Upcoming Webinar a Comprehensive Overview of the 2024

Understanding the 2021 Oregon ORS308290 Form

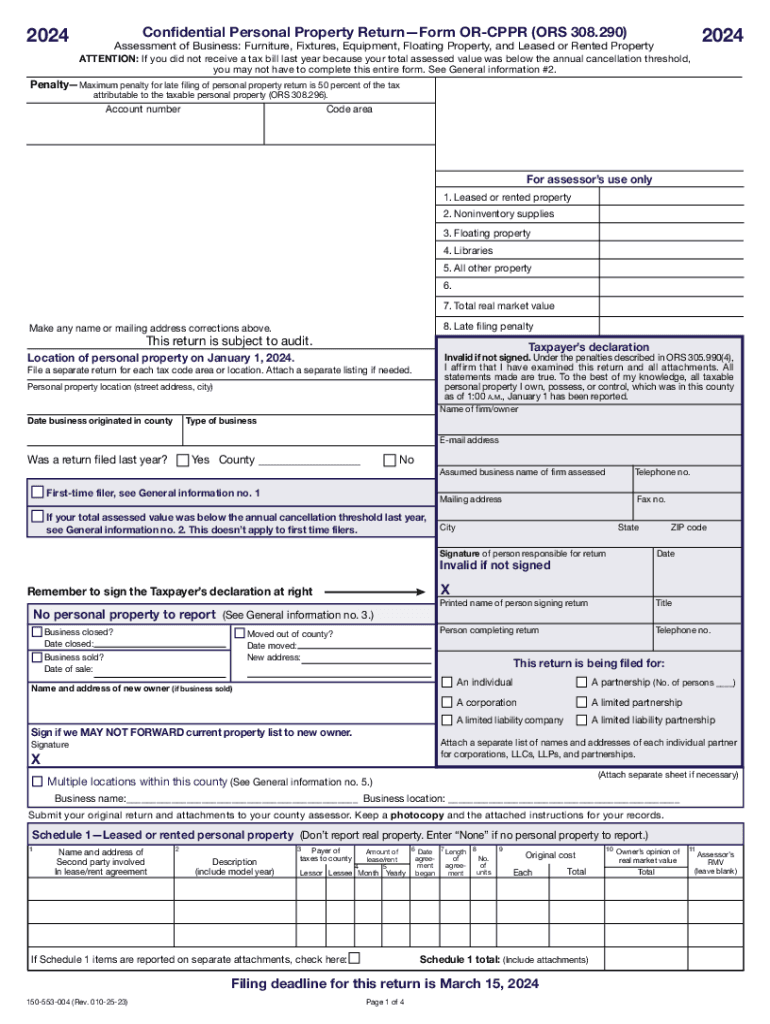

The 2021 Oregon ORS308290 form is primarily used for property tax returns in the state of Oregon. This form is essential for individuals and businesses who own property, as it helps to report property values to the local tax authorities. Accurate completion of this form ensures that property taxes are assessed correctly, which is crucial for compliance with state tax laws.

Key Elements of the 2021 Oregon ORS308290 Form

The form includes several critical sections that require detailed information. Key elements include:

- Property Identification: This section requires the address and legal description of the property.

- Ownership Information: Details about the owner(s) of the property must be provided, including names and contact information.

- Property Value Assessment: Taxpayers must report the assessed value of the property, which is crucial for determining tax liabilities.

- Exemptions and Deductions: Any applicable exemptions or deductions that the property owner is eligible for should be clearly stated.

Steps to Complete the 2021 Oregon ORS308290 Form

Completing the ORS308290 form involves several steps to ensure accuracy and compliance:

- Gather necessary documents, including previous tax returns and property deeds.

- Fill out the property identification section with accurate details.

- Provide ownership information, ensuring all names are spelled correctly.

- Assess the property value based on current market conditions and report this value.

- Review any exemptions or deductions that may apply to your property.

- Double-check all entries for accuracy before submission.

Filing Deadlines for the 2021 Oregon ORS308290 Form

Timely submission of the ORS308290 form is crucial to avoid penalties. The filing deadline for this form typically aligns with the property tax assessment period. It is important to check with local tax authorities for specific dates, as they may vary by county.

Form Submission Methods for the 2021 Oregon ORS308290

The ORS308290 form can be submitted through various methods, providing flexibility for taxpayers:

- Online Submission: Many counties in Oregon offer online portals for electronic filing.

- Mail: Completed forms can be mailed to the appropriate county tax assessor's office.

- In-Person: Taxpayers may also choose to submit the form in person at their local tax office.

Penalties for Non-Compliance with the 2021 Oregon ORS308290 Form

Failure to file the ORS308290 form on time or providing inaccurate information can result in penalties. These may include fines or increased property tax assessments. It is essential to adhere to all filing requirements and deadlines to avoid such consequences.

Create this form in 5 minutes or less

Find and fill out the correct upcoming webinar a comprehensive overview of the

Create this form in 5 minutes!

How to create an eSignature for the upcoming webinar a comprehensive overview of the

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the significance of the 2021 oregon ors308290 in document signing?

The 2021 oregon ors308290 outlines specific regulations for electronic signatures in Oregon, ensuring that eSignatures are legally binding. Understanding this law is crucial for businesses using airSlate SignNow to ensure compliance and validity in their document transactions.

-

How does airSlate SignNow comply with the 2021 oregon ors308290?

airSlate SignNow is designed to meet the requirements set forth by the 2021 oregon ors308290, providing users with a secure and compliant platform for electronic signatures. Our solution ensures that all signed documents adhere to state regulations, giving users peace of mind.

-

What features does airSlate SignNow offer that align with the 2021 oregon ors308290?

airSlate SignNow offers features such as secure document storage, audit trails, and customizable workflows that align with the 2021 oregon ors308290. These features enhance the signing experience while ensuring compliance with Oregon's electronic signature laws.

-

Is airSlate SignNow a cost-effective solution for businesses needing to comply with the 2021 oregon ors308290?

Yes, airSlate SignNow provides a cost-effective solution for businesses looking to comply with the 2021 oregon ors308290. Our pricing plans are designed to fit various budgets while offering robust features that streamline the document signing process.

-

Can airSlate SignNow integrate with other tools while adhering to the 2021 oregon ors308290?

Absolutely! airSlate SignNow integrates seamlessly with various business tools and applications, all while ensuring compliance with the 2021 oregon ors308290. This integration capability allows businesses to enhance their workflows without compromising on legal standards.

-

What are the benefits of using airSlate SignNow in relation to the 2021 oregon ors308290?

Using airSlate SignNow in relation to the 2021 oregon ors308290 offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. Our platform simplifies the signing process, making it easier for businesses to operate within legal frameworks.

-

How can I ensure my documents are compliant with the 2021 oregon ors308290 using airSlate SignNow?

To ensure compliance with the 2021 oregon ors308290 using airSlate SignNow, simply follow our guided workflows and utilize our compliance features. Our platform provides the necessary tools to create legally binding electronic signatures that meet Oregon's regulations.

Get more for Upcoming Webinar A Comprehensive Overview Of The

Find out other Upcoming Webinar A Comprehensive Overview Of The

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online