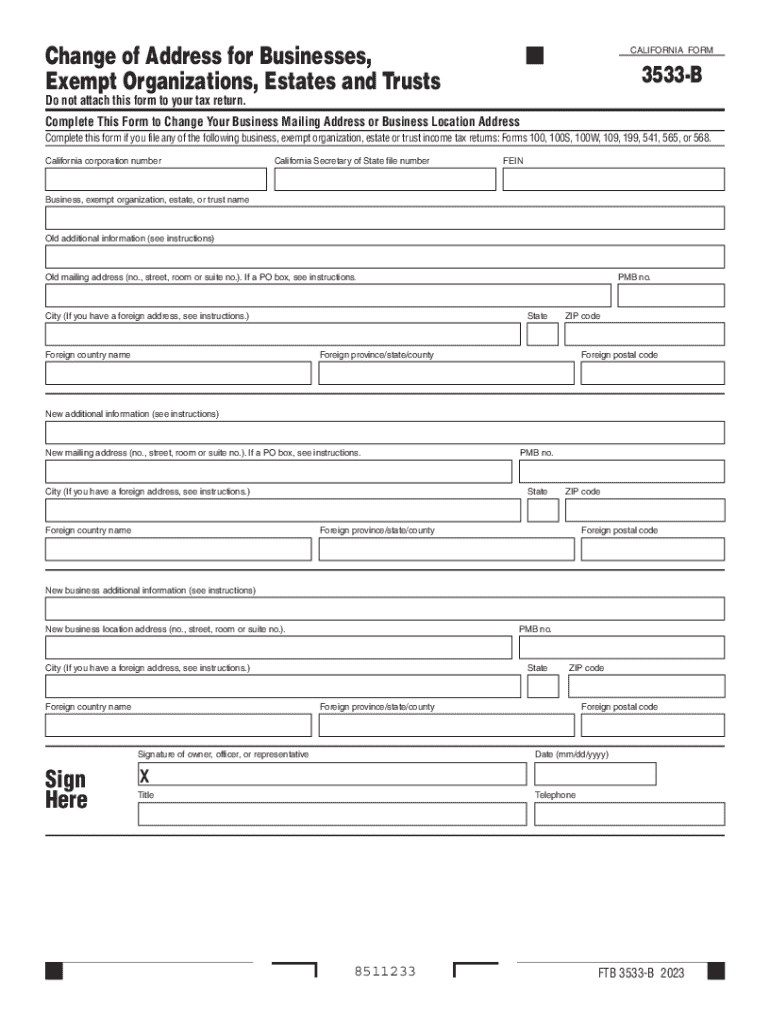

Ftb 3533 B Form

What is the FTB 3533 B?

The FTB 3533 B is a form used by residents of California to officially change their address with the California Franchise Tax Board (FTB). This form is essential for ensuring that taxpayers receive important tax documents and correspondence at their new address. It is specifically designed for individuals and businesses to keep their records up to date with the state tax authority.

How to Use the FTB 3533 B

To use the FTB 3533 B, individuals must complete the form with their current and new address information. It is important to provide accurate details to avoid any delays in processing. Once completed, the form can be submitted online, by mail, or in person at a local FTB office. Utilizing the online option can expedite the process and ensure quicker updates to the taxpayer's records.

Steps to Complete the FTB 3533 B

Completing the FTB 3533 B involves several straightforward steps:

- Gather necessary information, including your current address, new address, and taxpayer identification number.

- Access the FTB 3533 B form online or obtain a paper version.

- Fill in the required fields accurately, ensuring all information is correct.

- Review the form for completeness and accuracy.

- Submit the form through your chosen method: online, by mail, or in person.

Legal Use of the FTB 3533 B

The FTB 3533 B is legally recognized as the official method for notifying the California Franchise Tax Board of a change of address. Proper use of this form is crucial for compliance with state tax regulations. Failure to update your address can lead to missed communications regarding tax obligations, potentially resulting in penalties or other legal issues.

Required Documents

When submitting the FTB 3533 B, no additional documents are typically required. However, having your taxpayer identification number and any relevant previous correspondence from the FTB can be helpful. It is advisable to keep a copy of the submitted form for your records.

Form Submission Methods

The FTB 3533 B can be submitted through various methods, providing flexibility for taxpayers:

- Online: The most efficient method, allowing for immediate processing.

- By Mail: Print the completed form and send it to the address specified on the form.

- In Person: Visit a local FTB office to submit the form directly.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ftb 3533 b

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ftb 3533 b online form?

The ftb 3533 b online form is a California tax form used for various tax-related purposes. It allows users to report specific information to the Franchise Tax Board electronically. Utilizing airSlate SignNow, you can easily fill out and eSign the ftb 3533 b online form, streamlining your tax filing process.

-

How can I access the ftb 3533 b online form?

You can access the ftb 3533 b online form through the airSlate SignNow platform. Simply log in to your account, navigate to the forms section, and search for the ftb 3533 b online form. This user-friendly interface makes it easy to find and complete your tax documents.

-

Is there a cost associated with using airSlate SignNow for the ftb 3533 b online form?

Yes, there is a subscription fee for using airSlate SignNow, but it is designed to be cost-effective. The pricing plans offer various features that enhance your document management experience, including eSigning the ftb 3533 b online form. You can choose a plan that best fits your business needs.

-

What features does airSlate SignNow offer for the ftb 3533 b online form?

airSlate SignNow provides several features for the ftb 3533 b online form, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your documents are completed accurately and efficiently. Additionally, you can collaborate with team members seamlessly.

-

Can I integrate airSlate SignNow with other applications for the ftb 3533 b online form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the ftb 3533 b online form. You can connect with tools like Google Drive, Dropbox, and CRM systems to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the ftb 3533 b online form?

Using airSlate SignNow for the ftb 3533 b online form offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform allows you to complete and eSign documents quickly, saving you time and effort during tax season. Plus, your data is protected with advanced security measures.

-

Is it easy to eSign the ftb 3533 b online form with airSlate SignNow?

Yes, eSigning the ftb 3533 b online form with airSlate SignNow is straightforward and user-friendly. You can sign documents electronically from any device, making it convenient to complete your tax forms on the go. The intuitive interface guides you through the signing process effortlessly.

Get more for Ftb 3533 b

Find out other Ftb 3533 b

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF

- How Do I Sign Oregon Non-disclosure agreement PDF

- Sign Oregon Non disclosure agreement sample Mobile

- How Do I Sign Montana Rental agreement contract

- Sign Alaska Rental lease agreement Mobile

- Sign Connecticut Rental lease agreement Easy

- Sign Hawaii Rental lease agreement Mobile

- Sign Hawaii Rental lease agreement Simple

- Sign Kansas Rental lease agreement Later

- How Can I Sign California Rental house lease agreement

- How To Sign Nebraska Rental house lease agreement

- How To Sign North Dakota Rental house lease agreement