Form TX Comptroller 50 283 Fill Online, Printable 2024-2026

What is the Form TX Comptroller 50 283

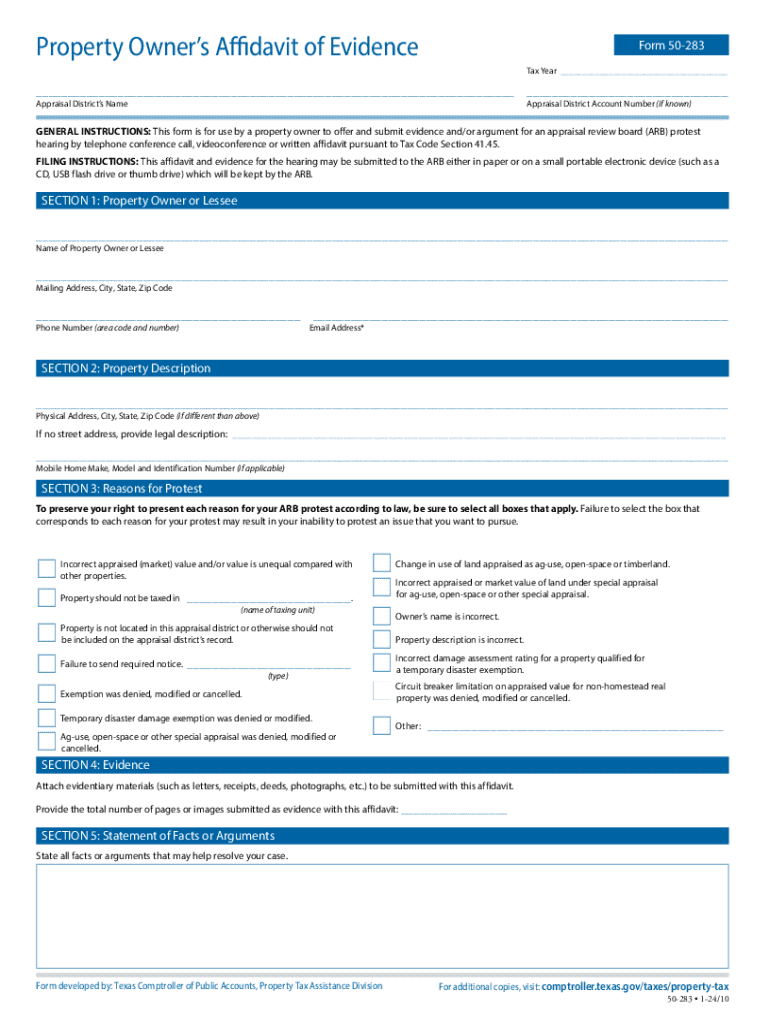

The Form TX Comptroller 50 283, commonly known as the Texas property tax form, is utilized by property owners in Texas to provide necessary information for property tax assessments. This form is essential for those seeking to contest their property appraisals or to claim exemptions. It serves as a formal declaration that includes details about the property, ownership, and any relevant claims that may affect the property’s assessed value.

How to Complete the Form TX Comptroller 50 283

Completing the Form TX Comptroller 50 283 involves several key steps:

- Gather necessary documentation, including proof of ownership and any previous appraisal notices.

- Fill out the form accurately, ensuring all sections are completed, including property details and owner information.

- Attach any supporting evidence, such as the Texas owner affidavit or appraisal review board decisions, to substantiate your claims.

- Review the completed form for accuracy before submission.

Required Documents for the Form TX Comptroller 50 283

When submitting the Form TX Comptroller 50 283, certain documents are necessary to support your application:

- Proof of ownership, such as a deed or title.

- Previous property tax statements or appraisal notices.

- Any relevant affidavits or evidence from the Texas appraisal review board.

- Additional documentation that may support your claim for a property tax exemption or adjustment.

Filing Methods for the Form TX Comptroller 50 283

The Form TX Comptroller 50 283 can be submitted through various methods, depending on the preferences of the property owner:

- Online submission through the Texas Comptroller's website, which allows for a streamlined process.

- Mailing the completed form and supporting documents to the appropriate local appraisal district.

- In-person submission at local appraisal district offices for those who prefer face-to-face interactions.

Key Elements of the Form TX Comptroller 50 283

Understanding the key elements of the Form TX Comptroller 50 283 is crucial for effective completion:

- Property identification details, including the address and account number.

- Owner information, which includes name, contact details, and ownership percentage if applicable.

- Specific claims being made, such as requests for exemptions or adjustments based on appraisal evidence.

- Signature of the property owner or authorized representative to validate the submission.

Eligibility Criteria for the Form TX Comptroller 50 283

To successfully file the Form TX Comptroller 50 283, property owners must meet certain eligibility criteria:

- Ownership of the property in question, with appropriate documentation to prove it.

- Timely submission of the form within the specified deadlines set by the local appraisal district.

- Compliance with any local requirements or additional documentation that may be requested.

Handy tips for filling out Form TX Comptroller 50 283 Fill Online, Printable online

Quick steps to complete and e-sign Form TX Comptroller 50 283 Fill Online, Printable online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Get access to a GDPR and HIPAA compliant platform for optimum straightforwardness. Use signNow to electronically sign and send out Form TX Comptroller 50 283 Fill Online, Printable for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form tx comptroller 50 283 fill online printable

Create this form in 5 minutes!

How to create an eSignature for the form tx comptroller 50 283 fill online printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Texas 50 property?

A Texas 50 property refers to a specific type of real estate transaction in Texas that involves a home equity loan. This type of property must adhere to the regulations set forth by the Texas Constitution, ensuring that homeowners are protected during the borrowing process.

-

How does airSlate SignNow support Texas 50 property transactions?

airSlate SignNow provides a streamlined platform for eSigning documents related to Texas 50 property transactions. Our solution allows users to securely send and sign necessary documents, ensuring compliance with Texas regulations while saving time and reducing paperwork.

-

What are the pricing options for using airSlate SignNow for Texas 50 property?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses involved in Texas 50 property transactions. Our cost-effective solution ensures that you only pay for the features you need, making it an ideal choice for real estate professionals.

-

What features does airSlate SignNow offer for Texas 50 property transactions?

Our platform includes features such as customizable templates, secure document storage, and real-time tracking for Texas 50 property transactions. These tools enhance efficiency and ensure that all parties can easily access and manage their documents.

-

How can airSlate SignNow improve the efficiency of Texas 50 property transactions?

By utilizing airSlate SignNow, businesses can signNowly reduce the time spent on document management for Texas 50 property transactions. Our user-friendly interface allows for quick eSigning and document sharing, streamlining the entire process.

-

Is airSlate SignNow compliant with Texas regulations for Texas 50 property?

Yes, airSlate SignNow is designed to comply with Texas regulations governing Texas 50 property transactions. Our platform ensures that all eSigned documents meet legal standards, providing peace of mind for both lenders and borrowers.

-

Can airSlate SignNow integrate with other tools for Texas 50 property management?

Absolutely! airSlate SignNow offers integrations with various CRM and document management systems, enhancing your workflow for Texas 50 property transactions. This allows you to manage all aspects of your real estate business seamlessly.

Get more for Form TX Comptroller 50 283 Fill Online, Printable

- Satisfaction release or cancellation of mortgage by corporation new hampshire form

- Satisfaction release or cancellation of mortgage by individual new hampshire form

- Release mortgage form

- Partial release of property from mortgage by individual holder new hampshire form

- Warranty deed for husband and wife converting property from tenants in common to joint tenancy new hampshire form

- Warranty deed for parents to child with reservation of life estate new hampshire form

- Warranty deed for separate or joint property to joint tenancy new hampshire form

- Warranty deed to separate property of one spouse to both spouses as joint tenants new hampshire form

Find out other Form TX Comptroller 50 283 Fill Online, Printable

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors