Unrelated Business Income Tax Information 2023

Understanding Unrelated Business Income Tax Information

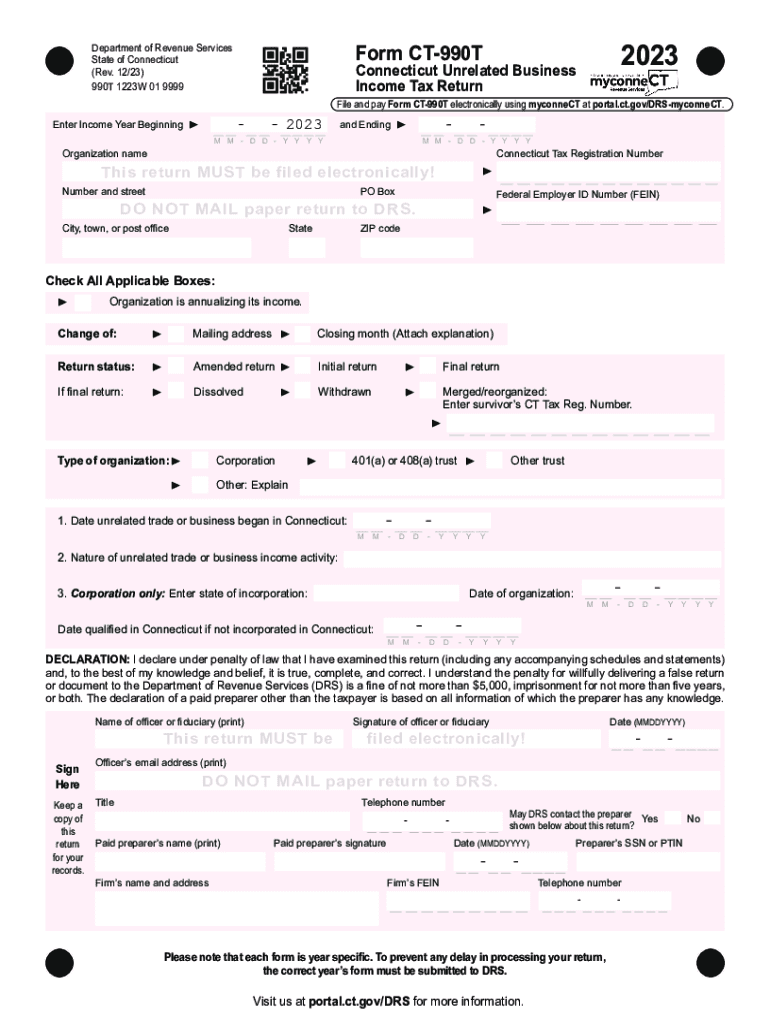

The Unrelated Business Income Tax (UBIT) applies to tax-exempt organizations that generate income from activities unrelated to their primary purpose. This tax ensures that tax-exempt entities do not have an unfair advantage over taxable businesses. Organizations must report this income on IRS Form 990-T, which outlines the specific revenue streams that may be subject to taxation. It is crucial for organizations to differentiate between related and unrelated business income to maintain their tax-exempt status.

Steps to Complete the Unrelated Business Income Tax Information

Completing the Unrelated Business Income Tax Information involves several key steps:

- Identify all sources of income generated by the organization.

- Determine which income sources are considered unrelated to the primary exempt purpose.

- Calculate the gross income from unrelated business activities.

- Deduct allowable expenses related to the unrelated business income.

- Complete IRS Form 990-T, ensuring all information is accurate and complete.

- File the form by the appropriate deadline, typically the fifteenth day of the fifth month after the end of the organization’s tax year.

Legal Use of Unrelated Business Income Tax Information

Organizations must adhere to specific legal guidelines when handling Unrelated Business Income Tax Information. This includes accurately reporting income and expenses, maintaining proper documentation, and ensuring compliance with IRS regulations. Failure to comply can result in penalties, loss of tax-exempt status, or additional scrutiny from the IRS. It is essential for organizations to consult with tax professionals to navigate these legal requirements effectively.

Filing Deadlines and Important Dates

Filing deadlines for the Unrelated Business Income Tax Information are critical for compliance. Generally, Form 990-T must be filed by the fifteenth day of the fifth month following the close of the organization’s tax year. For organizations operating on a calendar year, this typically means a due date of May 15. Extensions may be available, but organizations should be aware that any taxes owed must still be paid by the original deadline to avoid penalties.

Examples of Using Unrelated Business Income Tax Information

Examples of unrelated business income include income from advertising in a newsletter published by a tax-exempt organization or revenue from a gift shop operated by a museum. These activities, while generating income, do not directly relate to the organization’s primary mission. Understanding these examples helps organizations recognize potential tax liabilities and ensures proper reporting on Form 990-T.

Required Documents for Unrelated Business Income Tax Information

To accurately complete the Unrelated Business Income Tax Information, organizations must gather several documents:

- Financial statements detailing income and expenses from unrelated business activities.

- Records of any deductions claimed against unrelated business income.

- IRS Form 990-T, which must be filled out accurately.

- Documentation supporting the classification of income as unrelated.

Penalties for Non-Compliance

Non-compliance with Unrelated Business Income Tax regulations can lead to significant penalties. Organizations may face fines for failing to file Form 990-T or for inaccuracies in reporting. Additionally, if the IRS determines that an organization has engaged in excessive unrelated business activities, it may jeopardize its tax-exempt status. It is vital for organizations to stay informed and compliant to avoid these consequences.

Create this form in 5 minutes or less

Find and fill out the correct unrelated business income tax information

Create this form in 5 minutes!

How to create an eSignature for the unrelated business income tax information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Unrelated Business Income Tax Information?

Unrelated Business Income Tax Information refers to the tax obligations of organizations that earn income from activities unrelated to their primary purpose. Understanding this information is crucial for non-profits and other entities to ensure compliance with IRS regulations. airSlate SignNow can help streamline document management related to these tax requirements.

-

How can airSlate SignNow assist with Unrelated Business Income Tax Information?

airSlate SignNow provides a user-friendly platform for managing documents related to Unrelated Business Income Tax Information. With features like eSigning and document templates, businesses can efficiently handle tax forms and related paperwork. This ensures that all necessary documents are completed accurately and on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including options for small businesses and larger organizations. Each plan includes features that support the management of Unrelated Business Income Tax Information. You can choose a plan that best fits your budget and requirements.

-

Are there any integrations available with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing your ability to manage Unrelated Business Income Tax Information. These integrations allow for easy data transfer and document sharing across platforms. This connectivity helps streamline your workflow and improve efficiency.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and automated workflows, all of which are beneficial for handling Unrelated Business Income Tax Information. These tools simplify the process of creating, sending, and storing important tax documents. This ensures that your organization remains organized and compliant.

-

How secure is airSlate SignNow for handling sensitive tax information?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive Unrelated Business Income Tax Information. The platform employs advanced encryption and security protocols to protect your documents. This ensures that your data remains confidential and secure throughout the signing process.

-

Can airSlate SignNow help with compliance regarding Unrelated Business Income Tax?

Absolutely! airSlate SignNow can assist organizations in maintaining compliance with Unrelated Business Income Tax regulations. By providing tools for accurate documentation and timely submissions, the platform helps mitigate the risk of non-compliance. This is essential for organizations looking to avoid penalties and maintain their tax-exempt status.

Get more for Unrelated Business Income Tax Information

Find out other Unrelated Business Income Tax Information

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template