Form 502505 straight from your smartphone

How to make an electronic signature for the Personal Tax Payment Voucher For Form 502505 on iOS devices

How to make an eSignature for the Personal Tax Payment Voucher For Form 502505 on Android OS

People also ask

-

What is the maryland underpayment tax and how does it affect me?

The Maryland underpayment tax applies to taxpayers who do not pay enough tax throughout the year, potentially resulting in penalties and interest. Understanding your obligations can help you avoid these consequences and maintain compliance. Utilizing airSlate SignNow can streamline document signing for any filings related to underpayment taxes.

-

How can airSlate SignNow help with managing my maryland underpayment tax documents?

airSlate SignNow simplifies the signing and management of documents related to the Maryland underpayment tax. Our platform allows you to send, eSign, and track documents efficiently, ensuring you have all necessary paperwork in order to meet deadlines. This capability minimizes errors and aids in maintaining compliance.

-

What features does airSlate SignNow offer for businesses dealing with maryland underpayment tax?

airSlate SignNow offers a variety of features that are essential for handling maryland underpayment tax documents efficiently. Key features include customizable templates, advanced document tracking, and seamless collaboration tools. These functionalities ensure that your team can easily manage tax-related documents without hassle.

-

Are there any integrations available for managing maryland underpayment tax using airSlate SignNow?

Yes, airSlate SignNow integrates with numerous applications that can assist in managing maryland underpayment tax documents. Whether you use accounting software or CRM systems, our platform ensures a smooth flow of information. This integration helps streamline the process and keeps your tax management organized.

-

What are the pricing options for airSlate SignNow for businesses focusing on maryland underpayment tax?

airSlate SignNow offers competitive pricing plans aimed at businesses dealing with various document needs, including those related to maryland underpayment tax. Plans typically include various features that suit different organizational needs. It's best to check our website for detailed pricing information and to find the right fit for your business.

-

Can airSlate SignNow assist with filing maryland underpayment tax forms electronically?

Absolutely! airSlate SignNow facilitates the electronic signing of forms needed for filing your maryland underpayment tax. This feature ensures your submission is timely and compliant with state regulations. Our intuitive platform makes the process user-friendly for all parties involved.

-

What benefits do I gain using airSlate SignNow for maryland underpayment tax documents?

Utilizing airSlate SignNow allows for greater efficiency and accuracy in handling maryland underpayment tax documents. Improved turnaround times and reduced paperwork clutter are signNow advantages. Furthermore, eSigning reduces the need for physical delivery, saving time and resources.

Get more for Md 502up Form

- My floridacom form

- Consumers certificate of exemption form for ohio

- Alf licensure application addendum form

- Ahca alf application form

- Application for driver training instructors license dps mn form

- Disability parking certificate form

- Minnesota department of labor and industry labor standards prevailing wage 443 lafayette road north st dli mn form

- Mn dept of health class f license application form

Find out other Md 502up Form

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form