Form 590 P Nonresident Withholding Exemption Certificate for Previously Reported Income Form 590 P Nonresident Withholding Exemp

Understanding the Form 590 P Nonresident Withholding Exemption Certificate

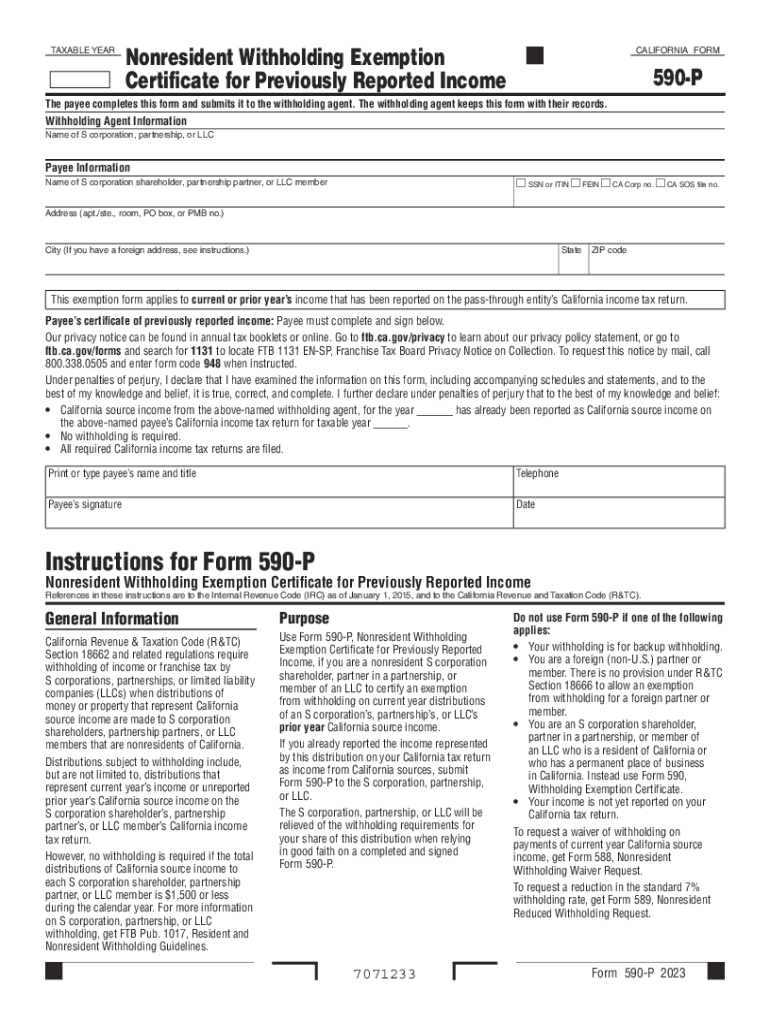

The Form 590 P is a crucial document for nonresidents who wish to claim an exemption from California withholding on income that has already been reported. This form allows nonresident individuals and entities to certify that they are not subject to withholding on certain types of income, such as interest, dividends, or capital gains. By submitting this form, taxpayers can ensure that they are not over-withheld on their income, which can help with cash flow and financial planning.

Steps to Complete the Form 590 P

Completing the Form 590 P involves several straightforward steps:

- Gather necessary information, including your taxpayer identification number and details about the income you are reporting.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Sign and date the form to certify that the information provided is true and correct.

- Submit the completed form to the withholding agent or payer of the income, not to the California Franchise Tax Board.

Eligibility Criteria for Using Form 590 P

To use the Form 590 P, you must meet specific eligibility criteria. Primarily, you should be a nonresident of California receiving income that has already been reported. This form is typically used by individuals or entities that are not subject to California withholding due to certain exemptions, such as income from investments or sales of property. It is essential to review the requirements carefully to ensure compliance.

Legal Use of the Form 590 P

The legal use of the Form 590 P is to prevent unnecessary withholding on income that is not subject to California taxes. By accurately completing and submitting this form, nonresidents can legally assert their right to exemption, thereby ensuring that their financial interests are protected. It is important to understand that misuse of the form can lead to penalties or legal repercussions, so accuracy and honesty are paramount.

Required Documents for Form 590 P Submission

When submitting the Form 590 P, certain supporting documents may be required to validate your claim for exemption. This can include:

- Proof of nonresidency, such as a driver's license or tax documents from your home state.

- Documentation of the income being reported, such as 1099 forms or other tax statements.

- Any additional forms that may be relevant to your specific situation.

Examples of Using the Form 590 P

There are various scenarios in which the Form 590 P may be utilized. For instance:

- A nonresident investor receiving dividends from California corporations may use this form to avoid withholding on those dividends.

- A foreign entity selling property in California can submit the form to claim exemption from withholding on the sale proceeds.

These examples illustrate the practical applications of the form and highlight its importance for nonresidents engaged in financial activities within California.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 590 p nonresident withholding exemption certificate for previously reported income form 590 p nonresident withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the pricing structure for airSlate SignNow 590 p.?

The pricing for airSlate SignNow 590 p. is designed to be cost-effective, catering to businesses of all sizes. We offer various plans that provide flexibility based on your needs, ensuring you only pay for what you use. You can choose from monthly or annual subscriptions, with discounts available for longer commitments.

-

What features does airSlate SignNow 590 p. offer?

airSlate SignNow 590 p. includes a range of features such as document templates, real-time collaboration, and advanced security measures. Users can easily create, send, and eSign documents, streamlining their workflow. Additionally, the platform supports mobile access, allowing you to manage documents on the go.

-

How can airSlate SignNow 590 p. benefit my business?

By using airSlate SignNow 590 p., your business can enhance efficiency and reduce turnaround times for document signing. The platform simplifies the eSigning process, making it faster and more reliable. This leads to improved customer satisfaction and can ultimately drive more sales.

-

Is airSlate SignNow 590 p. easy to integrate with other tools?

Yes, airSlate SignNow 590 p. offers seamless integrations with various third-party applications, including CRM systems and cloud storage services. This allows you to streamline your workflow and keep all your tools connected. Our API also enables custom integrations tailored to your specific business needs.

-

What types of documents can I send using airSlate SignNow 590 p.?

With airSlate SignNow 590 p., you can send a wide variety of documents for eSigning, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring compatibility with your existing documents. This versatility makes it suitable for various industries and use cases.

-

Is there a mobile app for airSlate SignNow 590 p.?

Yes, airSlate SignNow 590 p. has a mobile app that allows you to manage your documents and eSign on the go. The app is user-friendly and provides access to all the essential features of the desktop version. This ensures that you can stay productive, even when you're away from your office.

-

What security measures are in place for airSlate SignNow 590 p.?

airSlate SignNow 590 p. prioritizes the security of your documents with advanced encryption and compliance with industry standards. We implement measures such as two-factor authentication and secure data storage to protect your information. This ensures that your sensitive documents remain safe throughout the signing process.

Get more for Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income Form 590 P Nonresident Withholding Exemp

- Nj paad application form

- Cuyahoga homestead exemption form

- Manual j worksheet pdf form

- Live plant license georgia form

- Request for copy of ged form louisiana community and lctcs

- 1 year agreement letter for teacher form

- Cv 035 subpoena trial hrng dep rev 06 14 form

- F1311001fill in affidavit for general information

Find out other Form 590 P Nonresident Withholding Exemption Certificate For Previously Reported Income Form 590 P Nonresident Withholding Exemp

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online