Form 990 Schedule D 2010

What is the Form 990 Schedule D

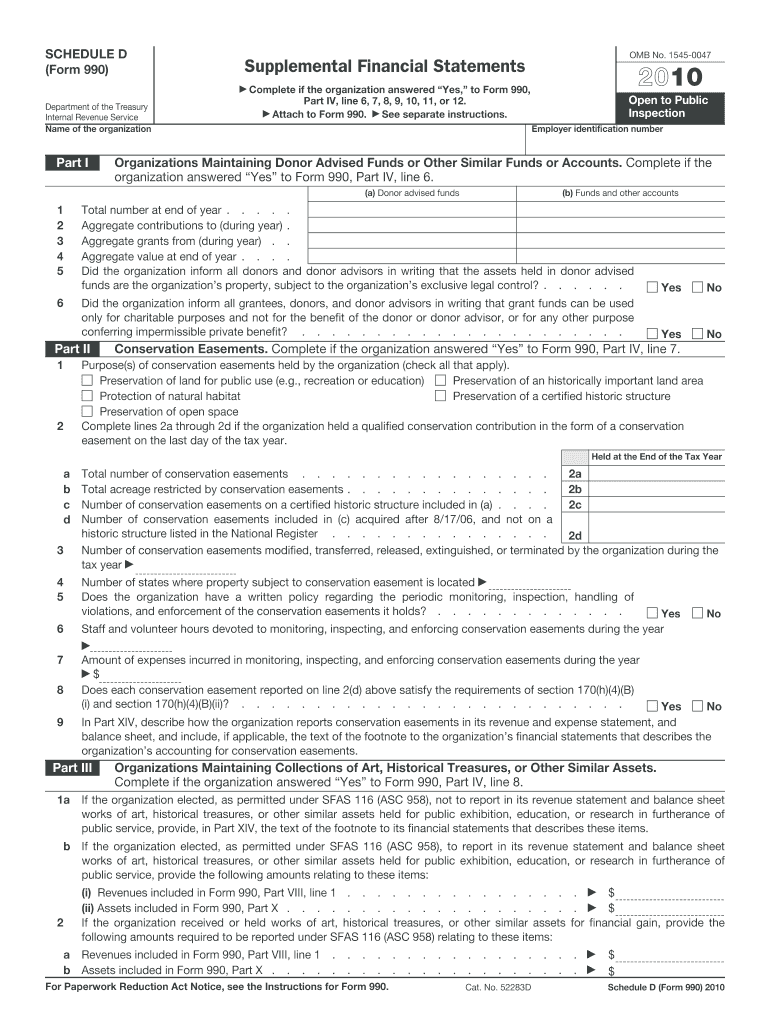

The Form 990 Schedule D is a supplementary document that nonprofit organizations in the United States must file with their annual Form 990. This schedule provides detailed information about the organization’s financial health, focusing on its endowment funds, investments, and other significant assets. It is essential for ensuring transparency and accountability in how nonprofits manage their finances and fulfill their missions. By completing Schedule D, organizations can provide the IRS and the public with insights into their financial practices and the sources of their funding.

How to use the Form 990 Schedule D

Using the Form 990 Schedule D involves several steps that ensure accurate reporting of financial information. Organizations must first gather relevant financial data, including details about their investments and endowment funds. Next, they should carefully fill out the schedule, ensuring that all required fields are completed accurately. Once the form is filled out, it should be attached to the main Form 990 when filing. It is important to review the completed Schedule D for accuracy and compliance with IRS guidelines before submission.

Steps to complete the Form 990 Schedule D

Completing the Form 990 Schedule D requires a systematic approach. Here are the key steps:

- Gather financial statements, including balance sheets and income statements.

- Identify all endowment funds and investments that need to be reported.

- Fill in the required sections of Schedule D, providing specific details about each fund and investment.

- Review the completed schedule for accuracy and completeness.

- Attach Schedule D to the Form 990 and submit it to the IRS by the filing deadline.

Key elements of the Form 990 Schedule D

The Form 990 Schedule D includes several key elements that organizations must report. These elements typically encompass:

- Details about endowment funds, including their sources and uses.

- Information on investments, such as stocks, bonds, and real estate.

- Descriptions of any significant financial transactions that impact the organization’s assets.

- Compliance with disclosure requirements regarding financial practices.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 990 Schedule D. Organizations must adhere to these guidelines to ensure compliance and avoid penalties. Key guidelines include:

- Accurate reporting of financial information, including valuation methods for assets.

- Timely submission of the form along with the main Form 990.

- Maintaining proper documentation to support the information reported on the schedule.

Filing Deadlines / Important Dates

Filing deadlines for the Form 990 Schedule D align with the due date for the Form 990 itself. Typically, nonprofit organizations must file their forms by the fifteenth day of the fifth month after the end of their fiscal year. For organizations operating on a calendar year, this means the deadline is May 15. Extensions may be available, but organizations should ensure compliance with IRS regulations to avoid penalties.

Quick guide on how to complete 2010 form 990 schedule d

Complete Form 990 Schedule D effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Form 990 Schedule D on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

The easiest way to modify and eSign Form 990 Schedule D with ease

- Locate Form 990 Schedule D and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional wet signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Form 990 Schedule D and guarantee superb communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 990 schedule d

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 990 schedule d

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is Form 990 Schedule D and why is it important?

Form 990 Schedule D is a supplemental form that organizations must file with their Form 990 tax return. It provides detailed information about the organization’s balance sheet, governing body, and financial activities. Understanding and accurately completing this form is crucial for maintaining transparency and compliance with IRS regulations.

-

How can airSlate SignNow help with completing Form 990 Schedule D?

airSlate SignNow simplifies the process of completing Form 990 Schedule D by allowing users to easily upload, edit, and eSign documents. Our platform streamlines workflows and improves collaboration among team members, ensuring that all necessary data is accurately captured in a timely manner.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various organizational needs. Our pricing options are designed to be cost-effective while providing all the essential features to help organizations manage their Form 990 Schedule D and other document needs efficiently. Explore our website for detailed pricing information tailored to nonprofit organizations.

-

Does airSlate SignNow support integrations with other software?

Yes, airSlate SignNow seamlessly integrates with a variety of popular software tools, allowing you to enhance your workflow when dealing with Form 990 Schedule D. These integrations facilitate easy data transfer and streamline the process, ensuring that you can manage your documents effectively without switching between platforms.

-

What features does airSlate SignNow offer to assist with tax form management?

airSlate SignNow provides a range of features designed to assist with the management of tax forms, including customizable templates for Form 990 Schedule D, secure eSignature options, automated reminders, and cloud storage. With these tools, you can ensure that your filing process is efficient and compliant with IRS requirements.

-

Can I track the status of my Form 990 Schedule D submission using airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your Form 990 Schedule D submissions in real-time. You’ll receive notifications when documents are opened, signed, or completed, providing peace of mind and ensuring timely follow-ups as needed.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Absolutely. airSlate SignNow prioritizes the security of your sensitive documents, including Form 990 Schedule D, by utilizing advanced encryption and security measures. Our platform complies with industry standards, ensuring that your information is safe and protected throughout the entire document management process.

Get more for Form 990 Schedule D

- Written revocation of will idaho form

- Last will and testament for other persons idaho form

- Notice to beneficiaries of being named in will idaho form

- Estate planning questionnaire and worksheets idaho form

- Document locator and personal information package including burial information form idaho

- Demand to produce copy of will from heir to executor or person in possession of will idaho form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497305930 form

- Illinois odometer disclosure statement form

Find out other Form 990 Schedule D

- Help Me With eSign New York Doctors PPT

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation