Form 709 1991

What is the Form 709

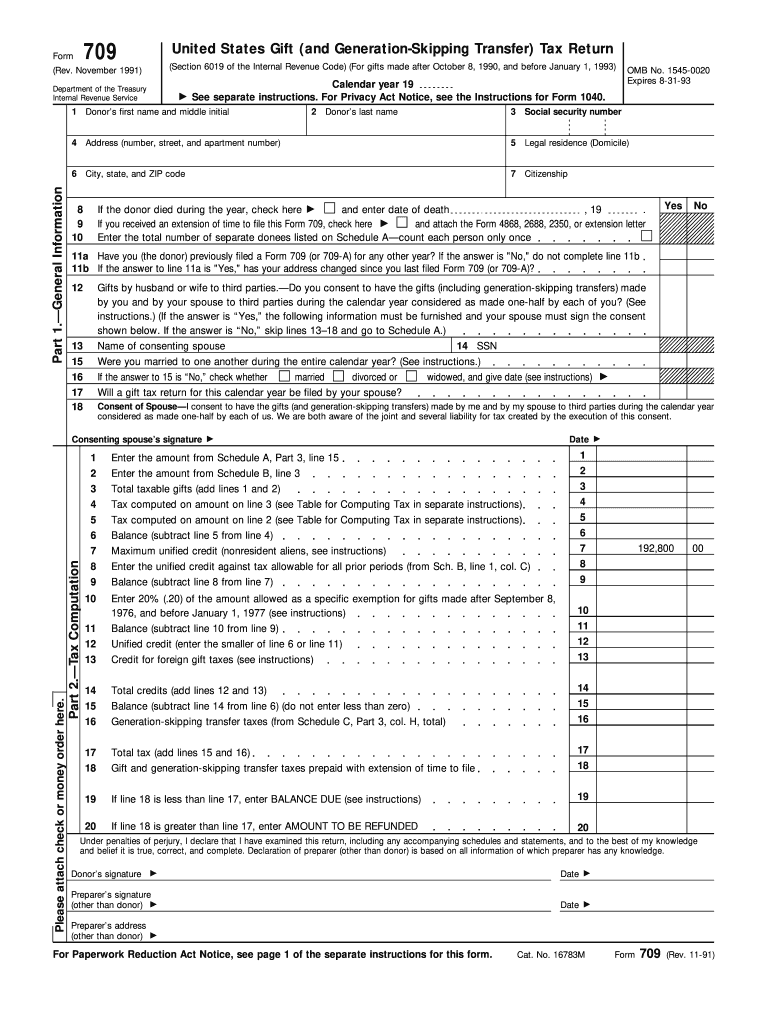

The Form 709, officially known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a tax form used by individuals to report gifts made during the tax year that exceed the annual exclusion limit. This form is crucial for individuals who may be subject to gift tax or who wish to allocate their lifetime gift tax exemption. Understanding the purpose and requirements of Form 709 is essential for proper tax compliance and planning.

How to use the Form 709

Using Form 709 involves several steps to ensure accurate reporting of gifts. Taxpayers must first determine if their gifts exceed the annual exclusion amount, which is adjusted periodically for inflation. Once it is established that a gift exceeds this limit, the taxpayer should complete the form by detailing the recipient, the value of the gift, and any applicable deductions or exclusions. It is important to file this form along with the individual's income tax return for the year in which the gifts were made.

Steps to complete the Form 709

Completing Form 709 requires careful attention to detail. Here are the essential steps:

- Gather necessary information about the gifts made during the year, including the recipient's details and the value of each gift.

- Fill out Part 1 of the form, which includes basic identifying information.

- Complete Part 2 to report the gifts, including any applicable deductions.

- Review the instructions for any specific situations that may apply, such as gifts to spouses or charities.

- Sign and date the form before submission.

Legal use of the Form 709

Form 709 is legally recognized for reporting gifts and ensuring compliance with federal tax laws. It is essential to use this form correctly to avoid potential penalties. The form must be filed by April 15 of the year following the tax year in which the gifts were made, or an extension may be requested. Incorrectly reporting gifts can lead to audits or additional tax liabilities, making it vital to adhere to IRS guidelines.

Filing Deadlines / Important Dates

The filing deadline for Form 709 coincides with the individual's federal income tax return due date, typically April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. Taxpayers may request an extension to file Form 709, but any gift tax owed must still be paid by the original deadline to avoid interest and penalties.

Required Documents

To complete Form 709, individuals should prepare several documents, including:

- Records of all gifts made during the tax year, detailing the recipient and value.

- Documentation for any deductions claimed, such as gifts to charities.

- Previous years' Form 709 if applicable, to track cumulative gifts against the lifetime exemption.

Form Submission Methods (Online / Mail / In-Person)

Form 709 can be submitted through various methods. While electronic filing is not available for this form, it can be mailed to the appropriate IRS address based on the taxpayer's location. It is advisable to send the form via certified mail to ensure it is received by the IRS. In-person submission is not typical for this form, as it primarily relies on postal service delivery.

Quick guide on how to complete 1991 form 709 2014

Effortlessly prepare Form 709 on any device

The management of documents online has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents promptly without delays. Manage Form 709 on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Form 709 with ease

- Obtain Form 709 and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Emphasize important parts of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes a few seconds and bears the same legal validity as a conventional ink signature.

- Review the details and then click the Done button to save your changes.

- Select your preferred method of sending the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form hunting, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 709 while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1991 form 709 2014

Create this form in 5 minutes!

How to create an eSignature for the 1991 form 709 2014

How to make an electronic signature for a PDF document in the online mode

How to make an electronic signature for a PDF document in Chrome

The best way to generate an eSignature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The best way to generate an eSignature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is Form 709 and why do I need it?

Form 709 is the United States Gift (and Generation-Skipping Transfer) Tax Return that individuals must use when they make gifts exceeding the annual exclusion limit. This form is essential for tax compliance, ensuring that large gifts are documented correctly for potential tax liabilities. Using airSlate SignNow can simplify the process of signing and submitting Form 709, making it easier for users to manage their gifting obligations.

-

How can airSlate SignNow help me with Form 709?

airSlate SignNow provides a streamlined platform for electronically signing and sending Form 709, allowing users to complete tax documentation quickly and efficiently. With features like customizable templates and reusable fields, users can ensure that Form 709 is filled out correctly every time. This not only saves time but also reduces the likelihood of errors in this important tax form.

-

Is airSlate SignNow a cost-effective solution for managing Form 709?

Yes, airSlate SignNow is designed to be a cost-effective solution, especially for individuals and businesses managing multiple forms like Form 709. Our pricing plans cater to various user needs, ensuring that you get maximum value without compromising on features or quality. Whether you’re filing a single Form 709 or managing multiple returns, airSlate SignNow can help keep costs down while providing robust functionality.

-

What features does airSlate SignNow offer for Form 709 users?

airSlate SignNow offers a suite of features tailored for users of Form 709, including advanced eSignature capabilities, document templates, and mobile access. Users can easily track the status of their Form 709 submissions, receive notifications, and securely store completed documents. This integrated approach simplifies the management of tax forms and helps ensure compliance with IRS regulations.

-

Can I integrate airSlate SignNow with other software for Form 709 management?

Absolutely! airSlate SignNow offers integrations with popular software solutions that many users rely on for managing fintech-related tasks, including Form 709 completion. By connecting your existing tools, you can enhance productivity and streamline your document workflows. This means you can manage Form 709 efficiently while maintaining consistency with your overall financial management processes.

-

How secure is airSlate SignNow when handling Form 709?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like Form 709. Our platform employs advanced encryption protocols and complies with industry standards to ensure that your data is secure and confidential. Users can trust that their Form 709 submissions and personal information are protected throughout the signing and storage processes.

-

What if I need assistance with Form 709 while using airSlate SignNow?

If you need assistance while using airSlate SignNow to manage Form 709, our customer support team is readily available to help. We offer comprehensive resources, including tutorials, FAQs, and direct support to address any queries you may have. Our aim is to ensure you have a seamless experience while completing your Form 709 and other documentation.

Get more for Form 709

- Il odometer form

- Promissory note in connection with sale of vehicle or automobile illinois form

- Bill of sale for watercraft or boat illinois form

- Bill of sale of automobile and odometer statement for as is sale illinois form

- Construction contract cost plus or fixed fee illinois form

- Painting contract for contractor illinois form

- Trim carpenter contract for contractor illinois form

- Fencing contract for contractor illinois form

Find out other Form 709

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure