6252 Form 2013

What is the 6252 Form

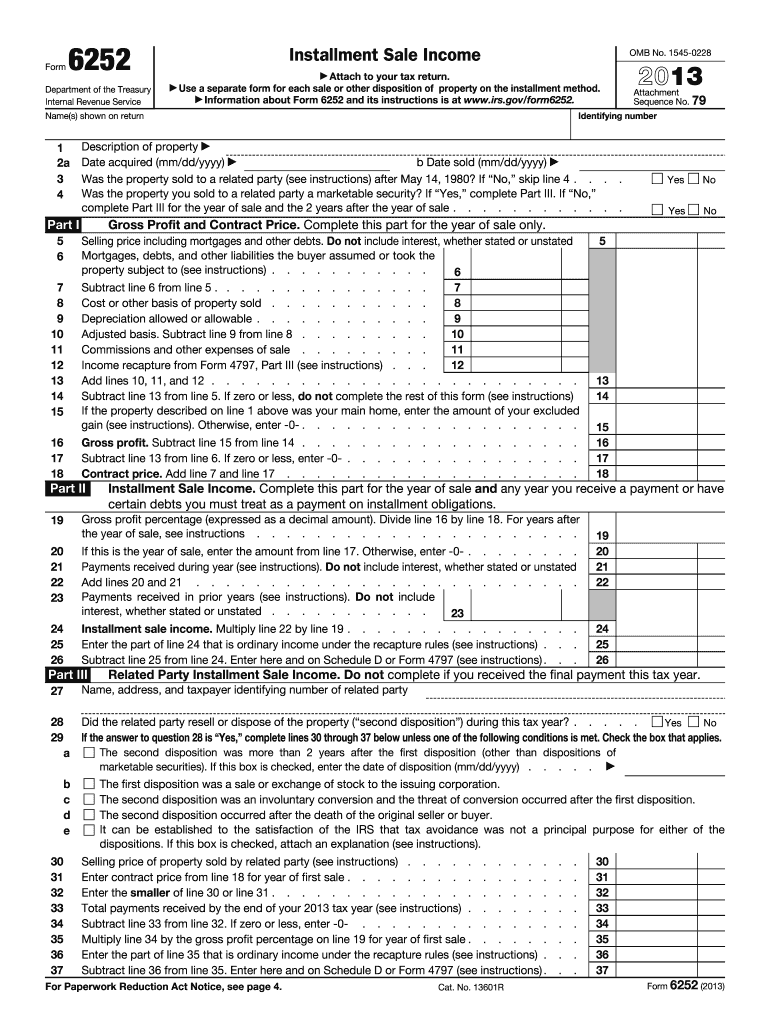

The 6252 Form, officially known as the Installment Sale Income form, is utilized by taxpayers to report income from sales of property where payments are received over time. This form is particularly relevant for individuals and businesses who sell assets and choose to receive payments in installments rather than a lump sum. By using the 6252 Form, taxpayers can spread their tax liability over the duration of the installment payments, which can be beneficial for cash flow management.

How to use the 6252 Form

Using the 6252 Form involves several key steps. First, gather all necessary documentation related to the sale, including details of the property sold, the sale price, and the payment terms. Next, complete the form by providing information about the seller, buyer, and the terms of the sale. It is important to accurately calculate the gross profit and the amount of gain to report for each year payments are received. Finally, submit the completed form along with your tax return to the IRS to ensure compliance with tax regulations.

Steps to complete the 6252 Form

Completing the 6252 Form requires careful attention to detail. Follow these steps:

- Begin by entering your personal information, including your name and Social Security number.

- Provide details about the property sold, including its description and the date of sale.

- Calculate the total selling price and the adjusted basis of the property to determine your gross profit.

- Detail the payment terms, including the amount and timing of each installment payment.

- Report the amount of gain you will recognize in the current tax year, based on the payments received.

Legal use of the 6252 Form

The 6252 Form is legally binding when completed correctly and submitted to the IRS. It is essential to adhere to IRS guidelines regarding installment sales to ensure that the income reported is accurate and compliant with tax laws. Failure to use the form properly can result in penalties or additional taxes owed. It is advisable to consult a tax professional if there are any uncertainties regarding the legal implications of using this form.

Filing Deadlines / Important Dates

Timely filing of the 6252 Form is crucial to avoid penalties. Typically, the form is due on the same date as your tax return, which is usually April fifteenth for individual taxpayers. If you are unable to meet this deadline, you may request an extension, but it is important to note that any taxes owed are still due by the original deadline. Keeping track of these dates ensures that you remain compliant with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of the 6252 Form. These guidelines include instructions on calculating the gross profit, determining the amount of gain to report, and the treatment of interest on installment payments. It is essential to refer to the IRS instructions for the most current information, as tax laws and regulations can change. Adhering to these guidelines will help ensure that the form is filled out correctly and submitted in compliance with federal tax laws.

Quick guide on how to complete 2013 6252 form

Complete 6252 Form seamlessly on any device

Digital document management has gained traction among enterprises and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the right form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents promptly without holdups. Handle 6252 Form on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related task today.

How to modify and eSign 6252 Form effortlessly

- Locate 6252 Form and click Get Form to begin.

- Utilize the tools we offer to submit your document.

- Emphasize important sections of your documents or conceal confidential information with the tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and eSign 6252 Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2013 6252 form

Create this form in 5 minutes!

How to create an eSignature for the 2013 6252 form

How to make an electronic signature for your PDF online

How to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to create an eSignature right from your smartphone

The best way to generate an electronic signature for a PDF on iOS

The way to create an eSignature for a PDF on Android

People also ask

-

What is the 6252 Form?

The 6252 Form is a tax form used to report the sale of certain assets, specifically for installment sales. It allows sellers to report capital gains income and calculate tax liability over time. Using airSlate SignNow, you can easily eSign and send the 6252 Form securely.

-

How can airSlate SignNow help with the 6252 Form?

airSlate SignNow simplifies the process of completing the 6252 Form by allowing users to fill out the document electronically and eSign it. This reduces the potential for errors and saves time, ensuring that your form is submitted accurately and on time. Additionally, you can store and manage all documents in one platform.

-

Is there a cost associated with using airSlate SignNow for the 6252 Form?

Yes, airSlate SignNow offers several pricing plans to suit different business needs. Each plan includes features that facilitate the completion and eSigning of the 6252 Form, providing a cost-effective solution for document management. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 6252 Form?

With airSlate SignNow, you can enjoy features such as customizable templates, in-app signing, and real-time tracking for your 6252 Form. Additionally, the platform provides secure cloud storage and automated reminders to ensure timely completion and submission of your forms.

-

Can I integrate airSlate SignNow with other software for the 6252 Form?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, including CRM and accounting tools. This means you can easily pull in data required for the 6252 Form from other platforms, streamlining your workflow and enhancing productivity.

-

Are there any benefits of using airSlate SignNow for the 6252 Form?

Using airSlate SignNow for the 6252 Form offers several benefits, including increased efficiency, improved accuracy, and enhanced security. The platform allows for quick access and editing of documents, ensuring that your tax forms are handled with care and precision, reducing the chances of costly mistakes.

-

Is it safe to eSign the 6252 Form using airSlate SignNow?

Yes, eSigning the 6252 Form with airSlate SignNow is extremely safe. The platform employs top-notch security measures, including data encryption and secure authentication protocols, ensuring that your personal and financial information remains protected. You can confidently manage your tax documents.

Get more for 6252 Form

- Hvac contract for contractor illinois form

- Landscape contract for contractor illinois form

- Commercial contract for contractor illinois form

- Excavator contract for contractor illinois form

- Renovation contract for contractor illinois form

- Concrete mason contract for contractor illinois form

- Demolition contract for contractor illinois form

- Framing contract for contractor illinois form

Find out other 6252 Form

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document