Form 540NR California Nonresident or Part Year Resident Income Tax Return , Form 540NR, California Nonresident or Part Year Resi

Understanding the Form 540NR California Nonresident Or Part Year Resident Income Tax Return

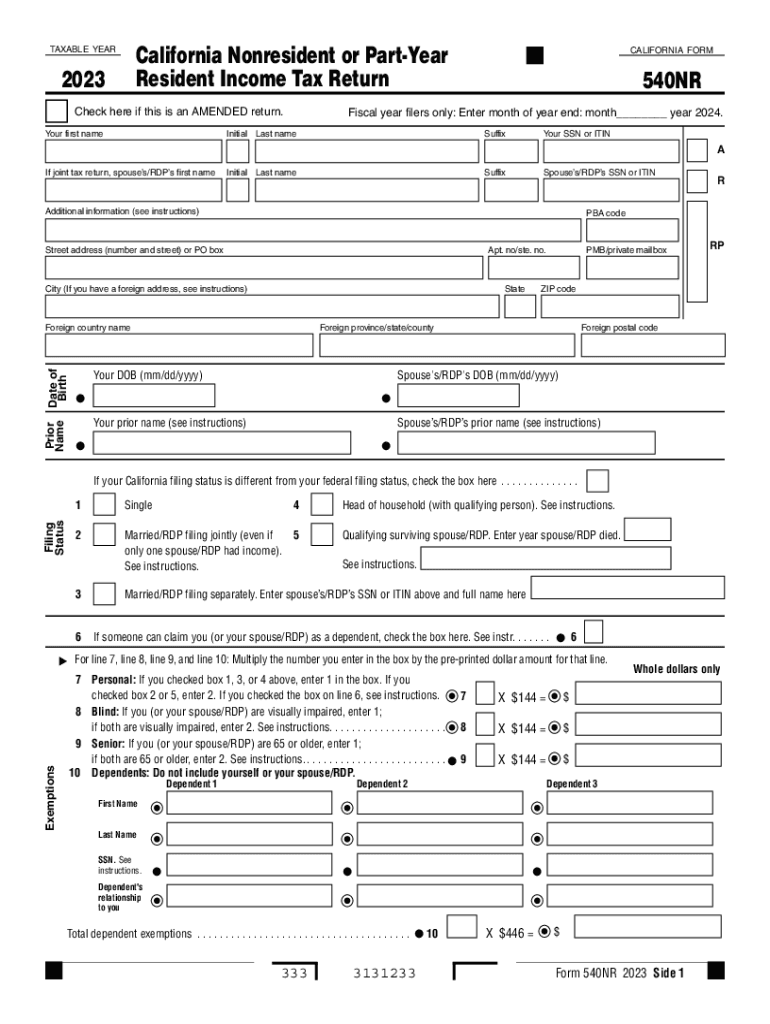

The Form 540NR is designed for individuals who are nonresidents or part-year residents of California. This tax return allows these individuals to report their income earned within the state, ensuring compliance with California tax laws. It is essential for anyone who has lived in California for part of the year or has earned income from California sources while residing elsewhere.

Steps to Complete the Form 540NR

Completing the Form 540NR involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Determine your residency status for the year in question, as this will affect how you fill out the form.

- Fill out the form accurately, ensuring all income sources are reported and deductions are applied where applicable.

- Review the completed form for accuracy before submission.

How to Obtain the Form 540NR

The Form 540NR can be obtained through the California Franchise Tax Board (FTB) website, where it is available for download in PDF format. Additionally, physical copies can be requested from the FTB or found at various tax assistance locations throughout California.

Key Elements of the Form 540NR

Important components of the Form 540NR include:

- Personal information section, where you provide your name, address, and Social Security number.

- Income section, detailing all sources of income earned within California.

- Deductions and credits section, allowing you to claim eligible tax benefits.

- Signature area, where you affirm the accuracy of the information provided.

Eligibility Criteria for the Form 540NR

To qualify for filing the Form 540NR, individuals must meet specific criteria. This includes being a nonresident or part-year resident of California and having income sourced from California. Understanding these eligibility requirements is crucial to ensure compliance and avoid potential penalties.

Filing Deadlines for the Form 540NR

Filing deadlines for the Form 540NR typically align with the federal tax filing deadlines. Generally, the form must be submitted by April 15 for the previous tax year. However, if this date falls on a weekend or holiday, the due date may be extended to the next business day.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 540nr california nonresident or part year resident income tax return form 540nr california nonresident or part year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are fill ins teeth and how do they work?

Fill ins teeth refer to dental restorations used to repair cavities or damaged teeth. They work by filling the decayed or broken areas with a material that restores the tooth's shape and function. This process not only enhances the appearance of your smile but also prevents further decay.

-

How much do fill ins teeth typically cost?

The cost of fill ins teeth can vary based on the material used and the complexity of the procedure. On average, you can expect to pay between $100 to $300 per filling. It's best to consult with your dentist for a personalized estimate based on your specific needs.

-

What materials are used for fill ins teeth?

Common materials for fill ins teeth include composite resin, amalgam, and porcelain. Composite resin is popular for its natural appearance, while amalgam is known for its durability. Your dentist will recommend the best material based on the location of the filling and your dental health.

-

Are fill ins teeth covered by dental insurance?

Many dental insurance plans cover fill ins teeth, especially if they are deemed necessary for health reasons. Coverage can vary, so it's important to check with your insurance provider to understand your benefits and any out-of-pocket costs you may incur.

-

How long do fill ins teeth last?

The lifespan of fill ins teeth depends on the material used and your oral hygiene practices. Generally, composite fillings last about 5 to 7 years, while amalgam fillings can last 10 years or more. Regular dental check-ups can help ensure the longevity of your fillings.

-

What are the benefits of getting fill ins teeth?

Fill ins teeth not only restore the function of your teeth but also improve your overall oral health. They help prevent further decay and can alleviate discomfort caused by cavities. Additionally, they enhance the aesthetic appeal of your smile, boosting your confidence.

-

Can I eat normally after getting fill ins teeth?

Yes, you can typically eat normally after getting fill ins teeth, but it's advisable to wait at least 24 hours before consuming hard or sticky foods. This allows the filling material to set properly. Always follow your dentist's post-procedure instructions for the best results.

Get more for Form 540NR California Nonresident Or Part Year Resident Income Tax Return , Form 540NR, California Nonresident Or Part Year Resi

Find out other Form 540NR California Nonresident Or Part Year Resident Income Tax Return , Form 540NR, California Nonresident Or Part Year Resi

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF