Farmland Preservation Tax Credit Claim State of Michigan 2019

What is the Farmland Preservation Tax Credit Claim in Michigan?

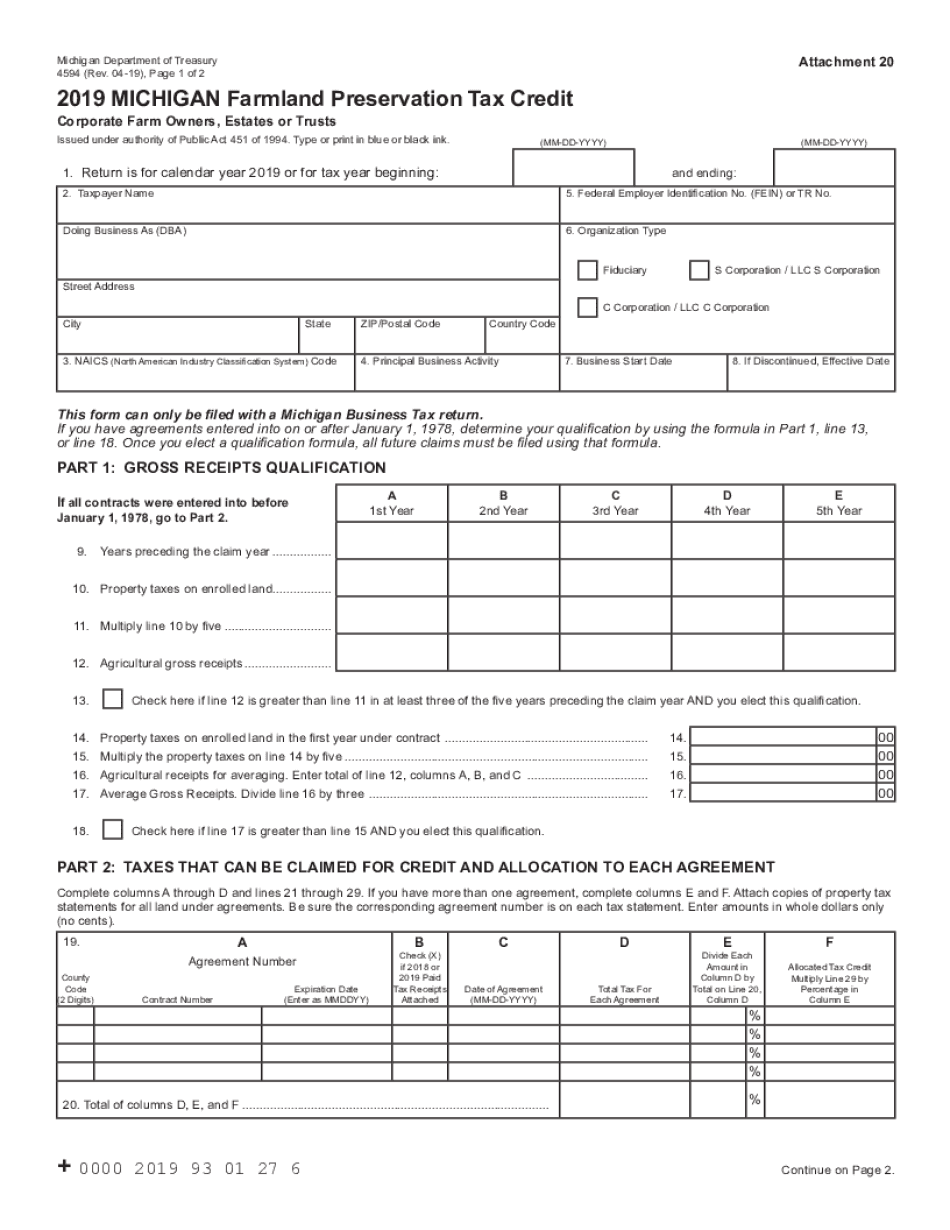

The Farmland Preservation Tax Credit Claim in Michigan, commonly referred to as form 4594, is a tax incentive designed to encourage the preservation of farmland. This credit is available to property owners who maintain their land for agricultural use, thereby contributing to the conservation of Michigan's agricultural resources. By filling out this form, eligible taxpayers can receive a credit against their state income tax, which can significantly reduce their tax liability.

Steps to Complete the Farmland Preservation Tax Credit Claim

Completing form 4594 requires careful attention to detail to ensure accuracy and compliance with state regulations. Here are the essential steps to follow:

- Gather necessary documents, including proof of agricultural use and property tax information.

- Fill out the form with accurate property details, including the parcel number and assessed value.

- Provide information regarding the agricultural activities conducted on the property.

- Sign and date the form to validate your claim.

- Submit the completed form to the appropriate state agency by the designated deadline.

Eligibility Criteria for the Farmland Preservation Tax Credit Claim

To qualify for the Farmland Preservation Tax Credit, applicants must meet specific eligibility criteria. These include:

- The property must be classified as agricultural land by the local tax assessor.

- The land must be actively used for farming or agricultural production.

- Applicants must have owned the property for a minimum period, as defined by state guidelines.

- Compliance with any local zoning regulations pertaining to agricultural use is required.

Required Documents for the Farmland Preservation Tax Credit Claim

When filing form 4594, it is crucial to include all required documentation to support your claim. The following documents are typically necessary:

- Proof of agricultural use, such as sales receipts or farm operation records.

- Property tax statements showing the assessed value and classification of the land.

- Any additional forms or documentation requested by the state agency processing your claim.

Form Submission Methods for the Farmland Preservation Tax Credit Claim

Form 4594 can be submitted through various methods to accommodate different preferences. The available submission methods include:

- Online submission through the state’s tax portal, if applicable.

- Mailing the completed form to the designated state agency address.

- In-person submission at local tax offices or designated state agencies.

Key Elements of the Farmland Preservation Tax Credit Claim

Understanding the key elements of form 4594 is essential for successful completion. Important aspects include:

- The identification of the property, including its location and parcel number.

- A detailed description of the agricultural activities conducted on the land.

- Calculation of the tax credit amount based on the assessed value of the property.

- Signatures from the property owner and any required witnesses.

Quick guide on how to complete farmland preservation tax credit claim state of michigan

Prepare Farmland Preservation Tax Credit Claim State Of Michigan effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Farmland Preservation Tax Credit Claim State Of Michigan on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

The easiest way to modify and eSign Farmland Preservation Tax Credit Claim State Of Michigan without hassle

- Obtain Farmland Preservation Tax Credit Claim State Of Michigan and click on Get Form to begin.

- Use the tools we offer to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and select the Done button to save your modifications.

- Decide how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Farmland Preservation Tax Credit Claim State Of Michigan and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct farmland preservation tax credit claim state of michigan

Create this form in 5 minutes!

How to create an eSignature for the farmland preservation tax credit claim state of michigan

The best way to create an electronic signature for a PDF document in the online mode

The best way to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

The way to generate an eSignature from your mobile device

The way to create an eSignature for a PDF document on iOS devices

The way to generate an eSignature for a PDF file on Android devices

People also ask

-

What is form 4594 and how is it used?

Form 4594 is a specific document that businesses often need for regulatory compliance. It is used for various purposes, including tax reporting and documentation validation, ensuring that all necessary information is accurately captured and filed. Using airSlate SignNow, you can easily fill out and eSign form 4594 to streamline your workflow.

-

How can airSlate SignNow help with form 4594 management?

airSlate SignNow provides tools that simplify the process of managing form 4594. With our intuitive platform, you can create, fill, and eSign this form quickly and efficiently, reducing the time spent on paperwork. Our solution also ensures that your documents are securely stored and easily accessible when you need them.

-

Is there a cost associated with using airSlate SignNow for form 4594?

Yes, airSlate SignNow offers various pricing plans designed to accommodate different business needs. Our cost-effective solution ensures that you can easily manage form 4594 without breaking the bank. You can choose the plan that best suits your organization’s requirements and budget.

-

What features does airSlate SignNow offer for processing form 4594?

Our platform offers a range of features for processing form 4594, including customizable templates, secure eSignature capabilities, and automatic reminders. These functionalities help streamline the workflow associated with this form, ensuring that it is completed accurately and promptly. Additionally, you can track document statuses in real-time.

-

Can I integrate airSlate SignNow with other tools for form 4594?

Yes, airSlate SignNow seamlessly integrates with various business applications to enhance the management of form 4594. Whether you use CRM, cloud storage, or project management tools, our integrations facilitate a smoother workflow. This ensures that the process of filling out and eSigning form 4594 is efficient and aligns with your existing systems.

-

How secure is airSlate SignNow for submitting form 4594?

Security is a top priority for airSlate SignNow. When submitting form 4594 through our platform, your documents are protected with advanced encryption methods. Additionally, we comply with industry standards and regulations to ensure that your sensitive information remains confidential and secure.

-

What are the benefits of using airSlate SignNow for form 4594?

Using airSlate SignNow for form 4594 provides numerous benefits, including improved efficiency, reduced paper waste, and enhanced collaboration. Our electronic signature solution enables quick turnaround times for document approval, allowing your team to focus on more important tasks. Furthermore, managing form 4594 digitally can save your organization both time and resources.

Get more for Farmland Preservation Tax Credit Claim State Of Michigan

- Warranty deed from husband and wife to a trust wisconsin form

- Mortgage wisconsin form

- Wi promissory note form

- Warranty deed from husband to himself and wife wisconsin form

- Quitclaim deed from husband to himself and wife wisconsin form

- Quitclaim deed from husband and wife to husband and wife wisconsin form

- Wi wife form

- Wisconsin property agreement form

Find out other Farmland Preservation Tax Credit Claim State Of Michigan

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF