Working Lands and Farmland Preservation Tax Credits 2023-2026

Understanding the Michigan Farmland Preservation Tax Credits

The Michigan Farmland Preservation Tax Credits are designed to encourage the preservation of agricultural land by providing tax benefits to eligible landowners. This program supports the state's agricultural economy and helps maintain the rural landscape. The credits are available to individuals and businesses that meet specific criteria related to the use and preservation of their farmland.

Eligibility Criteria for the Michigan Farmland Preservation Tax Credits

To qualify for the Michigan Farmland Preservation Tax Credits, landowners must meet certain eligibility requirements. These include:

- The property must be classified as agricultural land.

- The land must be enrolled in a farmland preservation program.

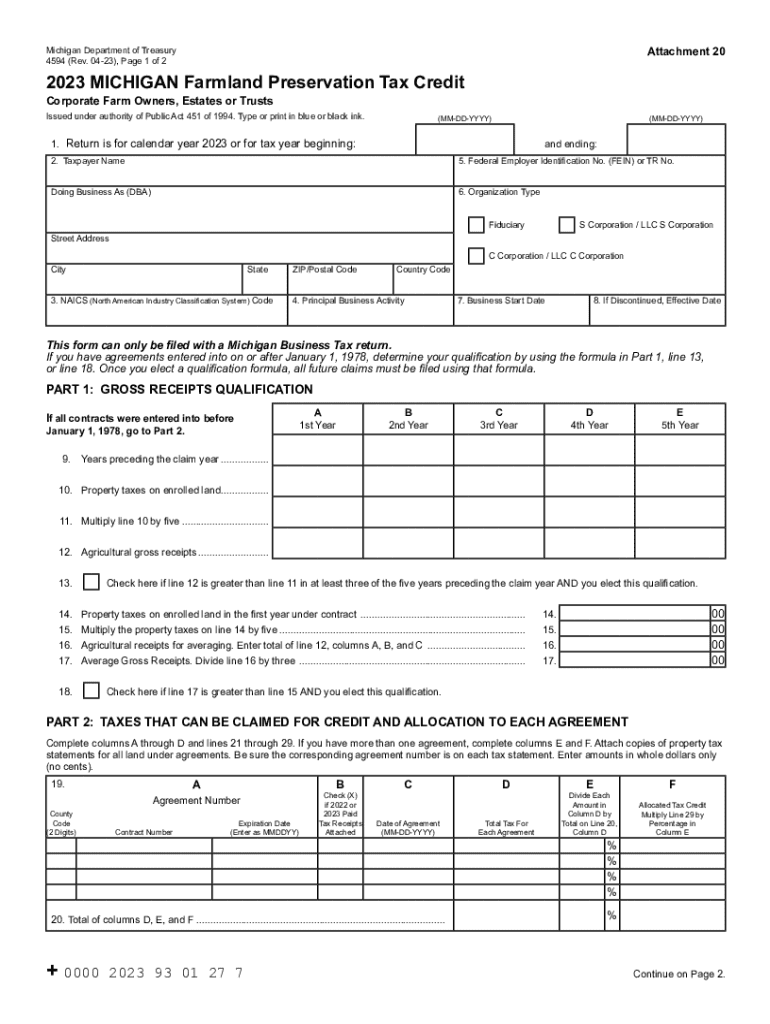

- Landowners must submit a completed Form 4594 to claim the credit.

It is essential for applicants to verify their eligibility before applying to ensure they meet all necessary conditions.

Steps to Complete the Michigan Farmland Preservation Tax Credits Application

Filing for the Michigan Farmland Preservation Tax Credits involves several steps:

- Gather required documentation, including proof of enrollment in a preservation program.

- Complete the Form 4594 accurately, ensuring all information is correct.

- Submit the form to the Michigan Department of Treasury by the specified deadline.

Following these steps carefully can help streamline the application process and increase the chances of approval.

Required Documents for the Michigan Farmland Preservation Tax Credits

When applying for the Michigan Farmland Preservation Tax Credits, applicants must provide specific documents to support their claims. These typically include:

- Proof of enrollment in a farmland preservation program.

- Documentation showing the classification of the land as agricultural.

- Any additional forms or attachments as specified in the application guidelines.

Having these documents ready can facilitate a smoother application process.

Form Submission Methods for the Michigan Farmland Preservation Tax Credits

Applicants can submit the Form 4594 through various methods. Options include:

- Online submission through the Michigan Department of Treasury's website.

- Mailing the completed form to the appropriate department.

- In-person submission at designated locations.

Choosing the right submission method can depend on personal preference and the urgency of the application.

Key Elements of the Michigan Farmland Preservation Tax Credits

The Michigan Farmland Preservation Tax Credits encompass several key elements that applicants should understand:

- The credit amount is based on the assessed value of the farmland.

- Credits can be carried forward if they exceed the tax liability for the year.

- Landowners must maintain their eligibility throughout the credit period.

Being aware of these elements can help landowners maximize their benefits from the program.

Create this form in 5 minutes or less

Find and fill out the correct working lands and farmland preservation tax credits

Create this form in 5 minutes!

How to create an eSignature for the working lands and farmland preservation tax credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Michigan farmland preservation tax?

The Michigan farmland preservation tax is a tax incentive designed to encourage landowners to maintain their agricultural land. By participating in this program, landowners can benefit from reduced property taxes, making it easier to preserve farmland for future generations.

-

How can airSlate SignNow help with Michigan farmland preservation tax documentation?

airSlate SignNow simplifies the process of managing documents related to the Michigan farmland preservation tax. Our platform allows users to easily create, send, and eSign necessary forms, ensuring compliance and efficiency in handling tax-related paperwork.

-

What are the benefits of using airSlate SignNow for Michigan farmland preservation tax forms?

Using airSlate SignNow for Michigan farmland preservation tax forms offers numerous benefits, including time savings and enhanced accuracy. Our user-friendly interface allows for quick document preparation and eSigning, reducing the risk of errors and ensuring timely submissions.

-

Is there a cost associated with using airSlate SignNow for Michigan farmland preservation tax?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs, including those related to the Michigan farmland preservation tax. Our cost-effective solutions provide excellent value, especially for landowners looking to streamline their documentation processes.

-

Can airSlate SignNow integrate with other tools for managing Michigan farmland preservation tax?

Absolutely! airSlate SignNow integrates seamlessly with various tools and platforms that can assist in managing the Michigan farmland preservation tax. This integration capability allows users to enhance their workflow and maintain organized records efficiently.

-

What features does airSlate SignNow offer for managing Michigan farmland preservation tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for managing Michigan farmland preservation tax documents. These features ensure that users can handle their tax-related paperwork with ease and confidence.

-

How does airSlate SignNow ensure the security of Michigan farmland preservation tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect all documents, including those related to the Michigan farmland preservation tax, ensuring that sensitive information remains confidential and safe.

Get more for Working Lands And Farmland Preservation Tax Credits

Find out other Working Lands And Farmland Preservation Tax Credits

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now