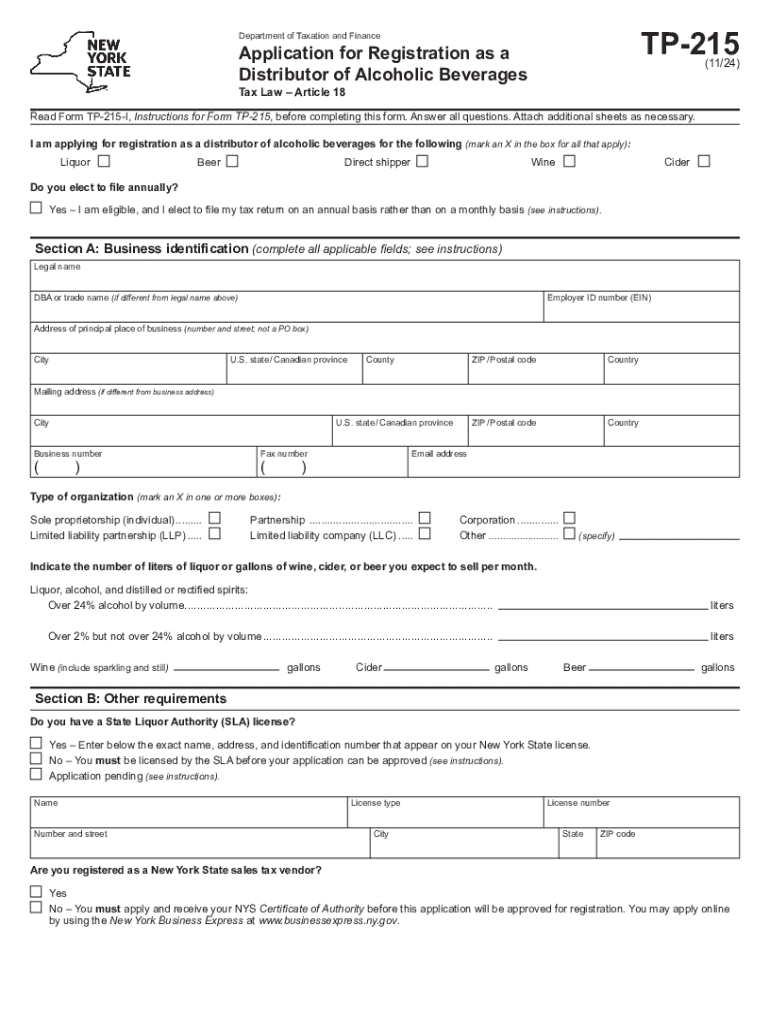

Form TP 215 Application for Registration as a Distributor of Alcoholic Beverages Revised 1124

What is the Form TP-215 Application for Registration as a Distributor of Alcoholic Beverages?

The Form TP-215 is a crucial document used for registering as a distributor of alcoholic beverages in the United States. This form is specifically designed for individuals or businesses that intend to distribute alcoholic products within the state. It outlines the necessary information required by state authorities to ensure compliance with local laws governing the distribution of alcoholic beverages. The form includes sections for personal and business information, types of alcoholic beverages to be distributed, and other relevant details that help regulatory bodies assess the application.

Steps to Complete the Form TP-215 Application for Registration as a Distributor of Alcoholic Beverages

Completing the TP-215 form involves several key steps:

- Gather Required Information: Collect all necessary personal and business details, including your business structure, contact information, and any previous licenses held.

- Fill Out the Form: Carefully complete each section of the form, ensuring accuracy in the information provided. Pay special attention to the types of beverages you plan to distribute.

- Review for Accuracy: Double-check all entries to avoid mistakes that could delay processing. Ensure that all required fields are filled out completely.

- Submit the Form: Choose your submission method, whether online, by mail, or in person, and follow the specific instructions for your chosen method.

How to Obtain the Form TP-215 Application for Registration as a Distributor of Alcoholic Beverages

The TP-215 form can typically be obtained from the state’s alcohol regulatory agency or its official website. In most cases, it is available as a downloadable PDF, which can be filled out digitally or printed for manual completion. Additionally, physical copies may be available at designated government offices or through industry associations that support alcoholic beverage distributors.

Legal Use of the Form TP-215 Application for Registration as a Distributor of Alcoholic Beverages

Using the TP-215 form legally requires adherence to state regulations governing the distribution of alcoholic beverages. This includes ensuring that all provided information is truthful and accurate. Misrepresentation or failure to comply with state laws can result in penalties, including the denial of your application or revocation of any issued licenses. It is essential to understand the legal implications of the information submitted and to maintain compliance with ongoing regulatory requirements.

Eligibility Criteria for the Form TP-215 Application for Registration as a Distributor of Alcoholic Beverages

To be eligible for the TP-215 application, applicants typically must meet certain criteria, which may include:

- Being of legal age to distribute alcoholic beverages, usually at least twenty-one years old.

- Having a valid business license and registration in the state where distribution will occur.

- Meeting any specific state requirements related to the type of alcoholic beverages to be distributed.

Form Submission Methods for the TP-215 Application for Registration as a Distributor of Alcoholic Beverages

The TP-215 form can be submitted through various methods, depending on state regulations. Common submission methods include:

- Online Submission: Many states offer an online portal for submitting the TP-215 form, allowing for faster processing and confirmation.

- Mail: Applicants can print the completed form and send it via postal mail to the designated state agency.

- In-Person Submission: Some applicants may prefer to submit the form in person at local government offices, where they can receive immediate assistance.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form tp 215 application for registration as a distributor of alcoholic beverages revised 1124

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an SLA TP form and how does it work?

An SLA TP form is a Service Level Agreement Third Party form that outlines the expectations and responsibilities between parties. With airSlate SignNow, you can easily create, send, and eSign SLA TP forms, ensuring that all parties are aligned on their commitments. This streamlines the process and enhances accountability.

-

How can airSlate SignNow help with SLA TP forms?

airSlate SignNow provides a user-friendly platform to create and manage SLA TP forms efficiently. You can customize templates, automate workflows, and track document status in real-time. This not only saves time but also reduces the risk of errors in your agreements.

-

What are the pricing options for using airSlate SignNow for SLA TP forms?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for small teams and large enterprises. Each plan includes features for managing SLA TP forms, such as unlimited eSignatures and document storage. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available for SLA TP forms with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage SLA TP forms. You can connect with tools like Google Drive, Salesforce, and more to streamline your document workflows. This integration capability helps centralize your operations and improve efficiency.

-

What are the benefits of using airSlate SignNow for SLA TP forms?

Using airSlate SignNow for SLA TP forms offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. The platform allows for quick eSigning and document sharing, ensuring that your agreements are executed promptly. Additionally, it provides audit trails for compliance and accountability.

-

Can I customize my SLA TP forms in airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your SLA TP forms to meet your specific needs. You can add fields, adjust layouts, and include branding elements to ensure that your forms reflect your company's identity. This level of customization enhances professionalism and clarity in your agreements.

-

Is it easy to track the status of SLA TP forms with airSlate SignNow?

Yes, tracking the status of SLA TP forms is straightforward with airSlate SignNow. The platform provides real-time updates on document status, so you can see when a form is sent, viewed, and signed. This transparency helps you manage your agreements more effectively and follow up as needed.

Get more for Form TP 215 Application For Registration As A Distributor Of Alcoholic Beverages Revised 1124

- 2022 i 119 instructions for wisconsin schedule t wisconsin schedule t instructions form

- 4582 michigan business tax penalty and interest computatino for underpaid estimated tax 4582 michigan business tax penalty and form

- Electronic filing requirement for tax return preparers form

- State of georgia certificate of exemption of local form

- Pdf revenue division of department of treasury act 122 of form

- D2l2jhoszs7d12cloudfrontnetstatemichiganmichigan department of state refund request form a 226

- Scprodmichigangov lara new on premises specially designated merchant sdm application form

- 500 and 500 ez forms and general instructions

Find out other Form TP 215 Application For Registration As A Distributor Of Alcoholic Beverages Revised 1124

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form