What is Alabama's Initial Business Privilege Tax Return 2024

Understanding Alabama's Initial Business Privilege Tax Return

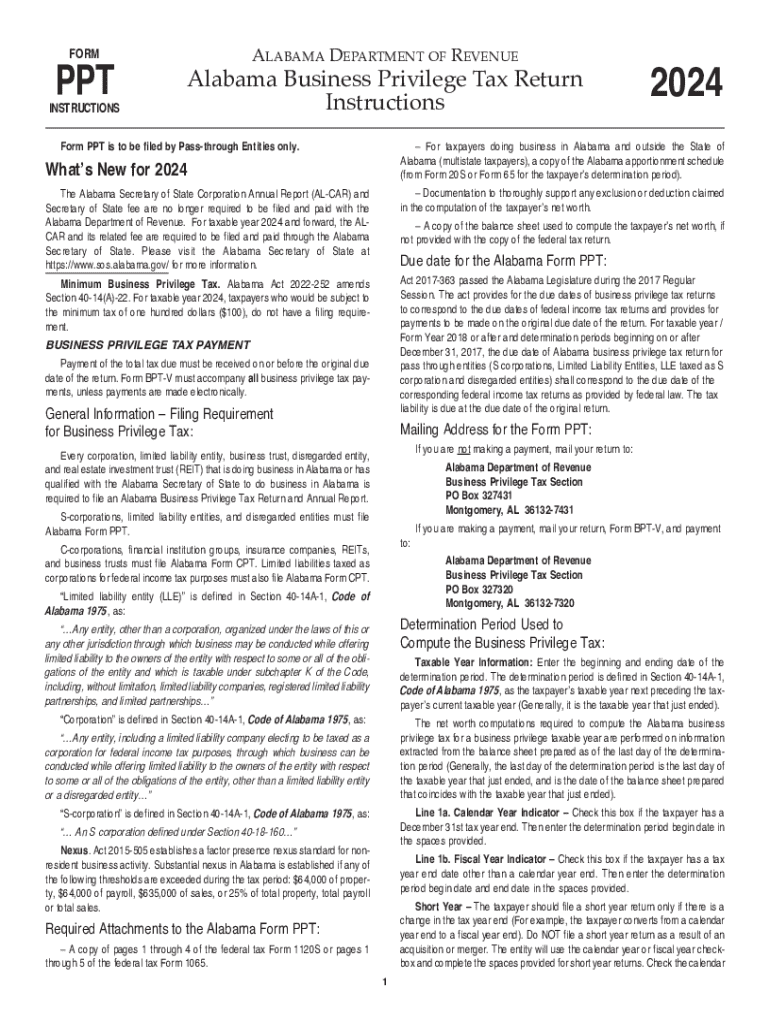

The Alabama Initial Business Privilege Tax Return is a crucial document for businesses operating within the state. This tax return is required for entities such as corporations, limited liability companies (LLCs), and other business structures. It serves to assess the privilege of doing business in Alabama and is essential for compliance with state tax regulations.

Steps to Complete Alabama's Initial Business Privilege Tax Return

Completing the Alabama Initial Business Privilege Tax Return involves several key steps:

- Gather necessary information about your business, including the legal name, address, and federal employer identification number (EIN).

- Calculate your business privilege tax based on the entity type and gross receipts.

- Fill out the tax return form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form by the specified deadline to avoid penalties.

Required Documents for Submission

When preparing to file the Alabama Initial Business Privilege Tax Return, certain documents are essential. These include:

- Your business's federal EIN.

- Financial statements or records that detail gross receipts.

- Any prior tax returns if applicable, to provide context for your current filing.

Filing Deadlines for Alabama's Initial Business Privilege Tax Return

It is important to be aware of the filing deadlines for the Alabama Initial Business Privilege Tax Return to avoid late fees. Generally, the return is due on the fifteenth day of the third month following the end of your business's tax year. For most businesses operating on a calendar year, this means the return is due by March 15.

Penalties for Non-Compliance

Failure to file the Alabama Initial Business Privilege Tax Return by the deadline can result in significant penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid taxes.

- Potential legal action for continued non-compliance.

Who Issues the Alabama Initial Business Privilege Tax Return

The Alabama Department of Revenue is the authoritative body responsible for issuing the Initial Business Privilege Tax Return. This department oversees the collection of business privilege taxes and ensures compliance with state tax laws.

Quick guide on how to complete what is alabamas initial business privilege tax return

Complete What Is Alabama's Initial Business Privilege Tax Return effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle What Is Alabama's Initial Business Privilege Tax Return on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The simplest way to modify and electronically sign What Is Alabama's Initial Business Privilege Tax Return with ease

- Obtain What Is Alabama's Initial Business Privilege Tax Return and click Get Form to begin.

- Use the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and press the Done button to save your changes.

- Choose your delivery method for the form: by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign What Is Alabama's Initial Business Privilege Tax Return to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct what is alabamas initial business privilege tax return

Create this form in 5 minutes!

How to create an eSignature for the what is alabamas initial business privilege tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the 2019 Alabama form instructions for filing taxes?

The 2019 Alabama form instructions provide detailed guidance on how to complete your tax forms accurately. They cover essential information such as eligibility, required documentation, and submission deadlines. Following these instructions ensures compliance and helps avoid potential penalties.

-

How can airSlate SignNow assist with the 2019 Alabama form instructions?

airSlate SignNow simplifies the process of completing and signing documents related to the 2019 Alabama form instructions. Our platform allows users to easily upload, edit, and eSign forms, ensuring that all necessary information is accurately captured. This streamlines the filing process and enhances efficiency.

-

Are there any costs associated with using airSlate SignNow for the 2019 Alabama form instructions?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan provides access to features that facilitate the completion of the 2019 Alabama form instructions, including document templates and eSignature capabilities. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 2019 Alabama form instructions?

airSlate SignNow includes features such as customizable templates, automated workflows, and secure eSigning to help manage the 2019 Alabama form instructions effectively. These tools enhance productivity and ensure that all forms are completed correctly and efficiently. Users can also track document status in real-time.

-

Can I integrate airSlate SignNow with other software for the 2019 Alabama form instructions?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate the 2019 Alabama form instructions into your existing workflows. Whether you use CRM systems, cloud storage, or accounting software, our platform can seamlessly connect to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the 2019 Alabama form instructions?

Using airSlate SignNow for the 2019 Alabama form instructions provides numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform allows for quick document turnaround and reduces the risk of errors associated with manual entry. Additionally, your documents are securely stored and easily accessible.

-

Is airSlate SignNow user-friendly for completing the 2019 Alabama form instructions?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to navigate the platform while completing the 2019 Alabama form instructions. The intuitive interface guides users through each step, ensuring that even those with minimal technical skills can efficiently manage their documents.

Get more for What Is Alabama's Initial Business Privilege Tax Return

Find out other What Is Alabama's Initial Business Privilege Tax Return

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free