4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit 2020

Understanding the Michigan Farmland Preservation Tax Credit (Form 4594)

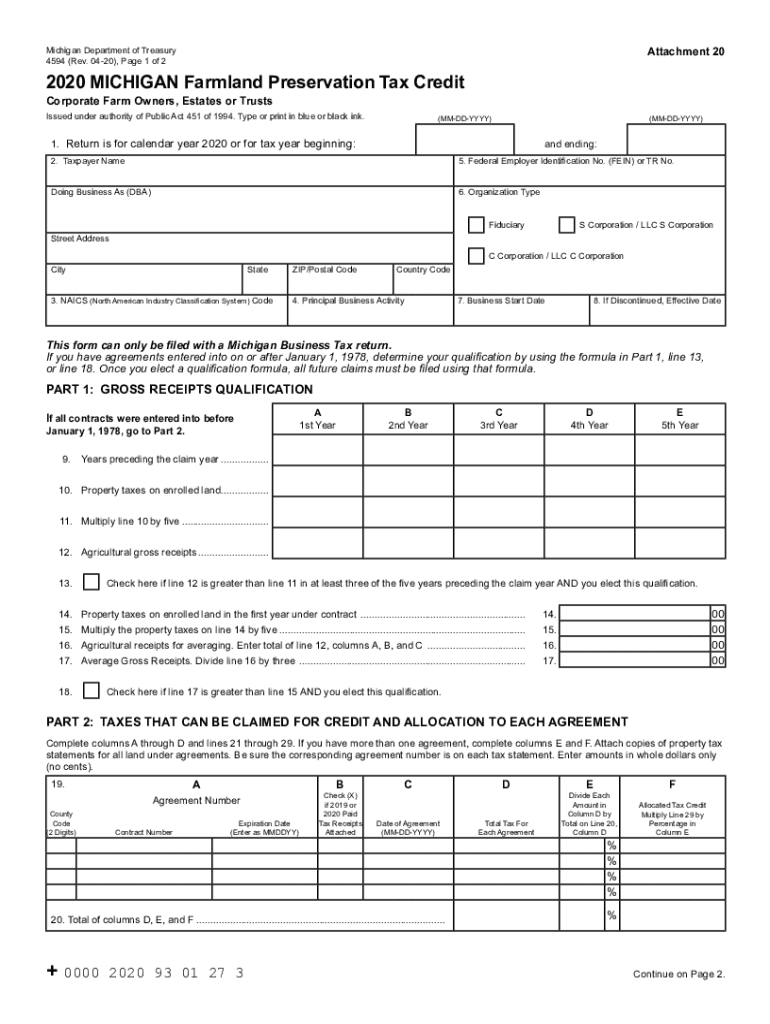

The Michigan Farmland Preservation Tax Credit is designed to encourage the preservation of farmland by providing tax credits to eligible property owners. This program aims to maintain agricultural land and support local farming communities. The form 4594 is the official document that property owners must complete to apply for this credit. By participating in this program, landowners can receive a tax credit that reduces their overall tax liability, thereby promoting the conservation of valuable farmland.

Steps to Complete Form 4594

Completing the form 4594 involves several key steps to ensure accuracy and compliance. Start by gathering necessary information, including property details, ownership proof, and any prior tax documents related to the farmland. Next, fill out the form accurately, providing all requested information. It is essential to review the completed form for any errors before submission. After ensuring everything is correct, submit the form to the appropriate state department, either online or via mail, depending on your preference.

Eligibility Criteria for the Farmland Preservation Tax Credit

To qualify for the Michigan Farmland Preservation Tax Credit, property owners must meet specific eligibility criteria. The land must be designated as agricultural, and the owner must have entered into a farmland preservation agreement with the state. Additionally, the property should not have been developed for non-agricultural purposes. Understanding these criteria is crucial for applicants to determine their eligibility before completing the form 4594.

Required Documents for Form Submission

When submitting form 4594, applicants must provide several supporting documents to validate their claims. These typically include proof of ownership, a copy of the farmland preservation agreement, and any previous tax returns that pertain to the property. Ensuring that all required documents are included with the application can help expedite the review process and increase the chances of approval.

Filing Deadlines and Important Dates

Timely submission of form 4594 is essential to secure the tax credit. The state sets specific filing deadlines each year, which applicants must adhere to. It is important to stay informed about these dates to avoid missing out on potential tax benefits. Generally, the deadlines align with the state’s tax filing schedule, so checking the Michigan Department of Treasury’s announcements can provide the most accurate information.

Legal Use of Form 4594

The form 4594 is legally binding once submitted and accepted by the state. This means that all information provided must be truthful and accurate, as any discrepancies can lead to penalties or denial of the tax credit. Understanding the legal implications of the form is crucial for applicants, as it ensures compliance with state regulations and protects their rights as property owners.

Form Submission Methods

Applicants have various options for submitting form 4594. The form can be completed and submitted online through the Michigan Department of Treasury's website, which is often the fastest method. Alternatively, applicants can print the form and mail it to the designated office. In-person submissions may also be possible at local tax offices, providing flexibility for those who prefer direct interaction.

Quick guide on how to complete 4594 2020 michigan farmland preservation tax credit 4594 2020 michigan farmland preservation tax credit

Finish 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and safely store it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents swiftly and without delays. Handle 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit without difficulty

- Find 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit and ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4594 2020 michigan farmland preservation tax credit 4594 2020 michigan farmland preservation tax credit

Create this form in 5 minutes!

How to create an eSignature for the 4594 2020 michigan farmland preservation tax credit 4594 2020 michigan farmland preservation tax credit

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What is form 4594 and how can airSlate SignNow help with it?

Form 4594 is a specific document used for various business processes. With airSlate SignNow, businesses can efficiently create, send, and eSign form 4594, ensuring a smooth workflow and compliance with legal requirements.

-

What are the key features of airSlate SignNow for managing form 4594?

AirSlate SignNow offers a range of features for managing form 4594, including template creation, customizable fields, and automated workflows. These tools streamline the form filling and signing process, making it easier for users to complete necessary documentation quickly.

-

Is airSlate SignNow cost-effective for businesses needing form 4594?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing form 4594 management. With flexible pricing plans, companies can choose a package that fits their budget while benefiting from powerful eSigning capabilities.

-

Can I integrate airSlate SignNow with other systems while using form 4594?

Absolutely! AirSlate SignNow can seamlessly integrate with various applications and software, allowing you to manage form 4594 effectively. This flexibility helps businesses streamline their processes by connecting existing tools with airSlate SignNow’s eSigning capabilities.

-

How does airSlate SignNow ensure the security of form 4594?

AirSlate SignNow takes security seriously, employing advanced encryption and compliance measures to protect your form 4594. This ensures that sensitive information remains confidential during the eSigning process, giving users peace of mind.

-

What benefits does airSlate SignNow provide for teams working on form 4594?

AirSlate SignNow enhances team collaboration when working on form 4594 by allowing multiple users to access and edit documents simultaneously. This feature helps eliminate bottlenecks, ensuring that all team members can contribute efficiently and effectively.

-

How can airSlate SignNow improve my workflow for handling form 4594?

By using airSlate SignNow, you can automate repetitive tasks related to form 4594, such as reminders and document routing. This automation reduces manual work and increases productivity, enabling you to focus on other important business tasks.

Get more for 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit

- Contractor license registration form hardee county

- Profit ampamp loss from business schedule c data sheet form

- Bda form

- Penndot change of address form

- Nebraska central registry expungement form

- Behavioural neurology assessment short form pdf

- Tci community college application form

- Get your used vehicle appraised for tax purposes during a form

Find out other 4594, Michigan Farmland Preservation Tax Credit 4594, Michigan Farmland Preservation Tax Credit

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now