ET 706 New York State Estate Tax Return Form

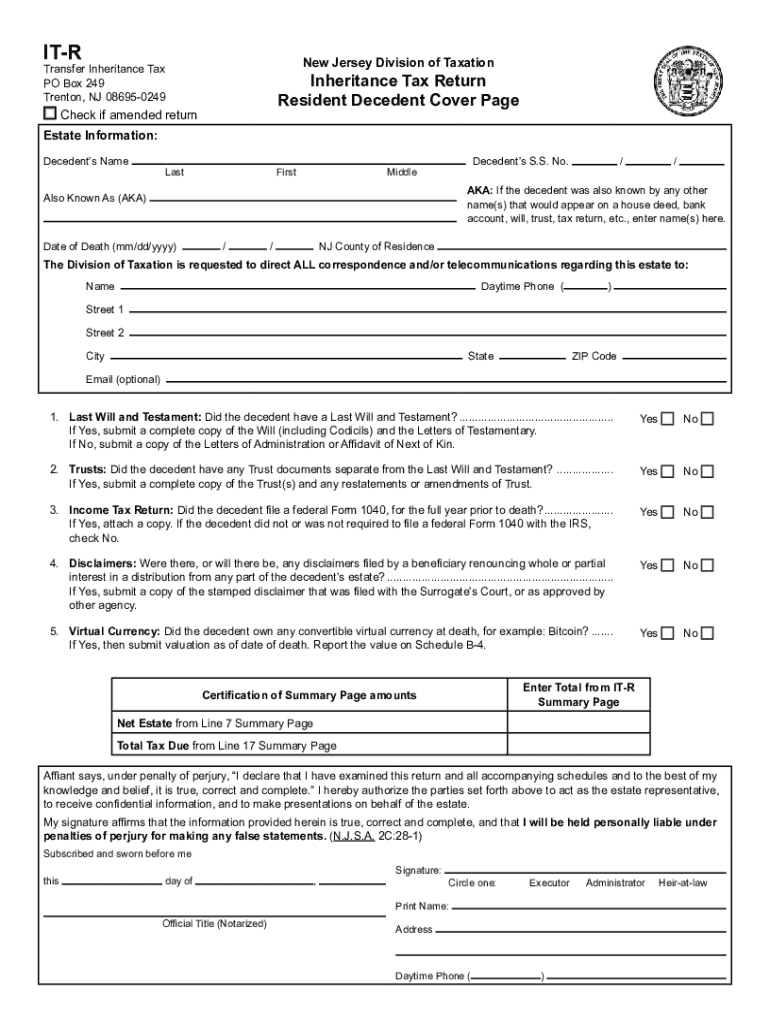

Understanding the NJ Inheritance Tax Return Form IT-R

The NJ inheritance tax return form IT-R is essential for reporting the transfer of assets following a person's death in New Jersey. This form is specifically designed to calculate the inheritance tax owed on property transferred to beneficiaries. The tax rate varies based on the relationship between the deceased and the beneficiary, with closer relatives generally facing lower rates. Understanding the nuances of this form is crucial for compliance with state tax laws.

Steps to Complete the NJ Inheritance Tax Return Form IT-R

Completing the NJ inheritance tax return form IT-R involves several key steps:

- Gather all necessary documentation, including the death certificate, a list of assets, and details about beneficiaries.

- Fill out the form accurately, ensuring all information is complete and truthful.

- Calculate the inheritance tax based on the relationship of the beneficiaries to the deceased and the value of the assets inherited.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the New Jersey Division of Taxation.

Required Documents for NJ Inheritance Tax Return Form IT-R

To successfully file the NJ inheritance tax return form IT-R, several documents are required:

- The death certificate of the deceased.

- A complete inventory of the deceased's estate, including real estate, bank accounts, and personal property.

- Documentation of the relationship between the deceased and each beneficiary.

- Any previous tax returns related to the deceased’s estate, if applicable.

Filing Deadlines for the NJ Inheritance Tax Return Form IT-R

It is important to be aware of the filing deadlines associated with the NJ inheritance tax return form IT-R. Generally, the form must be filed within eight months of the date of death. Failure to file on time may result in penalties and interest on the tax owed. It is advisable to file as soon as possible to avoid complications.

Penalties for Non-Compliance with NJ Inheritance Tax Laws

Non-compliance with NJ inheritance tax laws can lead to significant penalties. If the inheritance tax return form IT-R is not filed by the deadline, penalties may include:

- A late filing penalty, which can be a percentage of the tax due.

- Interest charges on unpaid taxes, accruing from the due date until payment is made.

- Potential legal action by the state to recover owed taxes.

Who Issues the NJ Inheritance Tax Return Form IT-R

The NJ inheritance tax return form IT-R is issued by the New Jersey Division of Taxation. This state agency is responsible for overseeing the administration of tax laws in New Jersey, including inheritance taxes. For any questions regarding the form or the filing process, individuals can contact the Division of Taxation for guidance and support.

Handy tips for filling out ET 706 New York State Estate Tax Return online

Quick steps to complete and e-sign ET 706 New York State Estate Tax Return online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Gain access to a GDPR and HIPAA compliant service for maximum simpleness. Use signNow to electronically sign and share ET 706 New York State Estate Tax Return for collecting e-signatures.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the et 706 new york state estate tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are nj it r instructions for using airSlate SignNow?

The nj it r instructions for airSlate SignNow involve a straightforward process for sending and signing documents electronically. Users can easily upload documents, add recipients, and set signing order, ensuring a seamless experience. This user-friendly interface is designed to help businesses streamline their document workflows efficiently.

-

How much does airSlate SignNow cost?

Pricing for airSlate SignNow varies based on the plan you choose, with options suitable for individuals and businesses alike. Each plan offers different features, including the nj it r instructions for document management and eSigning. You can visit our pricing page for detailed information on the available plans and their respective costs.

-

What features does airSlate SignNow offer?

airSlate SignNow provides a range of features designed to enhance document management, including customizable templates, automated workflows, and secure eSigning. The nj it r instructions are integrated into these features, making it easy for users to navigate the platform. These tools help businesses save time and improve efficiency in their document processes.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document handling and improve overall productivity. The nj it r instructions ensure that users can quickly learn how to utilize the platform effectively. Additionally, the cost-effective solution helps businesses save money while enhancing their document management capabilities.

-

Does airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers integrations with various software applications, including CRM systems, cloud storage services, and productivity tools. These integrations allow users to streamline their workflows and incorporate nj it r instructions into their existing processes. This flexibility makes it easier for businesses to adopt airSlate SignNow without disrupting their current systems.

-

Is airSlate SignNow secure for sensitive documents?

Absolutely, airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance with industry standards. The nj it r instructions include guidelines on how to ensure your documents are handled securely throughout the signing process. This commitment to security helps businesses maintain confidentiality and trust with their clients.

-

Can I use airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing users to send and sign documents on the go. The nj it r instructions are accessible via mobile, ensuring that you can manage your documents anytime, anywhere. This mobile capability enhances flexibility and convenience for busy professionals.

Get more for ET 706 New York State Estate Tax Return

- State tax form 2 form of list

- Ca last form fill out ampamp sign online dochub

- State rundown 15 state taxes coming in hot in new year form

- Sc issues tax relief due to hurricane ian encourages filing by form

- Motor vehicle and vessel gift declaration fill online form

- Rd 113 form

- X 0845 4204 2 0 2 1 louisiana department of revenue form

- State of south carolina department of revenue form

Find out other ET 706 New York State Estate Tax Return

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form