Taxpayer Advocate ServicesFTB Ca Gov Franchise Tax Board 2024-2026

Understanding the Taxpayer Advocate Services

The Taxpayer Advocate Services (TAS) is an independent organization within the Internal Revenue Service (IRS) designed to assist taxpayers facing difficulties in resolving their tax issues. This service advocates for taxpayers' rights and ensures they receive fair treatment. The TAS can help with various issues, including delays in processing, disputes with the IRS, and understanding complex tax regulations. It is particularly beneficial for individuals who feel they have been treated unfairly by the tax system.

How to Access the Taxpayer Advocate Services

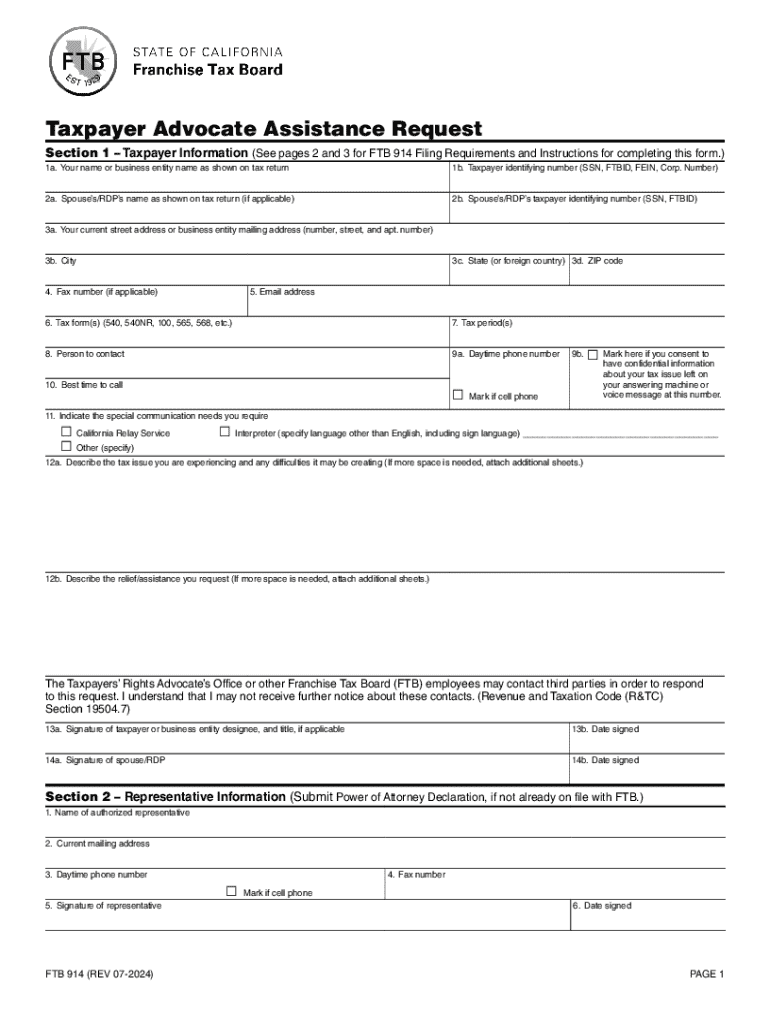

To access the Taxpayer Advocate Services, taxpayers can visit the official IRS website or contact their local TAS office. The process typically involves filling out Form 911, which is the Request for Taxpayer Advocate Service Assistance. This form allows taxpayers to explain their situation and request help. It is advisable to provide as much detail as possible to facilitate a quicker resolution.

Steps to Complete the Request for Assistance

Completing the request for assistance through the Taxpayer Advocate Services involves several key steps:

- Gather all relevant documentation related to your tax issue.

- Fill out Form 911, ensuring to include your contact information and a detailed description of your problem.

- Submit the completed form either online or by mailing it to the appropriate TAS office.

- Follow up with the TAS office to confirm receipt of your request and inquire about the next steps.

Legal Aspects of Using the Taxpayer Advocate Services

The Taxpayer Advocate Services operates under specific legal guidelines that protect taxpayer rights. The TAS is mandated to assist individuals who are experiencing financial difficulties or who believe that their rights have been violated. It is important for taxpayers to understand that while TAS can provide assistance, it does not have the authority to change tax laws or IRS policies. However, it can help navigate the complexities of the tax system and ensure that taxpayers receive the support they need.

Eligibility Criteria for Taxpayer Advocate Services

Eligibility for assistance from the Taxpayer Advocate Services is generally based on the following criteria:

- Taxpayers must be experiencing significant hardship due to their tax situation.

- The issue must be unresolved and require intervention from the TAS.

- Taxpayers should have already attempted to resolve the issue through normal IRS channels.

Individuals who meet these criteria are encouraged to reach out to the TAS for support in resolving their tax issues.

Common Scenarios for Utilizing Taxpayer Advocate Services

There are various scenarios where taxpayers may find it beneficial to engage with the Taxpayer Advocate Services. Some common situations include:

- Facing financial hardship due to tax levies or liens.

- Experiencing delays in tax refunds or processing of returns.

- Disputing IRS decisions regarding audits or penalties.

In these cases, the TAS can provide valuable assistance and guidance to help navigate the complexities of the tax system.

Create this form in 5 minutes or less

Find and fill out the correct taxpayer advocate servicesftb ca gov franchise tax board

Create this form in 5 minutes!

How to create an eSignature for the taxpayer advocate servicesftb ca gov franchise tax board

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it benefit an FTB taxpayer?

airSlate SignNow is a powerful eSignature solution that allows FTB taxpayers to send and sign documents electronically. This service streamlines the signing process, making it faster and more efficient, which is essential for managing tax-related documents. By using airSlate SignNow, FTB taxpayers can save time and reduce the hassle of paperwork.

-

How much does airSlate SignNow cost for FTB taxpayers?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of FTB taxpayers. Whether you are an individual or a business, you can choose a plan that fits your budget and requirements. The cost-effective nature of airSlate SignNow ensures that FTB taxpayers can access essential features without breaking the bank.

-

What features does airSlate SignNow offer for FTB taxpayers?

airSlate SignNow provides a range of features designed specifically for FTB taxpayers, including customizable templates, secure cloud storage, and real-time tracking of document status. These features enhance the user experience and ensure that FTB taxpayers can manage their documents efficiently. Additionally, the platform is user-friendly, making it accessible for everyone.

-

Can FTB taxpayers integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications that FTB taxpayers may already be using. This includes popular tools like Google Drive, Salesforce, and Microsoft Office. These integrations help streamline workflows and ensure that FTB taxpayers can manage their documents in one place.

-

Is airSlate SignNow secure for FTB taxpayers?

Absolutely! airSlate SignNow prioritizes security, ensuring that all documents signed by FTB taxpayers are protected with advanced encryption and compliance with industry standards. This means that FTB taxpayers can confidently send and sign sensitive documents without worrying about data bsignNowes or unauthorized access.

-

How does airSlate SignNow improve the document signing process for FTB taxpayers?

airSlate SignNow simplifies the document signing process for FTB taxpayers by allowing them to sign documents from anywhere, at any time. This flexibility is crucial for FTB taxpayers who may have busy schedules or need to sign documents on the go. The platform's intuitive interface makes it easy for FTB taxpayers to complete their signing tasks quickly.

-

What support options are available for FTB taxpayers using airSlate SignNow?

FTB taxpayers using airSlate SignNow have access to a variety of support options, including a comprehensive knowledge base, live chat, and email support. This ensures that any questions or issues can be addressed promptly, allowing FTB taxpayers to make the most of the platform. The dedicated support team is always ready to assist FTB taxpayers with their needs.

Get more for Taxpayer Advocate ServicesFTB ca gov Franchise Tax Board

- Goal setting worksheets enhanced learning enhanced learning form

- Test request form school of veterinary science veterinary

- Socratic seminar observationassessment tools spokane public form

- John carlton pdf form

- Audiology experts audiologists ampamp hearing aids in arlington tx form

- Fax 888 436 6591 form

- Parental guarantee agreement template form

- Parental responsibility agreement template form

Find out other Taxpayer Advocate ServicesFTB ca gov Franchise Tax Board

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy