4594, Michigan Farmland Preservation Tax State of 2017

What is the 4594, Michigan Farmland Preservation Tax State Of

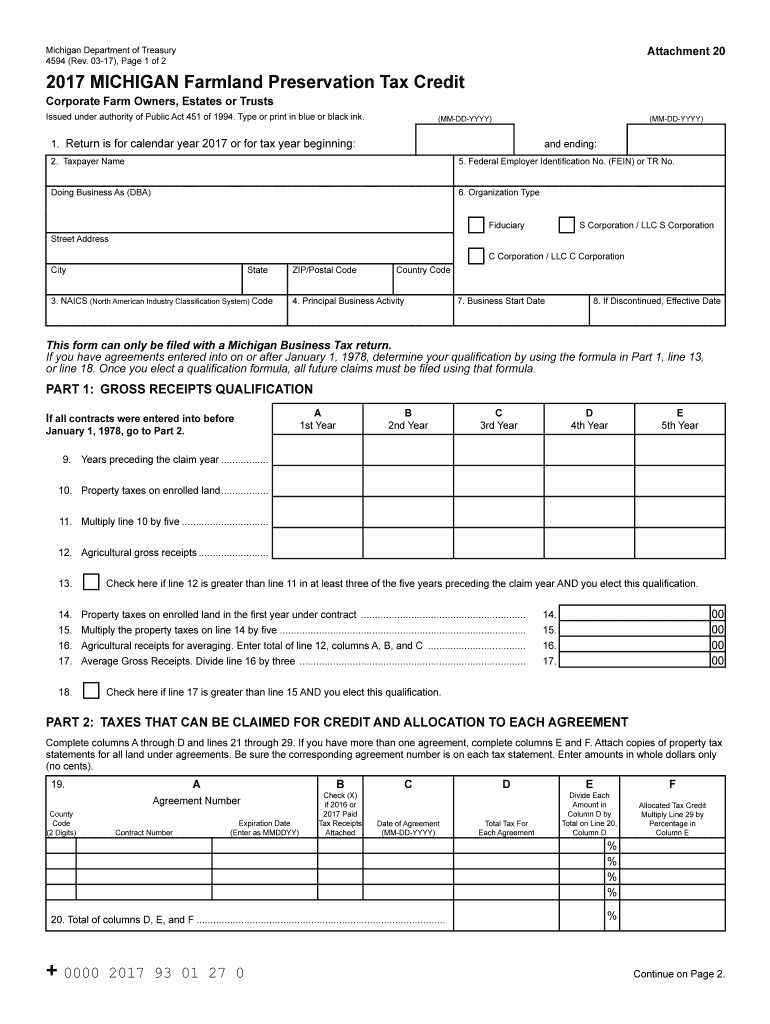

The 4594, Michigan Farmland Preservation Tax State Of form is a crucial document designed to support the preservation of farmland in Michigan. This form allows property owners to apply for tax benefits under the Farmland and Open Space Preservation Act. By completing this form, landowners can receive property tax reductions, thus encouraging the maintenance of agricultural land and preventing urban sprawl. The program aims to protect the agricultural economy and promote sustainable land use practices across the state.

How to use the 4594, Michigan Farmland Preservation Tax State Of

Using the 4594, Michigan Farmland Preservation Tax State Of form involves several steps. First, landowners must ensure their property qualifies for the program by meeting specific criteria, such as being primarily used for agricultural purposes. Next, they need to complete the form accurately, providing necessary details about the property and its agricultural use. Once completed, the form should be submitted to the local assessing office for review. It is essential to keep a copy of the submitted form for personal records and future reference.

Steps to complete the 4594, Michigan Farmland Preservation Tax State Of

Completing the 4594 form requires careful attention to detail. Follow these steps for successful submission:

- Gather necessary documentation, including proof of agricultural use and property details.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form to your local assessing office by the designated deadline.

- Retain a copy of the submitted form for your records.

Eligibility Criteria

To qualify for the benefits associated with the 4594, Michigan Farmland Preservation Tax State Of form, property owners must meet specific eligibility criteria. The property must be primarily used for agricultural purposes, and it should be at least 40 acres in size or part of a larger agricultural operation. Additionally, the land must not be developed for non-agricultural uses. Applicants should also ensure they comply with local zoning regulations and maintain the property in accordance with agricultural standards.

Required Documents

When completing the 4594, Michigan Farmland Preservation Tax State Of form, certain documents are required to support the application. These may include:

- Proof of agricultural use, such as receipts or contracts.

- Property tax information.

- Maps or diagrams showing the property boundaries.

- Any relevant zoning or land use documents.

Penalties for Non-Compliance

Failure to comply with the requirements of the 4594, Michigan Farmland Preservation Tax State Of form can result in penalties. If a property owner does not maintain the agricultural use of the land or fails to submit the form by the deadline, they may lose their tax benefits. Additionally, local authorities may impose fines or require repayment of any tax savings received. It is crucial for landowners to stay informed about compliance requirements to avoid these potential penalties.

Quick guide on how to complete 4594 2017 michigan farmland preservation tax state of

Effortlessly Prepare 4594, Michigan Farmland Preservation Tax State Of on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage 4594, Michigan Farmland Preservation Tax State Of on any device with the airSlate SignNow mobile applications for Android or iOS and enhance any document-related process today.

How to Modify and Electronically Sign 4594, Michigan Farmland Preservation Tax State Of with Ease

- Find 4594, Michigan Farmland Preservation Tax State Of and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, text message (SMS), or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 4594, Michigan Farmland Preservation Tax State Of and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 4594 2017 michigan farmland preservation tax state of

Create this form in 5 minutes!

How to create an eSignature for the 4594 2017 michigan farmland preservation tax state of

How to generate an electronic signature for the 4594 2017 Michigan Farmland Preservation Tax State Of online

How to generate an electronic signature for the 4594 2017 Michigan Farmland Preservation Tax State Of in Chrome

How to make an eSignature for signing the 4594 2017 Michigan Farmland Preservation Tax State Of in Gmail

How to generate an electronic signature for the 4594 2017 Michigan Farmland Preservation Tax State Of from your mobile device

How to make an electronic signature for the 4594 2017 Michigan Farmland Preservation Tax State Of on iOS

How to create an eSignature for the 4594 2017 Michigan Farmland Preservation Tax State Of on Android

People also ask

-

What is the 4594, Michigan Farmland Preservation Tax State Of?

The 4594, Michigan Farmland Preservation Tax State Of is a tax incentive designed to encourage the preservation of farmland in Michigan. By participating, landowners can benefit from reduced taxes while helping to maintain valuable agricultural land. This program is essential for both farmers and communities focused on sustainability.

-

How can airSlate SignNow assist with the 4594, Michigan Farmland Preservation Tax State Of?

airSlate SignNow provides an efficient platform to manage and sign documents related to the 4594, Michigan Farmland Preservation Tax State Of. This easy-to-use solution ensures that all necessary forms are completed accurately and signed in a timely manner. As a result, you can streamline the application process and focus more on your agricultural activities.

-

What are the costs associated with the 4594, Michigan Farmland Preservation Tax State Of program?

There are no direct costs for participating in the 4594, Michigan Farmland Preservation Tax State Of program; however, there may be fees related to document preparation and submission. Using airSlate SignNow can help you minimize those costs by providing a cost-effective solution for document management. This allows you to concentrate your resources on preserving valuable farmland.

-

What features does airSlate SignNow offer for managing the 4594, Michigan Farmland Preservation Tax State Of documents?

airSlate SignNow offers features such as easy eSigning, document storage, and real-time tracking for documents related to the 4594, Michigan Farmland Preservation Tax State Of. These capabilities enable users to keep track of important filings and deadlines. Furthermore, the platform ensures that your documentation remains secure and accessible at all times.

-

Can airSlate SignNow integrate with other tools for the 4594, Michigan Farmland Preservation Tax State Of?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your workflow for the 4594, Michigan Farmland Preservation Tax State Of. Integration with tools such as CRM systems and project management software allows for streamlined processes and better organization. This helps ensure that your documents are managed efficiently throughout the tax process.

-

What are the benefits of using airSlate SignNow for the 4594, Michigan Farmland Preservation Tax State Of?

By using airSlate SignNow for the 4594, Michigan Farmland Preservation Tax State Of, users can enhance efficiency and reduce errors in document handling. The platform simplifies the process of obtaining signatures and managing paperwork, which can save you time and effort. Ultimately, this will help you focus more on your farming operations while ensuring compliance with tax regulations.

-

Is airSlate SignNow user-friendly for new users managing the 4594, Michigan Farmland Preservation Tax State Of?

Absolutely! airSlate SignNow is designed to be user-friendly, making it accessible even for those unfamiliar with digital document management. The intuitive interface ensures that anyone can quickly learn to navigate the platform for the 4594, Michigan Farmland Preservation Tax State Of. Comprehensive support resources are also available to assist new users.

Get more for 4594, Michigan Farmland Preservation Tax State Of

- Purpose of this application texas department of state dshs state tx form

- Purpose of this application texas department of state dshs state tx 16898030 form

- Tdi fast form

- Dwc form 003me

- Fire alarm certificate form

- Lcra employees united charities grant application form

- Deliquent lvn license in texas form

- Private bird hunting area application texas parks amp wildlife tpwd state tx form

Find out other 4594, Michigan Farmland Preservation Tax State Of

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe