Instructions Returns Form

What is the Instructions Returns Form

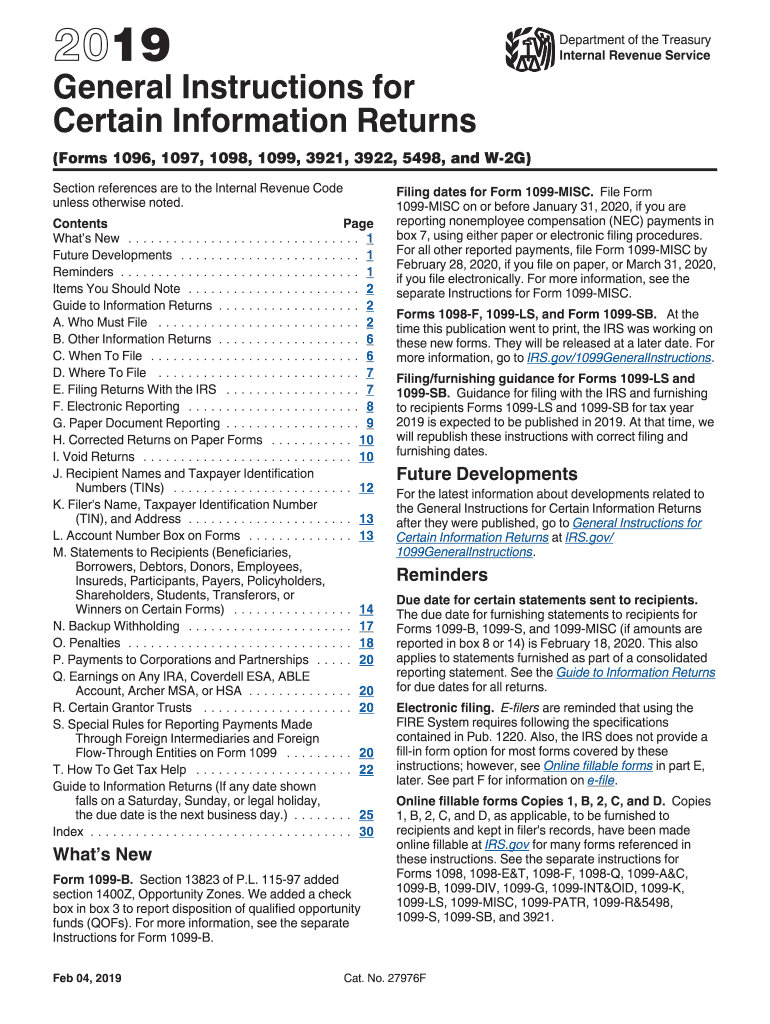

The Instructions Returns Form is a crucial document used for reporting certain types of income to the Internal Revenue Service (IRS). This form provides detailed guidance on how to report various income sources, including payments made to independent contractors, rental income, and other earnings that may require tax reporting. Understanding this form is essential for compliance with federal tax laws, ensuring that all income is accurately reported.

Steps to complete the Instructions Returns Form

Completing the Instructions Returns Form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the taxpayer's identification number, the recipient's details, and the amounts paid. Next, follow the specific instructions provided for each section of the form. It is important to double-check all entries for accuracy before submission. Finally, sign and date the form as required, ensuring that it is submitted by the appropriate deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Instructions Returns Form are critical to avoid penalties. Generally, the form must be submitted to the IRS by January thirty-first of the year following the tax year in which payments were made. If filing electronically, the deadline may extend to March thirty-first. It is essential to keep track of these dates to ensure timely compliance and avoid potential fines.

Form Submission Methods (Online / Mail / In-Person)

The Instructions Returns Form can be submitted through various methods, including online, by mail, or in person. For online submissions, the IRS provides e-filing options that streamline the process and ensure quicker processing times. If submitting by mail, ensure that the form is sent to the correct address based on the recipient's state. In-person submissions are generally not common for this form but may be available in specific circumstances at local IRS offices.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting the Instructions Returns Form. These guidelines outline the requirements for reporting income, the necessary documentation, and the correct procedures for submission. It is important to review these guidelines thoroughly to ensure compliance with all federal regulations, as failure to adhere to these rules may result in penalties or audits.

Legal use of the Instructions Returns Form

The legal use of the Instructions Returns Form is essential for maintaining compliance with tax laws. This form serves as an official record of income reporting, which can be critical during audits or disputes with the IRS. Ensuring that the form is filled out correctly and submitted on time protects both the payer and the recipient from potential legal issues related to tax compliance.

Who Issues the Form

The Instructions Returns Form is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides the necessary forms and guidelines for taxpayers to report their income accurately. Understanding the role of the IRS in this process helps clarify the importance of adhering to their requirements for tax reporting.

Quick guide on how to complete about form 1099internal revenue service irsgov

Complete Instructions Returns Form effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Instructions Returns Form on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Instructions Returns Form without hassle

- Obtain Instructions Returns Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you prefer. Edit and electronically sign Instructions Returns Form and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 1099internal revenue service irsgov

How to generate an electronic signature for your About Form 1099internal Revenue Service Irsgov in the online mode

How to generate an electronic signature for your About Form 1099internal Revenue Service Irsgov in Google Chrome

How to generate an electronic signature for putting it on the About Form 1099internal Revenue Service Irsgov in Gmail

How to generate an eSignature for the About Form 1099internal Revenue Service Irsgov from your mobile device

How to make an eSignature for the About Form 1099internal Revenue Service Irsgov on iOS devices

How to make an electronic signature for the About Form 1099internal Revenue Service Irsgov on Android OS

People also ask

-

What is footlocker readyreturns?

Footlocker readyreturns is an innovative feature that simplifies the return process for Footlocker customers. With airSlate SignNow, you can easily generate and send return forms electronically, streamlining your return experience. This ensures that customers have a hassle-free way to manage their returns.

-

How does footlocker readyreturns benefit my business?

Utilizing footlocker readyreturns can signNowly enhance customer satisfaction by offering a simplified return process. By integrating this feature with airSlate SignNow, your business can reduce paperwork and minimize processing times, ultimately leading to improved operational efficiency and customer loyalty.

-

Is there a cost associated with footlocker readyreturns?

The cost of implementing footlocker readyreturns through airSlate SignNow varies depending on the features and volume of use. However, it is designed to be a cost-effective solution for businesses of all sizes, making it an affordable option to enhance your return processing while maximizing satisfaction.

-

Can I integrate footlocker readyreturns with existing systems?

Yes, footlocker readyreturns can be seamlessly integrated with your existing e-commerce systems and software solutions. airSlate SignNow offers various integration options to ensure that you can incorporate the readyreturns feature without any disruptions to your workflow.

-

How do I set up footlocker readyreturns on my website?

Setting up footlocker readyreturns is straightforward with airSlate SignNow. You can follow the step-by-step guide provided during the integration process, which will help you establish the necessary forms and automation to enable a smooth customer experience for returns.

-

What tracking options are available for footlocker readyreturns?

With footlocker readyreturns, users have access to robust tracking options that allow both the business and customers to monitor return statuses. airSlate SignNow enables notifications and updates throughout the return process, enhancing transparency and communication.

-

Are there templates available for footlocker readyreturns?

Yes, airSlate SignNow provides customizable templates specifically for footlocker readyreturns. These templates can be tailored to fit your brand and ensure a consistent messaging approach while also simplifying the eSigning process for your customers.

Get more for Instructions Returns Form

- Page 345 mac62 mac621253ge form

- Annual review of information science and technology arist

- Toward a scalable holographic word form researchgate

- Address and street city zip form

- Form it 634 empire state jobs retention program credit tax year 772088711

- Form it 258 claim for nursing home assessment credit tax year

- Form it 606 claim for qeze credit for real property taxes tax year

- Game design contract template form

Find out other Instructions Returns Form

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe