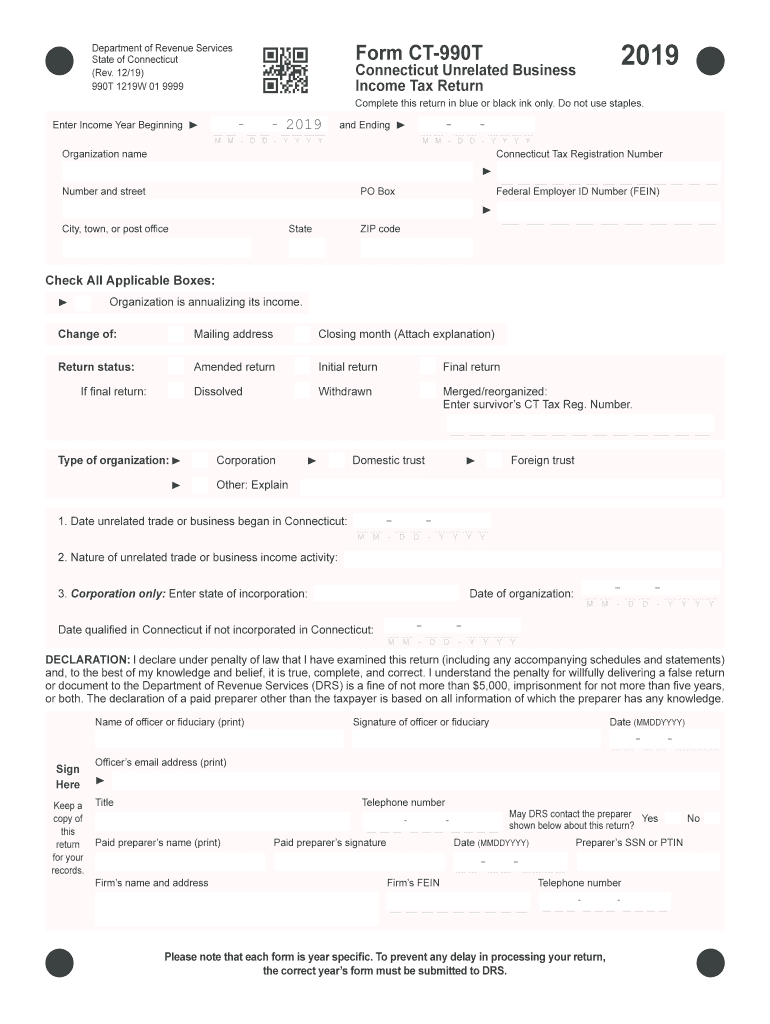

Unrelated Business Tax CT Gov 2019

Understanding the Unrelated Business Tax in Connecticut

The Unrelated Business Tax (UBT) in Connecticut is imposed on income generated by tax-exempt organizations from activities that are not substantially related to their exempt purpose. This tax is crucial for maintaining the integrity of tax-exempt status while ensuring that organizations contribute fairly to state revenues. The UBT applies to various entities, including charities and educational institutions, when they engage in business activities that generate income unrelated to their primary mission.

Steps to Complete the Unrelated Business Tax Form

Completing the Unrelated Business Tax form in Connecticut involves several key steps. First, gather all necessary financial information related to the unrelated business activities. This includes income statements, expense reports, and any relevant documentation that supports your claims. Next, accurately fill out the form CT 990T, ensuring that all income and expenses are reported correctly. After completing the form, review it for accuracy before submission. Finally, submit the form electronically or by mail, adhering to the specified filing deadlines to avoid penalties.

Filing Deadlines for the Unrelated Business Tax

Timely filing of the Unrelated Business Tax form is essential to avoid penalties. The due date for the form CT 990T is typically the fifteenth day of the fifth month after the close of the organization’s fiscal year. For organizations operating on a calendar year, this means the form is due on May 15. It is important to keep track of these deadlines and ensure that all necessary documentation is prepared in advance to facilitate a smooth filing process.

Required Documents for the Unrelated Business Tax

When filing the Unrelated Business Tax form, certain documents are required to substantiate the income and expenses reported. These documents may include:

- Income statements detailing revenue from unrelated business activities.

- Expense reports that outline costs associated with generating that income.

- Any relevant contracts or agreements related to the business activities.

- Prior year tax returns, if applicable, to provide context for the current filing.

