Instructions for Form CST 240 Claim for Refund or Credit of

Understanding the CST 240 Claim for Refund or Credit

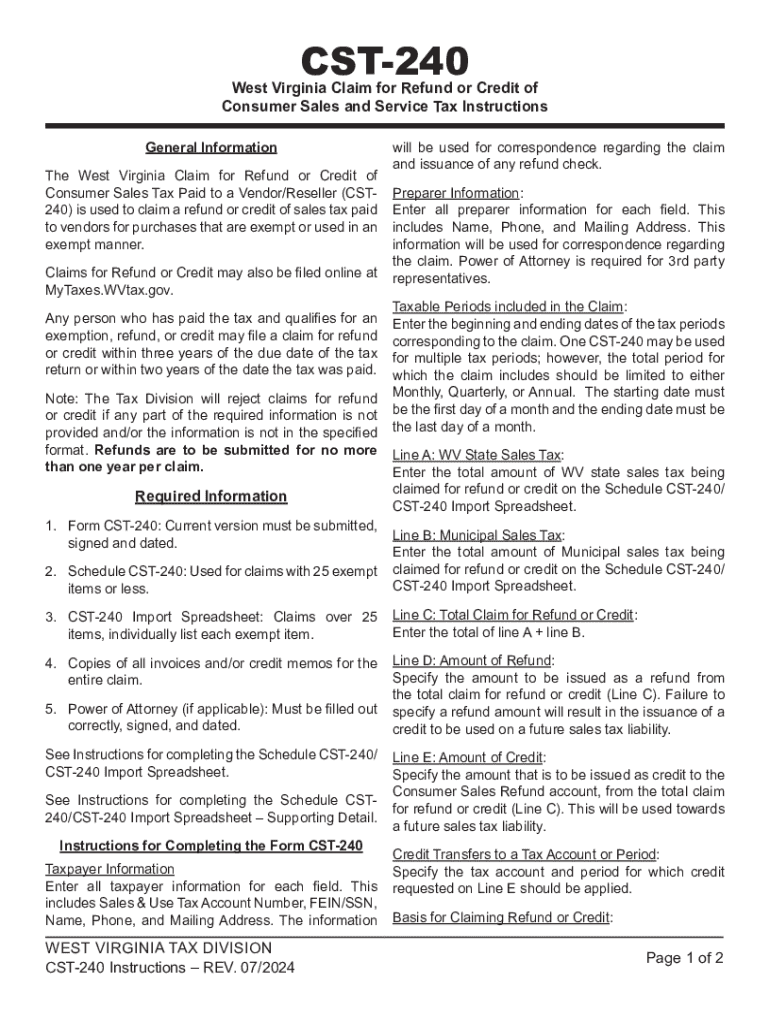

The CST 240 form is utilized to claim a refund or credit for certain taxes paid. This form is essential for taxpayers who believe they have overpaid or are eligible for a credit. The instructions for this form outline the eligibility criteria, the necessary information to include, and the process for submission. Understanding the purpose of the CST 240 is crucial for ensuring that claims are accurately filed and processed in a timely manner.

Steps to Complete the CST 240 Claim Form

Completing the CST 240 form requires careful attention to detail. Here are the key steps involved:

- Gather all relevant documents, including proof of payment and any supporting materials.

- Fill out the form with accurate information, ensuring that all sections are completed.

- Double-check for any errors or omissions, as these can delay processing.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Required Documents for CST 240 Submission

When submitting the CST 240 form, specific documents are necessary to support your claim. These may include:

- Receipts or proof of payment for the taxes in question.

- Any correspondence with tax authorities regarding your claim.

- Identification documents, if applicable, to verify your identity.

Having these documents ready can streamline the submission process and help ensure a successful claim.

Filing Deadlines for CST 240 Claims

It is important to be aware of the filing deadlines associated with the CST 240 form. Generally, claims must be submitted within a specific timeframe following the tax year in which the overpayment occurred. Missing these deadlines can result in the forfeiture of your claim, so it is advisable to mark these dates on your calendar and prepare your submission in advance.

Eligibility Criteria for CST 240 Claims

To successfully file a CST 240 claim, you must meet certain eligibility criteria. These criteria typically include:

- Having paid taxes that are eligible for a refund or credit.

- Submitting the claim within the designated timeframe.

- Providing accurate and complete information on the form.

Understanding these requirements is vital for ensuring that your claim is accepted and processed without complications.

Submission Methods for the CST 240 Form

The CST 240 form can be submitted through various methods, allowing flexibility for taxpayers. The available submission options include:

- Online submission through the designated tax authority portal.

- Mailing a physical copy of the form to the appropriate address.

- In-person submission at designated tax offices, if available.

Choosing the right submission method can affect the processing time of your claim, so consider your options carefully.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the instructions for form cst 240 claim for refund or credit of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cst 240 in relation to airSlate SignNow?

CST 240 refers to a specific feature set within airSlate SignNow that enhances document signing and management. This feature allows users to streamline their workflow, making it easier to send and eSign documents efficiently. By utilizing cst 240, businesses can improve their overall productivity and reduce turnaround times.

-

How much does airSlate SignNow cost with cst 240 features?

The pricing for airSlate SignNow with cst 240 features varies based on the subscription plan you choose. Typically, plans start at a competitive rate, offering great value for the features included. For detailed pricing information, it's best to visit our website or contact our sales team.

-

What are the key benefits of using cst 240 in airSlate SignNow?

Using cst 240 in airSlate SignNow provides numerous benefits, including enhanced security for document transactions and improved user experience. This feature set allows for customizable workflows, ensuring that your document signing process is tailored to your business needs. Additionally, cst 240 helps in reducing errors and increasing compliance.

-

Can I integrate cst 240 with other software applications?

Yes, cst 240 in airSlate SignNow can be seamlessly integrated with various software applications. This includes popular CRM systems, cloud storage solutions, and productivity tools. These integrations help streamline your workflow and ensure that all your documents are easily accessible.

-

Is cst 240 suitable for small businesses?

Absolutely! cst 240 is designed to cater to businesses of all sizes, including small businesses. Its user-friendly interface and cost-effective pricing make it an ideal solution for small teams looking to enhance their document management processes. With cst 240, small businesses can compete effectively in their respective markets.

-

What types of documents can I eSign using cst 240?

With cst 240 in airSlate SignNow, you can eSign a wide variety of documents, including contracts, agreements, and forms. The platform supports multiple file formats, ensuring that you can manage all your essential documents in one place. This versatility makes cst 240 a powerful tool for any business.

-

How does cst 240 improve the document signing process?

CST 240 improves the document signing process by providing a streamlined, intuitive interface that simplifies the steps involved. Users can easily send, track, and manage documents, reducing the time it takes to get signatures. This efficiency not only saves time but also enhances the overall user experience.

Get more for Instructions For Form CST 240 Claim For Refund Or Credit Of

Find out other Instructions For Form CST 240 Claim For Refund Or Credit Of

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors