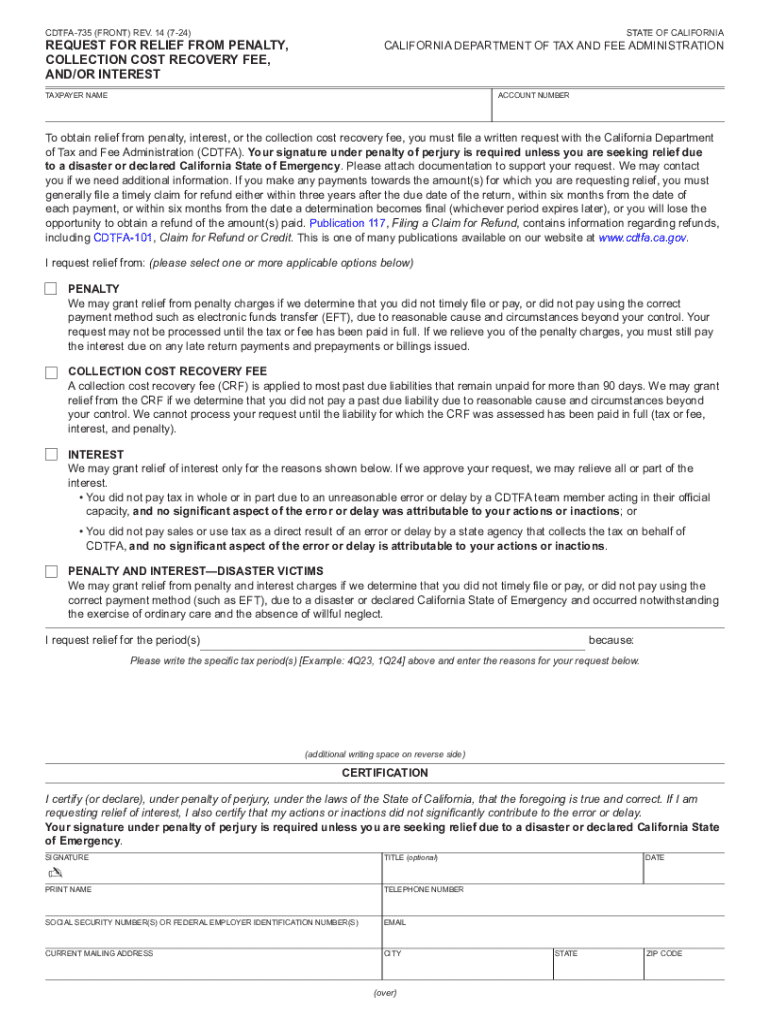

Request for Relief from Penalty, Collection Cost Recovery Fee, Andor Interest Form

Understanding the Request for Relief from Penalty, Collection Cost Recovery Fee, and Interest

The Request for Relief from Penalty, Collection Cost Recovery Fee, and Interest is a formal application that taxpayers can submit to seek relief from certain penalties and fees imposed by the California Department of Tax and Fee Administration (CDTFA). This request is particularly relevant for individuals or businesses facing financial hardships that hinder their ability to meet tax obligations. The relief may apply to penalties related to late payments, as well as associated collection costs and interest charges that accrue over time.

Steps to Complete the Request for Relief

Completing the Request for Relief involves several important steps:

- Gather necessary documentation, including any relevant financial statements, tax returns, and correspondence from the CDTFA.

- Clearly articulate the reasons for the request, focusing on the financial difficulties that led to the inability to pay on time.

- Fill out the official request form accurately, ensuring all required fields are completed.

- Review the form for completeness and accuracy before submission.

- Submit the request through the appropriate channel, whether online, by mail, or in person, depending on CDTFA guidelines.

Eligibility Criteria for Relief Requests

To qualify for relief, taxpayers must meet specific eligibility criteria set by the CDTFA. Generally, these criteria include:

- Demonstrating a valid reason for the inability to pay taxes on time, such as unexpected medical expenses or loss of income.

- Providing evidence of efforts made to comply with tax obligations prior to the penalty being assessed.

- Submitting the request within the stipulated time frame following the assessment of penalties or fees.

Required Documents for Submission

When submitting the Request for Relief, it is crucial to include all necessary documentation to support the claim. Required documents may include:

- Financial statements that illustrate current income and expenses.

- Tax returns for the relevant years.

- Any correspondence from the CDTFA regarding the penalties or fees.

- Documentation of circumstances that contributed to the inability to pay, such as medical bills or termination notices from employers.

Form Submission Methods

Taxpayers can submit their Request for Relief through various methods, ensuring that they choose the most convenient option for their situation. Available submission methods include:

- Online submission through the CDTFA's official website, where taxpayers can fill out and submit the form digitally.

- Mailing the completed form to the designated CDTFA office, ensuring it is sent to the correct address to avoid delays.

- In-person submission at a local CDTFA office, which may allow for immediate feedback or clarification on the request.

Key Elements of a Successful Request

To enhance the chances of a successful outcome, certain key elements should be included in the Request for Relief. These elements comprise:

- A clear and concise explanation of the circumstances leading to the request.

- Supporting evidence that validates the claims made in the request.

- A respectful tone that acknowledges the CDTFA's role and expresses a willingness to comply with tax obligations moving forward.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the request for relief from penalty collection cost recovery fee andor interest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cdtfa relief and how can airSlate SignNow help?

CDTFA relief refers to the assistance provided by the California Department of Tax and Fee Administration for businesses facing financial challenges. airSlate SignNow can streamline the process of submitting necessary documents for CDTFA relief, ensuring that your applications are signed and sent quickly and securely.

-

How much does airSlate SignNow cost for accessing cdtfa relief features?

airSlate SignNow offers various pricing plans to suit different business needs, starting from a competitive monthly fee. Each plan includes features that facilitate the signing and management of documents related to CDTFA relief, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow provide for cdtfa relief applications?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are essential for managing CDTFA relief applications. These tools help ensure that your documents are completed accurately and submitted on time.

-

Can airSlate SignNow integrate with other software for cdtfa relief processes?

Yes, airSlate SignNow offers integrations with various software applications, enhancing your workflow for CDTFA relief processes. This means you can connect it with your existing tools, making it easier to manage your documents and submissions.

-

What are the benefits of using airSlate SignNow for cdtfa relief?

Using airSlate SignNow for CDTFA relief provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the signing process, allowing you to focus on your business while ensuring compliance with CDTFA requirements.

-

Is airSlate SignNow user-friendly for cdtfa relief applications?

Absolutely! airSlate SignNow is designed with user experience in mind, making it easy for anyone to navigate and use for CDTFA relief applications. Its intuitive interface allows users to quickly create, send, and sign documents without extensive training.

-

How does airSlate SignNow ensure the security of cdtfa relief documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and secure cloud storage. This ensures that all documents related to CDTFA relief are protected from unauthorized access, giving you peace of mind.

Get more for Request For Relief From Penalty, Collection Cost Recovery Fee, Andor Interest

- Vat100 form pdf

- Meiosis coloring worksheet form

- Apprentice form for fashion designer

- Meal intake cna meal percentage chart form

- Western financial pet insurance claim form

- For the royal college of ophthalmologists official use only form

- Ucc financing statement addendum form ucc1ad

- List academic program auto collision repair technology year 1st semester witcc form

Find out other Request For Relief From Penalty, Collection Cost Recovery Fee, Andor Interest

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself