4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit 2021

Understanding the Michigan Farmland Preservation Tax Credit (Form 4594)

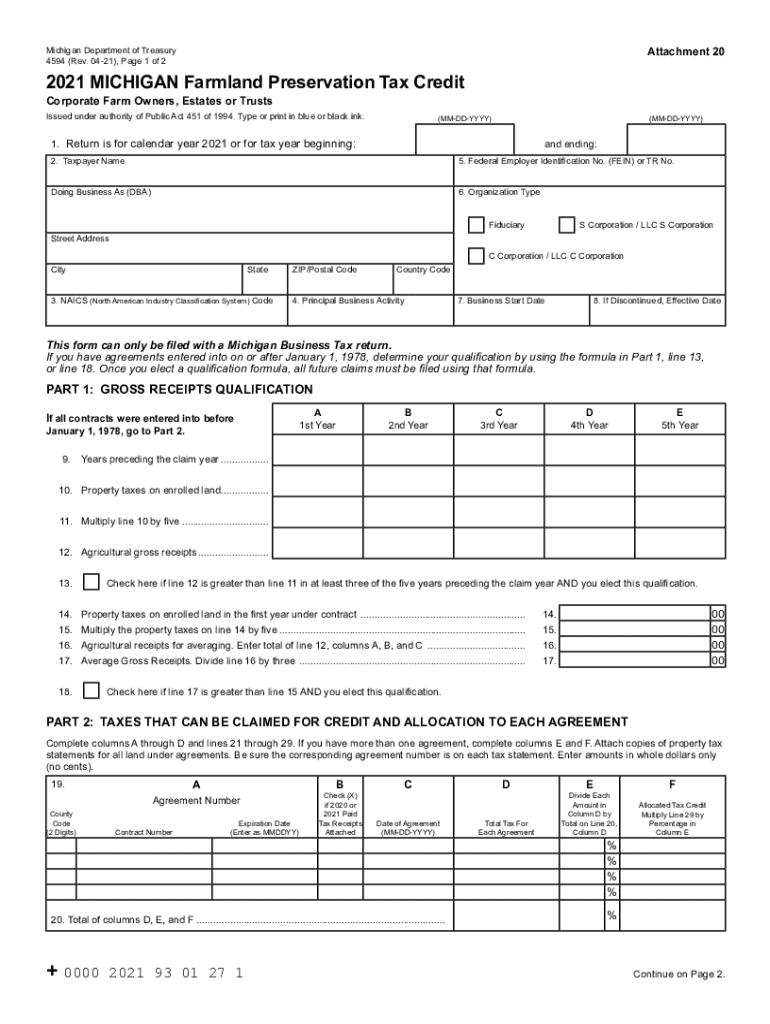

The Michigan Farmland Preservation Tax Credit, commonly referred to as Form 4594, is designed to encourage the preservation of farmland in Michigan. This tax credit allows eligible property owners to receive a credit against their state income tax based on the value of their preserved farmland. The intent is to support agricultural sustainability and protect valuable agricultural land from development.

Eligibility Criteria for the Farmland Preservation Tax Credit

To qualify for the Michigan Farmland Preservation Tax Credit, property owners must meet specific eligibility criteria. These include:

- The property must be enrolled in the Michigan Farmland and Open Space Preservation Act.

- The land must be actively used for agricultural purposes.

- Applicants must provide proof of ownership and the land's preservation status.

Meeting these criteria is essential for successfully claiming the credit and ensuring compliance with state regulations.

Steps to Complete Form 4594

Filling out Form 4594 involves several key steps to ensure accurate submission. The process includes:

- Gathering necessary documentation, including proof of land preservation.

- Completing the form with accurate information about the property and ownership.

- Submitting the form electronically or via mail to the appropriate Michigan Treasury department.

Following these steps will help ensure that the application process is smooth and efficient.

Required Documents for Submission

When submitting Form 4594, certain documents are necessary to validate the application. Required documents typically include:

- Proof of enrollment in the Farmland and Open Space Preservation Act.

- Documentation demonstrating the agricultural use of the land.

- Any additional forms or statements required by the Michigan Treasury.

Having these documents ready will facilitate a quicker review process by the state.

Legal Use of Form 4594

The legal framework surrounding Form 4594 ensures that the tax credit is utilized appropriately. Compliance with state laws is crucial. The form must be filled out accurately, and all eligibility requirements must be met to avoid penalties. Understanding the legal implications of the tax credit can help property owners navigate the application process effectively.

Submission Methods for Form 4594

Form 4594 can be submitted through various methods, providing flexibility for applicants. The submission options include:

- Online submission through the Michigan Treasury's designated portal.

- Mailing the completed form to the appropriate department.

- In-person submission at local tax offices, if available.

Choosing the right submission method can streamline the process and ensure timely processing of the application.

Quick guide on how to complete 4594 michigan farmland preservation tax credit 4594 michigan farmland preservation tax credit

Complete 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed materials, allowing you to access the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Handle 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to edit and eSign 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit with ease

- Locate 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit and guarantee outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4594 michigan farmland preservation tax credit 4594 michigan farmland preservation tax credit

Create this form in 5 minutes!

People also ask

-

What is Michigan farmland credit?

Michigan farmland credit refers to tax benefits available to agricultural property owners in Michigan. This credit aims to reduce the tax burden on farmers, making it easier for them to maintain and expand their operations. Understanding how Michigan farmland credit works can help you maximize your financial advantages as a farmer in the state.

-

How can I apply for Michigan farmland credit?

To apply for Michigan farmland credit, you need to complete the appropriate state application form and submit it to your local tax assessor's office. It may also require providing documentation proving your eligibility, such as proof of active farming operations. Ensure that you check the specific requirements for your county regarding the Michigan farmland credit application process.

-

Are there any costs associated with obtaining Michigan farmland credit?

There are typically no direct fees associated with applying for Michigan farmland credit. However, expenses may arise from gathering necessary documentation or hiring professionals for assistance. It's important to weigh these costs against potential tax savings when considering the benefits of the Michigan farmland credit.

-

What are the main benefits of Michigan farmland credit?

The primary benefit of Michigan farmland credit is the reduction of your property tax liability, allowing you to keep more income within your farm operations. Additionally, this credit can enhance the financial viability of your agricultural pursuits and support sustainable farming practices. Overall, the Michigan farmland credit serves as a signNow financial incentive for farmers.

-

Does airSlate SignNow support documentation for Michigan farmland credit applications?

Yes, airSlate SignNow can streamline the process of preparing and submitting documents for Michigan farmland credit applications. Its electronic signature features facilitate quick approvals and save time on paperwork, which is essential for busy farmers. By using airSlate SignNow, you can efficiently manage the documentation process related to your Michigan farmland credit.

-

Can I integrate airSlate SignNow with other tools for managing my Michigan farmland credit documents?

Absolutely! airSlate SignNow offers integrations with various productivity and document management tools, making it easier to streamline your workflow related to Michigan farmland credit. By connecting with platforms you already use, you can enhance your document processing capabilities, ensuring a smoother application process for your Michigan farmland credit.

-

How secure is the information I provide when applying for Michigan farmland credit using airSlate SignNow?

Your information is safe when using airSlate SignNow for Michigan farmland credit applications. The platform employs advanced security measures, including encryption and secure access controls, to protect your sensitive data. Trusting airSlate SignNow allows you to focus on your farming business while securely managing your document needs.

Get more for 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit

- Document locator and personal information package including burial information form north carolina

- Demand to produce copy of will from heir to executor or person in possession of will north carolina form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497317346 form

- Bill of sale of automobile and odometer statement north dakota form

- Bill of sale for automobile or vehicle including odometer statement and promissory note north dakota form

- Promissory note in connection with sale of vehicle or automobile north dakota form

- Bill of sale for watercraft or boat north dakota form

- Bill of sale of automobile and odometer statement for as is sale north dakota form

Find out other 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement