a Comprehensive Overview of the Oregon Personal 2025-2026

Understanding the Oregon Personal Property Return

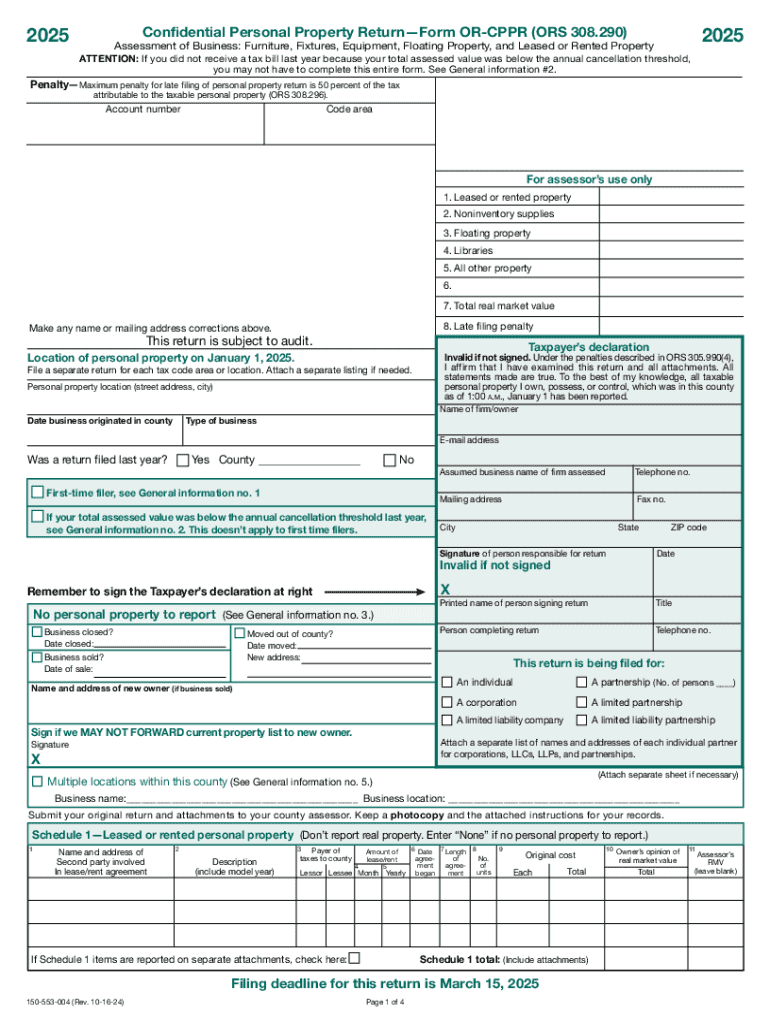

The Oregon Personal Property Return, officially known as ORS 308.290, is a crucial document for businesses and individuals who own personal property in Oregon. This form is used to report personal property to the county assessor for tax purposes. It ensures that personal property is accurately assessed and taxed according to state laws. Understanding the requirements and implications of this form is essential for compliance and financial planning.

Steps to Complete the Oregon Personal Property Return

Completing the Oregon Personal Property Return involves several key steps:

- Gather Documentation: Collect all necessary information about your personal property, including purchase dates, costs, and descriptions.

- Fill Out the Form: Complete the ORS 308.290 form, ensuring all sections are accurately filled out to reflect your property holdings.

- Review and Verify: Double-check your entries for accuracy and completeness to avoid potential issues with the county assessor.

- Submit the Form: File the completed form with your local county assessor's office by the designated deadline.

Legal Use of the Oregon Personal Property Return

The Oregon Personal Property Return is legally required for individuals and businesses that own taxable personal property. Failing to submit this form can lead to penalties and increased assessments. It is essential to understand that the information provided on this form is used to determine property taxes, making accurate reporting vital for compliance with Oregon tax laws.

Required Documents for the Oregon Personal Property Return

When preparing to file the Oregon Personal Property Return, certain documents are necessary:

- Purchase Receipts: Documentation of the purchase price of personal property.

- Inventory Lists: A detailed list of all personal property owned, including descriptions and values.

- Previous Tax Returns: Past returns may provide useful information for completing the current form.

Filing Deadlines for the Oregon Personal Property Return

Timely submission of the Oregon Personal Property Return is crucial. The typical deadline for filing is March 15 of each year. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Late submissions can result in penalties, so it is advisable to be aware of these dates and plan accordingly.

Who Issues the Oregon Personal Property Return

The Oregon Personal Property Return is issued by the Oregon Department of Revenue. Each county assessor's office is responsible for collecting these returns and assessing the personal property reported. It is important to contact your local assessor's office for specific instructions and any additional requirements that may apply in your county.

Create this form in 5 minutes or less

Find and fill out the correct a comprehensive overview of the oregon personal

Create this form in 5 minutes!

How to create an eSignature for the a comprehensive overview of the oregon personal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ORS 308 290 and how does it relate to airSlate SignNow?

ORS 308 290 refers to a specific regulation that may impact document management and eSigning processes. airSlate SignNow provides a compliant solution that helps businesses navigate these regulations effectively. By using airSlate SignNow, you can ensure that your documents meet the necessary legal standards outlined in ORS 308 290.

-

How does airSlate SignNow ensure compliance with ORS 308 290?

airSlate SignNow is designed to comply with various legal standards, including ORS 308 290. Our platform incorporates features that ensure your eSigned documents are legally binding and secure. This compliance helps businesses avoid potential legal issues while streamlining their document workflows.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate different business needs. Our pricing is competitive and designed to provide value, especially for those needing to comply with regulations like ORS 308 290. You can choose from various plans based on your document volume and feature requirements.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features such as customizable templates, automated workflows, and secure eSigning. These features are particularly beneficial for businesses needing to adhere to ORS 308 290. With airSlate SignNow, you can manage your documents efficiently while ensuring compliance.

-

Can airSlate SignNow integrate with other software?

Yes, airSlate SignNow offers seamless integrations with various software applications, enhancing your document management capabilities. This is especially useful for businesses that need to align their processes with ORS 308 290. Integrating with your existing tools can streamline workflows and improve efficiency.

-

What are the benefits of using airSlate SignNow for eSigning?

Using airSlate SignNow for eSigning provides numerous benefits, including increased efficiency, cost savings, and enhanced security. For businesses concerned with compliance, such as those affected by ORS 308 290, our platform ensures that all eSigned documents are valid and secure. This allows you to focus on your core business activities.

-

Is airSlate SignNow suitable for small businesses?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it ideal for small businesses. With features that support compliance with regulations like ORS 308 290, small businesses can manage their documents efficiently without breaking the bank.

Get more for A Comprehensive Overview Of The Oregon Personal

- Signing agent form

- California disclaimer 497298211 form

- Agreement for services of investment agent with agent to purchase and sell investments for the benefit of client california form

- Llc limited liability company form

- Ca request notice form

- Quitclaim deed from husband and wife to husband and wife california form

- Deed husband wife 497298216 form

- California promissory template form

Find out other A Comprehensive Overview Of The Oregon Personal

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template