Instructions for Form 6385 Tax Attributes Car 2023-2026

What is the Instructions For Form 6385 Tax Attributes Car

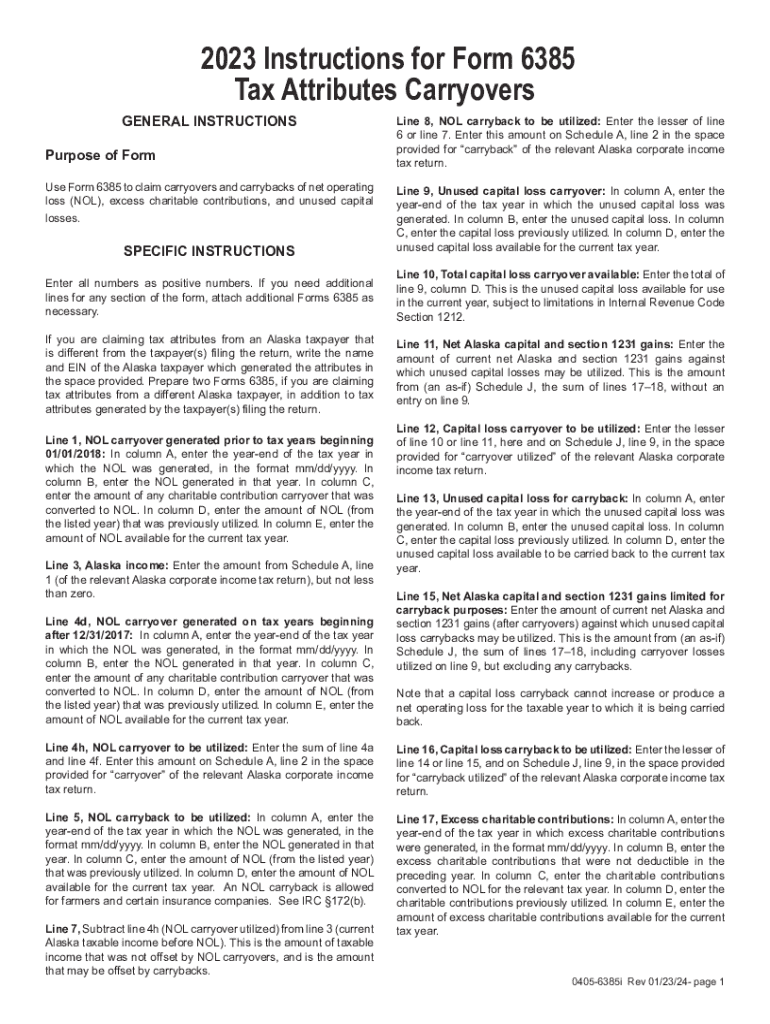

The Instructions For Form 6385 Tax Attributes Car provide essential guidance for taxpayers who need to report specific tax attributes related to vehicles. This form is typically used to determine the tax implications of car ownership and usage, particularly in relation to depreciation, deductions, and credits. Understanding the instructions is crucial for accurate reporting and compliance with IRS regulations.

Steps to complete the Instructions For Form 6385 Tax Attributes Car

Completing the Instructions For Form 6385 involves several key steps:

- Gather necessary documentation, including vehicle purchase details and previous tax filings.

- Review the specific tax attributes you need to report, such as depreciation methods and any applicable credits.

- Follow the step-by-step guidance provided in the instructions to fill out the form accurately.

- Double-check all entries for accuracy to avoid potential issues with the IRS.

- Submit the completed form by the designated deadline, ensuring you retain copies for your records.

Key elements of the Instructions For Form 6385 Tax Attributes Car

Several key elements are outlined in the Instructions For Form 6385 that are critical for successful completion:

- Vehicle Information: Details about the vehicle, including make, model, and year.

- Ownership Details: Information on how the vehicle is owned or leased.

- Depreciation Methods: Guidelines on how to calculate and report depreciation.

- Tax Credits: Information on any available tax credits related to vehicle use.

Filing Deadlines / Important Dates

It is important to be aware of key filing deadlines associated with the Instructions For Form 6385. Typically, the form must be submitted by the tax return due date, which is usually April fifteenth for individual taxpayers. If you are filing for an extension, ensure that the form is submitted by the extended deadline to avoid penalties.

Legal use of the Instructions For Form 6385 Tax Attributes Car

The Instructions For Form 6385 are legally required for taxpayers who need to report vehicle-related tax attributes. Proper use of the form ensures compliance with IRS regulations and helps avoid potential legal issues, including penalties for incorrect reporting. It is advisable to consult with a tax professional if there are uncertainties regarding the legal implications of the form.

Required Documents

To complete the Instructions For Form 6385, several documents are typically required:

- Proof of vehicle purchase or lease agreement.

- Previous tax returns that may affect current reporting.

- Documentation of any tax credits or deductions claimed in prior years.

- Records of vehicle usage, including mileage logs if applicable.

Quick guide on how to complete instructions for form 6385 tax attributes car 769843111

Prepare Instructions For Form 6385 Tax Attributes Car effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely save it online. airSlate SignNow provides all the resources necessary to create, edit, and eSign your documents quickly and without delays. Handle Instructions For Form 6385 Tax Attributes Car on any platform with the airSlate SignNow Android or iOS applications and streamline your document-based processes today.

The easiest way to edit and eSign Instructions For Form 6385 Tax Attributes Car without any hassle

- Find Instructions For Form 6385 Tax Attributes Car and click on Get Form to begin.

- Utilize the available tools to fill out your form.

- Emphasize important sections of your documents or obscure confidential information using features that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all information and click on the Done button to save your changes.

- Choose your preferred method for sharing your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Instructions For Form 6385 Tax Attributes Car and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form 6385 tax attributes car 769843111

Create this form in 5 minutes!

How to create an eSignature for the instructions for form 6385 tax attributes car 769843111

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For Form 6385 Tax Attributes Car?

The Instructions For Form 6385 Tax Attributes Car provide detailed guidance on how to report tax attributes related to vehicles. This form is essential for taxpayers who need to accurately calculate and report their vehicle-related tax benefits. Understanding these instructions can help ensure compliance and maximize potential deductions.

-

How can airSlate SignNow assist with the Instructions For Form 6385 Tax Attributes Car?

airSlate SignNow offers a streamlined platform for electronically signing and managing documents related to the Instructions For Form 6385 Tax Attributes Car. With our easy-to-use interface, you can quickly prepare and send your tax documents for eSignature, ensuring a hassle-free experience. This can save you time and reduce the risk of errors.

-

What features does airSlate SignNow provide for tax document management?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking for your documents. These features are particularly beneficial when dealing with the Instructions For Form 6385 Tax Attributes Car, as they help you stay organized and ensure that all necessary documents are completed accurately and on time.

-

Is airSlate SignNow cost-effective for small businesses handling tax forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses managing tax forms like the Instructions For Form 6385 Tax Attributes Car. Our pricing plans are flexible and cater to various needs, allowing you to choose the best option for your budget while still accessing essential features.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various accounting and tax preparation software, making it easier to manage your documents related to the Instructions For Form 6385 Tax Attributes Car. This seamless integration allows for efficient workflows and ensures that all your tax-related documents are in one place.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Instructions For Form 6385 Tax Attributes Car, provides numerous benefits such as enhanced security, faster processing times, and improved collaboration. Our platform ensures that your documents are securely stored and easily accessible, which can signNowly streamline your tax preparation process.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your documents by employing advanced encryption and secure cloud storage solutions. When dealing with sensitive information like the Instructions For Form 6385 Tax Attributes Car, you can trust that your data is protected against unauthorized access. Our compliance with industry standards further enhances the security of your documents.

Get more for Instructions For Form 6385 Tax Attributes Car

- Letter from tenant to landlord about sexual harassment tennessee form

- Letter from tenant to landlord about fair housing reduction or denial of services to family with children tennessee form

- Notice termination landlord form

- Letter from tenant to landlord responding to notice to terminate for noncompliance noncompliant condition caused by landlords 497326752 form

- Tennessee tenant landlord 497326753 form

- Tn codes form

- Letter from landlord to tenant where tenant complaint was caused by the deliberate or negligent act of tenant or tenants guest 497326755 form

- Letter from landlord to tenant for failure to keep premises as clean and safe as condition of premises permits remedy or lease 497326756 form

Find out other Instructions For Form 6385 Tax Attributes Car

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe