Are You Familiar with NY State Form it 2663?

Understanding NY State Form IT 2663

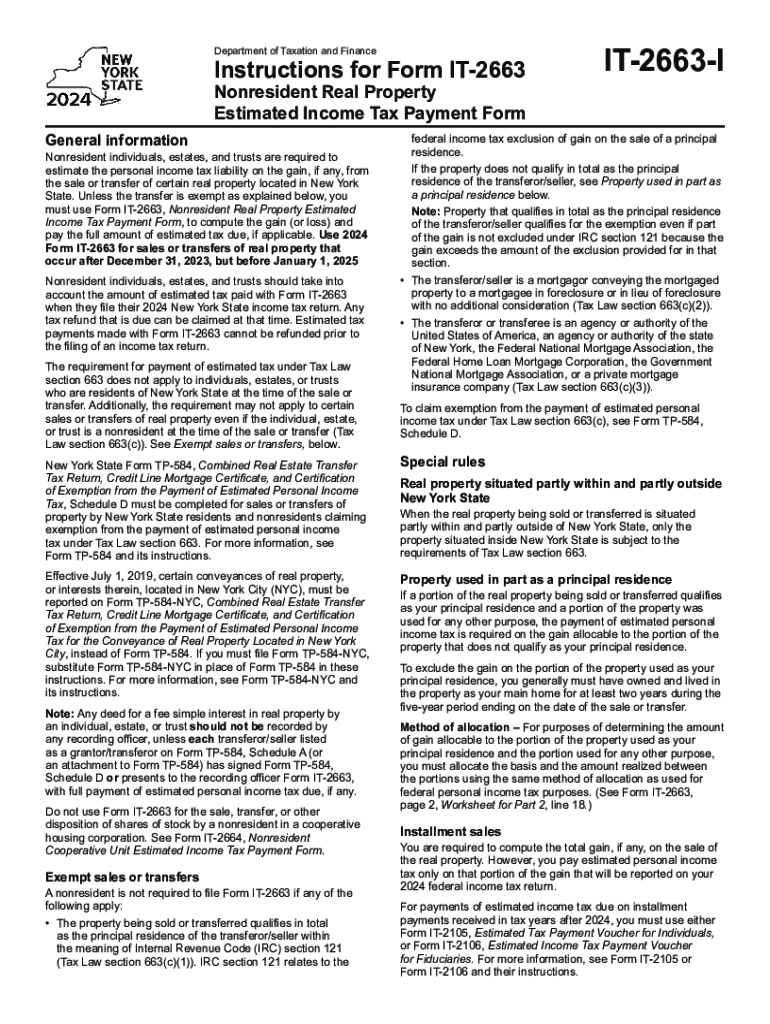

New York State Form IT 2663 is a crucial document for individuals and businesses involved in real estate transactions. This form is primarily used to report and pay New York State income tax on gains derived from the sale of real property. It is essential for sellers to understand the implications of this form, as it ensures compliance with state tax laws and helps avoid potential penalties.

Steps to Complete NY State Form IT 2663

Completing Form IT 2663 involves several key steps. First, gather all necessary information regarding the property being sold, including the purchase price, selling price, and any adjustments to the basis. Next, accurately fill out the form by providing details such as the seller's information, the property's address, and the tax calculation based on the gain from the sale. Finally, review the completed form for accuracy before submission to ensure compliance with state regulations.

Obtaining NY State Form IT 2663

Form IT 2663 can be obtained directly from the New York State Department of Taxation and Finance website. It is available for download in PDF format, allowing users to print and fill it out manually. Additionally, the form may be accessible through various tax preparation software that supports New York State tax filings, making it easier for users to complete their tax obligations efficiently.

Legal Use of NY State Form IT 2663

Form IT 2663 serves a legal purpose in the context of real estate transactions. It is required by law for sellers to report capital gains from the sale of real property in New York State. Failure to file this form can result in legal repercussions, including fines and penalties. Therefore, understanding the legal requirements surrounding this form is essential for compliance and to avoid any potential legal issues.

Key Elements of NY State Form IT 2663

Several key elements are essential when filling out Form IT 2663. These include the seller's name, Social Security number or Employer Identification Number, the address of the property sold, and the details of the transaction, such as the selling price and any deductions. Additionally, the form requires the calculation of the estimated tax due based on the gain from the sale, which is a critical component for accurate reporting.

Filing Deadlines for NY State Form IT 2663

Timely filing of Form IT 2663 is crucial to avoid penalties. The form must be submitted within a specified timeframe following the sale of the property. Generally, the deadline is the same as the due date for the seller's income tax return for the year in which the sale occurred. It is advisable to check the New York State Department of Taxation and Finance for any updates or changes to these deadlines to ensure compliance.

Required Documents for NY State Form IT 2663

When completing Form IT 2663, several documents are necessary to support the information provided. These include the closing statement from the sale, proof of the purchase price, and any documentation related to adjustments made to the basis of the property. Having these documents on hand will facilitate a smoother filing process and ensure that all required information is accurately reported.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the are you familiar with ny state form it 2663

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the it 2663 i feature in airSlate SignNow?

The it 2663 i feature in airSlate SignNow allows users to streamline their document signing process. This feature enhances efficiency by enabling users to send, sign, and manage documents electronically. With it 2663 i, businesses can reduce turnaround times and improve overall productivity.

-

How does pricing work for the it 2663 i solution?

Pricing for the it 2663 i solution is designed to be cost-effective, catering to businesses of all sizes. airSlate SignNow offers various subscription plans that provide flexibility based on your needs. You can choose a plan that best fits your budget while still accessing the powerful features of it 2663 i.

-

What are the key benefits of using it 2663 i?

Using the it 2663 i feature provides numerous benefits, including enhanced security, faster document processing, and improved collaboration. It allows teams to work more efficiently by reducing the time spent on manual paperwork. Additionally, it 2663 i ensures that your documents are legally binding and compliant with industry standards.

-

Can I integrate it 2663 i with other software?

Yes, airSlate SignNow's it 2663 i feature can be easily integrated with various software applications. This includes popular tools like CRM systems, project management software, and cloud storage services. Integrating it 2663 i with your existing tools enhances workflow efficiency and data management.

-

Is it 2663 i suitable for small businesses?

Absolutely! The it 2663 i solution is particularly beneficial for small businesses looking to optimize their document management processes. Its user-friendly interface and cost-effective pricing make it accessible for smaller teams. With it 2663 i, small businesses can compete effectively by streamlining their operations.

-

What types of documents can I manage with it 2663 i?

With the it 2663 i feature, you can manage a wide variety of documents, including contracts, agreements, and forms. This versatility allows businesses to handle all their essential paperwork electronically. The it 2663 i solution ensures that all documents are securely stored and easily retrievable.

-

How secure is the it 2663 i feature?

The it 2663 i feature prioritizes security, employing advanced encryption and authentication methods. This ensures that your documents are protected from unauthorized access and tampering. With airSlate SignNow's it 2663 i, you can confidently manage sensitive information while maintaining compliance with regulations.

Get more for Are You Familiar With NY State Form IT 2663?

- Dorwagov2023 excise tax return due dates2023 excise tax return due dateswashington department of form

- New mexico form pit x amended return taxformfinder

- Enrolled agents frequently asked questionsinternalenrolled agents frequently asked questionsinternalenrolled agents frequently form

- Form w 3pdf attention you may file forms w 2 and w 3 electronically

- Form 720 rev december 2022 quarterly federal excise tax return

- Docsliborgdoc4110687the art advisory panel of the commissioner of internal revenue form

- About form 8889 health savings accounts hsasinternalfederal form 8889 health savings accounts hsas 2020federal form 8889 health

- Forms ampamp publications nm taxation and revenue department

Find out other Are You Familiar With NY State Form IT 2663?

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free