Having these documents ready will help ensure compliance and accuracy in your filing.

Penalties for Non-Compliance with the Unrelated Business Tax

Failure to comply with the Unrelated Business Tax requirements can lead to significant penalties. These may include fines for late filing or underreporting of income. Additionally, organizations may face increased scrutiny from tax authorities, which can lead to audits and further complications. It is crucial to understand the importance of timely and accurate filing to maintain compliance and protect the organization’s tax-exempt status.

Who Issues the Unrelated Business Tax Form

The Unrelated Business Tax form CT 990T is issued by the Connecticut Department of Revenue Services. This department is responsible for administering tax laws in the state and ensuring that organizations comply with all tax obligations. For any questions regarding the form or the filing process, organizations can reach out to the department for assistance.

Quick guide on how to complete unrelated business tax ctgov

Effortlessly prepare Unrelated Business Tax CT gov on any device

Virtual document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without delays. Manage Unrelated Business Tax CT gov on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Unrelated Business Tax CT gov effortlessly

- Obtain Unrelated Business Tax CT gov and click Get Form to initiate the process.

- Utilize the tools we provide to finalize your document.

- Emphasize key sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs within a few clicks from your selected device. Edit and eSign Unrelated Business Tax CT gov to ensure exceptional communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct unrelated business tax ctgov

Create this form in 5 minutes!

How to create an eSignature for the unrelated business tax ctgov

The way to create an eSignature for a PDF file in the online mode

The way to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your smartphone

The best way to generate an eSignature for a PDF file on iOS devices

The best way to make an electronic signature for a PDF document on Android

People also ask

-

What is the 2018 ct 990t ext and how is it used?

The 2018 ct 990t ext is a tax extension form required for filing taxes in Connecticut. It allows businesses to request additional time to file their tax returns, ensuring they avoid late penalties. By understanding the 2018 ct 990t ext, users can seamlessly manage their tax obligations.

-

How can airSlate SignNow help with the 2018 ct 990t ext?

airSlate SignNow streamlines the process of signing and sending the 2018 ct 990t ext. With its easy-to-use platform, you can quickly get the necessary signatures from stakeholders and submit your documents on time. This ensures that your tax filings remain compliant and organized.

-

What are the key features of airSlate SignNow for handling the 2018 ct 990t ext?

airSlate SignNow offers features like customizable templates, secure document storage, and real-time collaboration specifically designed for managing forms like the 2018 ct 990t ext. These features simplify the signing process, allowing users to focus on critical deadlines and avoid paperwork errors.

-

Is there a cost associated with using airSlate SignNow for the 2018 ct 990t ext?

Yes, airSlate SignNow provides cost-effective pricing plans to cater to various business needs while handling forms such as the 2018 ct 990t ext. Users can choose from different subscription tiers based on their volume of document processing. This flexibility makes it an economical solution for businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for my 2018 ct 990t ext needs?

Absolutely! airSlate SignNow boasts a wide range of integrations with popular platforms, enhancing the management of the 2018 ct 990t ext. Whether you're using CRM systems or accounting software, these integrations facilitate a smoother workflow and ensure you're not bogged down by manual processes.

-

What benefits does airSlate SignNow provide for managing the 2018 ct 990t ext?

Using airSlate SignNow to manage the 2018 ct 990t ext delivers numerous benefits, including increased efficiency, reduced processing time, and improved security for sensitive documents. By digitizing your paperwork, you'll minimize physical document handling and streamline the overall filing process.

-

How secure is airSlate SignNow for filing the 2018 ct 990t ext?

airSlate SignNow prioritizes security for all documents, including the 2018 ct 990t ext, with bank-level encryption and secure cloud storage. This ensures that your sensitive information remains protected from unauthorized access. Trusting airSlate SignNow allows users to file their documents with peace of mind.

Get more for Unrelated Business Tax CT gov

- Sheetrock drywall contract for contractor utah form

- Flooring contract for contractor utah form

- Agreement or contract for deed for sale and purchase of real estate aka land or executory contract utah form

- Notice of intent to enforce forfeiture provisions of contact for deed utah form

- Final notice of forfeiture and request to vacate property under contract for deed utah form

- Buyers request for accounting from seller under contract for deed utah form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed utah form

- General notice of default for contract for deed utah form

Find out other Unrelated Business Tax CT gov

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document