FTB 914 Taxpayer Advocate Assistance Request FTB 914, Taxpayer Advocate Assistance Request, 01 2024

Understanding the FTB 914 Taxpayer Advocate Assistance Request

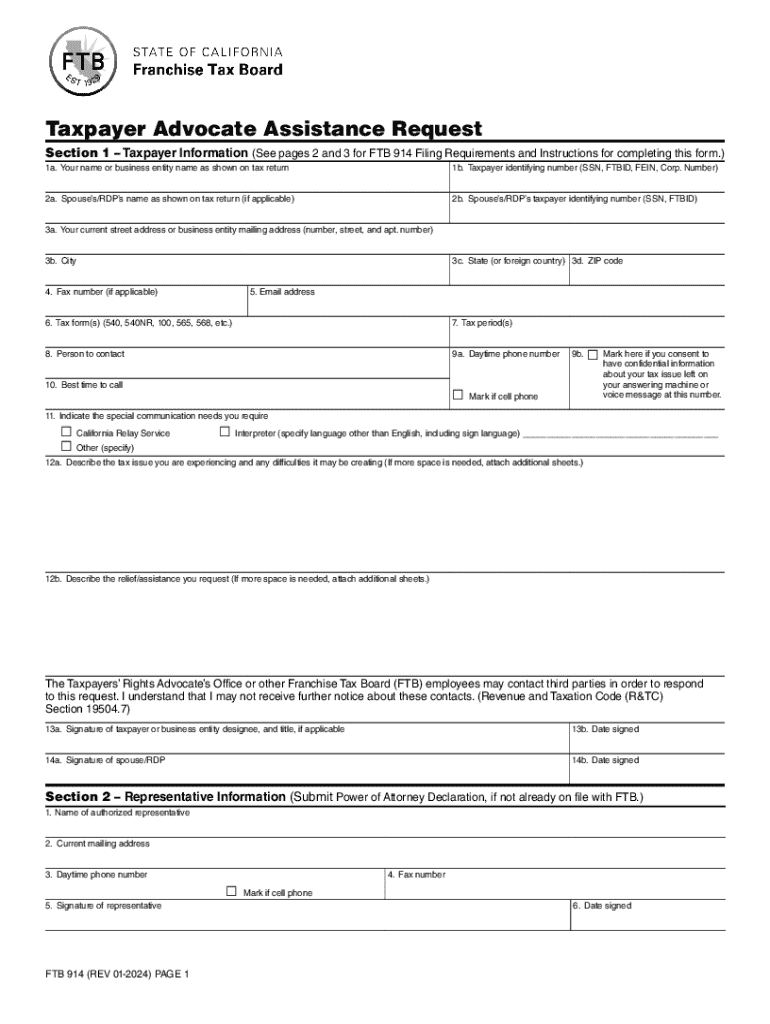

The FTB 914 Taxpayer Advocate Assistance Request is a form used by taxpayers in California who need help navigating issues with the Franchise Tax Board (FTB). This form allows individuals to request assistance from the Taxpayer Advocate, who is dedicated to ensuring that taxpayers' rights are protected and that they receive fair treatment. The Taxpayer Advocate can provide guidance on resolving disputes, understanding tax laws, and addressing concerns related to tax compliance.

Steps to Complete the FTB 914 Taxpayer Advocate Assistance Request

Completing the FTB 914 involves several key steps to ensure that the request is processed efficiently. First, gather all relevant information, including your personal details, tax identification number, and a clear description of the issue you are facing. Next, fill out the form accurately, ensuring that all sections are completed. It is important to provide as much detail as possible about your situation, as this will help the Taxpayer Advocate understand your case better. After filling out the form, review it for accuracy before submitting it to the FTB.

Eligibility Criteria for the FTB 914 Taxpayer Advocate Assistance Request

To be eligible for assistance through the FTB 914, taxpayers must demonstrate that they are experiencing significant hardship or that their tax issue is not being resolved through normal channels. This may include situations such as prolonged delays in processing a tax return, issues with tax refunds, or disputes over tax liabilities. The Taxpayer Advocate is there to assist those who feel that their concerns are not being adequately addressed by the FTB.

How to Submit the FTB 914 Taxpayer Advocate Assistance Request

Submitting the FTB 914 can be done through multiple methods. Taxpayers can mail the completed form directly to the FTB, ensuring that they keep a copy for their records. Alternatively, some may choose to submit the form in person at a local FTB office. It is essential to check the FTB website for any updates regarding submission methods, as electronic submission options may become available.

Key Elements of the FTB 914 Taxpayer Advocate Assistance Request

The FTB 914 includes several critical elements that must be filled out correctly. These elements typically include your name, contact information, tax identification number, and a detailed explanation of the issue you are facing. Additionally, there may be sections requesting specific information about previous attempts to resolve the issue and any relevant documentation that supports your case. Providing comprehensive information helps expedite the review process.

Common Scenarios for Using the FTB 914 Taxpayer Advocate Assistance Request

Taxpayers may find themselves in various situations that warrant the use of the FTB 914. Common scenarios include facing unexpected audits, receiving incorrect tax bills, or dealing with delays in tax refunds. Individuals who are self-employed or running small businesses may also encounter unique challenges that necessitate the assistance of a Taxpayer Advocate. Understanding these scenarios can help taxpayers recognize when to utilize this valuable resource.

Create this form in 5 minutes or less

Find and fill out the correct ftb 914 taxpayer advocate assistance request ftb 914 taxpayer advocate assistance request 01

Create this form in 5 minutes!

How to create an eSignature for the ftb 914 taxpayer advocate assistance request ftb 914 taxpayer advocate assistance request 01

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the FTB 914 Taxpayer Advocate Assistance Request FTB 914?

The FTB 914 Taxpayer Advocate Assistance Request FTB 914 is a formal request for assistance from the Taxpayer Advocate Service regarding tax-related issues. This request helps taxpayers navigate complex tax situations and ensures they receive the support they need. By utilizing this service, you can address your concerns effectively and efficiently.

-

How can I submit an FTB 914 Taxpayer Advocate Assistance Request?

To submit an FTB 914 Taxpayer Advocate Assistance Request, you can fill out the designated form available on the official FTB website. Ensure that all required information is accurately provided to facilitate a smooth processing of your request. Once submitted, you will receive confirmation and further instructions on the next steps.

-

What are the benefits of using the FTB 914 Taxpayer Advocate Assistance Request?

Using the FTB 914 Taxpayer Advocate Assistance Request provides several benefits, including personalized assistance with tax issues and expedited resolution of your concerns. The Taxpayer Advocate Service is dedicated to helping taxpayers understand their rights and navigate the tax system. This support can lead to a more favorable outcome for your tax situation.

-

Is there a cost associated with the FTB 914 Taxpayer Advocate Assistance Request?

No, there is no cost associated with submitting an FTB 914 Taxpayer Advocate Assistance Request. The Taxpayer Advocate Service is a free resource provided by the IRS to assist taxpayers. This ensures that everyone has access to the help they need without financial barriers.

-

What types of issues can the FTB 914 Taxpayer Advocate Assistance Request help with?

The FTB 914 Taxpayer Advocate Assistance Request can help with a variety of tax-related issues, including delays in processing, disputes with the IRS, and understanding tax laws. If you feel that your tax issue is not being resolved through normal channels, this request can provide the necessary support. It is designed to address complex situations that require additional assistance.

-

How long does it take to receive assistance after submitting the FTB 914 Taxpayer Advocate Assistance Request?

The response time for the FTB 914 Taxpayer Advocate Assistance Request can vary depending on the complexity of your issue and the current workload of the Taxpayer Advocate Service. Generally, you can expect to hear back within a few weeks. However, urgent cases may be prioritized for quicker resolution.

-

Can I track the status of my FTB 914 Taxpayer Advocate Assistance Request?

Yes, you can track the status of your FTB 914 Taxpayer Advocate Assistance Request by contacting the Taxpayer Advocate Service directly. They will provide you with updates on your request and any actions being taken. Keeping communication open is key to ensuring your concerns are addressed promptly.

Get more for FTB 914 Taxpayer Advocate Assistance Request FTB 914, Taxpayer Advocate Assistance Request, 01

- Wa tenant landlord 497429590 form

- No contact order 497429591 form

- Washington release claim form

- Tenant landlord with form

- Letter from tenant to landlord with demand that landlord provide proper outdoor garbage receptacles washington form

- Motion declaration form

- Letter from tenant to landlord about landlords failure to make repairs washington form

- Notice motion order form

Find out other FTB 914 Taxpayer Advocate Assistance Request FTB 914, Taxpayer Advocate Assistance Request, 01

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online