Wrap around Mortgage Security Agreement MegaDoxcom Form

What is the Wrap around Mortgage Security Agreement MegaDoxcom

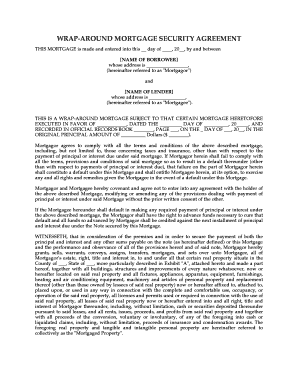

The Wrap around Mortgage Security Agreement is a legal document that facilitates financing by allowing a seller to extend a mortgage to a buyer while retaining the original mortgage on the property. This agreement effectively "wraps around" the existing mortgage, enabling the buyer to make payments to the seller, who in turn continues to make payments on the original mortgage. This type of agreement can be beneficial for buyers who may not qualify for traditional financing and for sellers looking to expedite the sale of their property.

Key elements of the Wrap around Mortgage Security Agreement MegaDoxcom

Several key elements define the Wrap around Mortgage Security Agreement. These include:

- Parties Involved: The agreement identifies the seller and buyer, along with any additional parties involved in the transaction.

- Property Description: A detailed description of the property being financed, including its legal description and address.

- Loan Amount: The total amount of the loan, which typically includes the existing mortgage and any additional financing provided by the seller.

- Interest Rate: The interest rate applied to the wrap-around mortgage, which may differ from the original mortgage rate.

- Payment Terms: Clear terms regarding payment schedules, including due dates and payment amounts.

- Default Clauses: Provisions that outline the consequences of defaulting on the agreement, including potential foreclosure actions.

Steps to complete the Wrap around Mortgage Security Agreement MegaDoxcom

Completing the Wrap around Mortgage Security Agreement involves several important steps:

- Gather Necessary Information: Collect all relevant information about the property, existing mortgage, and parties involved.

- Draft the Agreement: Use a template or legal software to draft the agreement, ensuring all key elements are included.

- Review Legal Requirements: Ensure compliance with local and state laws regarding wrap-around mortgages.

- Obtain Signatures: Have all parties review and sign the agreement, preferably in the presence of a notary public.

- File the Agreement: Depending on state laws, you may need to file the agreement with the local county recorder's office.

Legal use of the Wrap around Mortgage Security Agreement MegaDoxcom

The Wrap around Mortgage Security Agreement is legally recognized in many states, but its enforceability can vary based on local laws. It is essential to understand the legal implications of such an agreement, including the rights and responsibilities of both the seller and buyer. Consulting with a real estate attorney can provide clarity on legal use and help ensure that the agreement complies with all applicable regulations.

Examples of using the Wrap around Mortgage Security Agreement MegaDoxcom

There are various scenarios where a Wrap around Mortgage Security Agreement may be beneficial:

- Seller Financing: A seller may offer financing to a buyer who cannot secure a traditional mortgage, allowing for a quicker sale.

- Investment Properties: Investors may use this agreement to acquire properties without needing immediate full financing.

- Credit Challenges: Buyers with poor credit histories may find this option more accessible than conventional loans.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wrap around mortgage security agreement megadoxcom

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Wrap around Mortgage Security Agreement MegaDoxcom?

A Wrap around Mortgage Security Agreement MegaDoxcom is a financial document that allows a buyer to purchase a property while the seller retains the original mortgage. This agreement wraps the existing mortgage into a new loan, simplifying the financing process. It is particularly beneficial for buyers who may not qualify for traditional financing.

-

How does the Wrap around Mortgage Security Agreement MegaDoxcom benefit buyers?

The Wrap around Mortgage Security Agreement MegaDoxcom provides buyers with flexible financing options, often with lower interest rates. It allows buyers to bypass traditional lending requirements, making homeownership more accessible. Additionally, it can facilitate quicker transactions since it eliminates the need for bank approvals.

-

What features does the Wrap around Mortgage Security Agreement MegaDoxcom offer?

The Wrap around Mortgage Security Agreement MegaDoxcom includes customizable templates, eSigning capabilities, and secure document storage. These features streamline the process of creating and managing mortgage agreements. Users can easily track changes and ensure compliance with legal standards.

-

Is the Wrap around Mortgage Security Agreement MegaDoxcom cost-effective?

Yes, the Wrap around Mortgage Security Agreement MegaDoxcom is designed to be a cost-effective solution for both buyers and sellers. By reducing the need for extensive legal fees and simplifying the documentation process, it saves users time and money. This affordability makes it an attractive option for many real estate transactions.

-

Can I integrate the Wrap around Mortgage Security Agreement MegaDoxcom with other tools?

Absolutely! The Wrap around Mortgage Security Agreement MegaDoxcom can be integrated with various CRM and document management systems. This integration enhances workflow efficiency and allows users to manage their documents seamlessly. It ensures that all relevant information is easily accessible in one place.

-

What are the legal considerations for using a Wrap around Mortgage Security Agreement MegaDoxcom?

When using a Wrap around Mortgage Security Agreement MegaDoxcom, it is essential to understand local laws and regulations regarding real estate transactions. Consulting with a legal professional can help ensure compliance and protect both parties' interests. Properly drafted agreements can mitigate potential disputes in the future.

-

How secure is the Wrap around Mortgage Security Agreement MegaDoxcom?

The Wrap around Mortgage Security Agreement MegaDoxcom prioritizes security with advanced encryption and secure access controls. Users can trust that their sensitive information is protected throughout the document lifecycle. Regular security updates and compliance with industry standards further enhance the safety of your agreements.

Get more for Wrap around Mortgage Security Agreement MegaDoxcom

- Special or limited power of attorney for real estate purchase transaction by purchaser new york form

- Limited power of attorney where you specify powers with sample powers included new york form

- Limited power of attorney for stock transactions and corporate powers new york form

- Bank account form download

- New york small business form

- New york property management package new york form

- Ny annual statement form

- New york professional form

Find out other Wrap around Mortgage Security Agreement MegaDoxcom

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple