Instructions for Form CT 3 A, General Business Corporation 2023-2026

Understanding the NY NYC3L Online Form

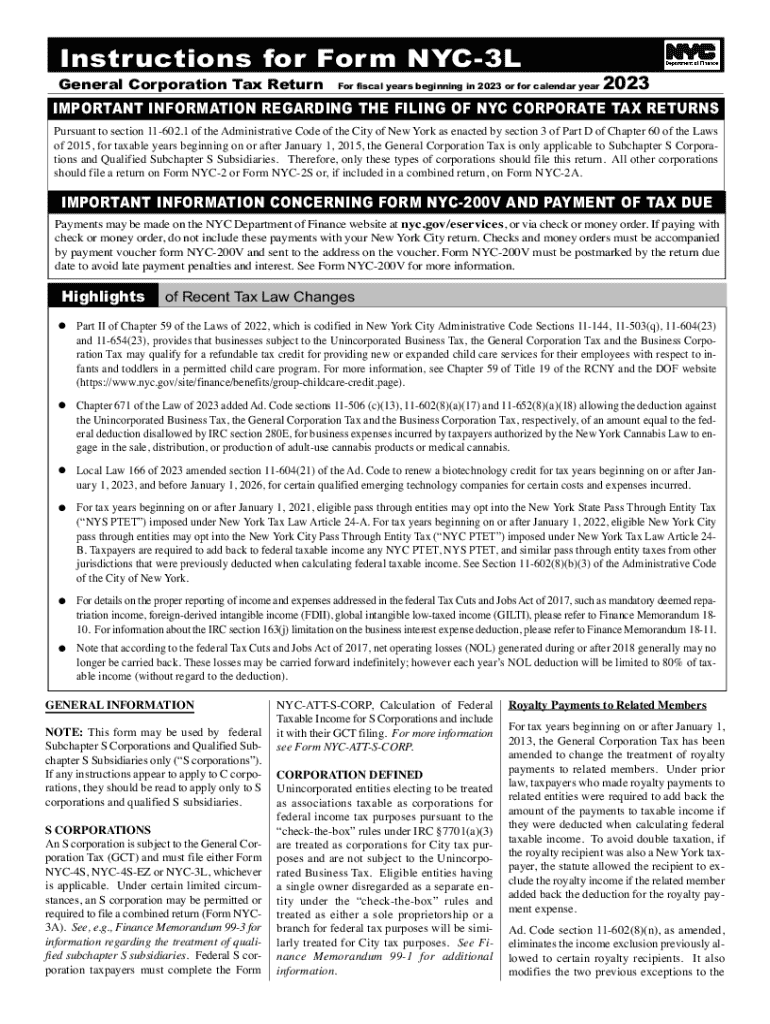

The NY NYC3L online form is a crucial document for businesses operating in New York. It serves as a declaration of the corporation's activities and is essential for compliance with state regulations. This form is particularly relevant for general business corporations and ensures that all necessary information is accurately reported to the state authorities.

Steps to Complete the NY NYC3L Online Form

Completing the NY NYC3L online form involves several key steps:

- Gather required information about your corporation, including its legal name, address, and tax identification number.

- Access the online form through the designated state portal.

- Fill in the necessary fields, ensuring that all data is accurate and up-to-date.

- Review the completed form for any errors or omissions before submission.

- Submit the form electronically, following any prompts for confirmation.

Legal Use of the NY NYC3L Online Form

The NY NYC3L online form is legally binding and must be completed in accordance with New York state laws. Submitting this form is a requirement for maintaining good standing as a corporation in the state. Failure to comply with filing requirements can result in penalties, including fines or loss of corporate status.

Filing Deadlines for the NY NYC3L Online Form

It is important to be aware of the filing deadlines associated with the NY NYC3L online form. Typically, corporations must file this form annually, and specific due dates may vary based on the corporation's fiscal year. Marking these dates on your calendar can help ensure timely compliance and avoid potential penalties.

Required Documents for NY NYC3L Online Submission

Before submitting the NY NYC3L online form, you will need to gather several documents:

- Certificate of incorporation or organization.

- Previous year's tax returns, if applicable.

- Any amendments to the corporation's bylaws or articles of incorporation.

Having these documents ready will facilitate a smoother filing process.

Examples of Using the NY NYC3L Online Form

Businesses may utilize the NY NYC3L online form in various scenarios, such as:

- Reporting changes in business structure or ownership.

- Updating contact information for the corporation.

- Filing annual reports to maintain compliance with state regulations.

These examples illustrate the form's importance in ensuring that a corporation remains compliant with state laws.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ct 3 a general business corporation

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ct 3 a general business corporation

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to ny nyc3l online?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents online. With the ny nyc3l online feature, users can streamline their document workflows, ensuring that signing and sending processes are efficient and secure.

-

How much does airSlate SignNow cost for ny nyc3l online users?

Pricing for airSlate SignNow varies based on the plan you choose. For ny nyc3l online users, there are flexible pricing options that cater to different business needs, ensuring you get the best value for your investment in eSignature solutions.

-

What features does airSlate SignNow offer for ny nyc3l online?

airSlate SignNow provides a range of features for ny nyc3l online, including customizable templates, real-time tracking, and secure cloud storage. These features enhance the signing experience and improve overall document management efficiency.

-

How can airSlate SignNow benefit my business with ny nyc3l online?

By using airSlate SignNow with ny nyc3l online, businesses can reduce turnaround times for document signing, improve compliance, and enhance customer satisfaction. This cost-effective solution helps streamline operations and saves valuable time.

-

Can I integrate airSlate SignNow with other tools while using ny nyc3l online?

Yes, airSlate SignNow offers seamless integrations with various applications and platforms. This means that ny nyc3l online users can easily connect their existing tools, enhancing productivity and ensuring a smooth workflow.

-

Is airSlate SignNow secure for ny nyc3l online transactions?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents. When using ny nyc3l online, you can trust that your sensitive information is safe and secure.

-

How do I get started with airSlate SignNow for ny nyc3l online?

Getting started with airSlate SignNow for ny nyc3l online is simple. You can sign up for a free trial on our website, explore the features, and see how it can transform your document signing process before committing to a plan.

Get more for Instructions For Form CT 3 A, General Business Corporation

Find out other Instructions For Form CT 3 A, General Business Corporation

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed