Unrelated Returns CT Gov 2024-2026

What is the Unrelated Returns CT gov

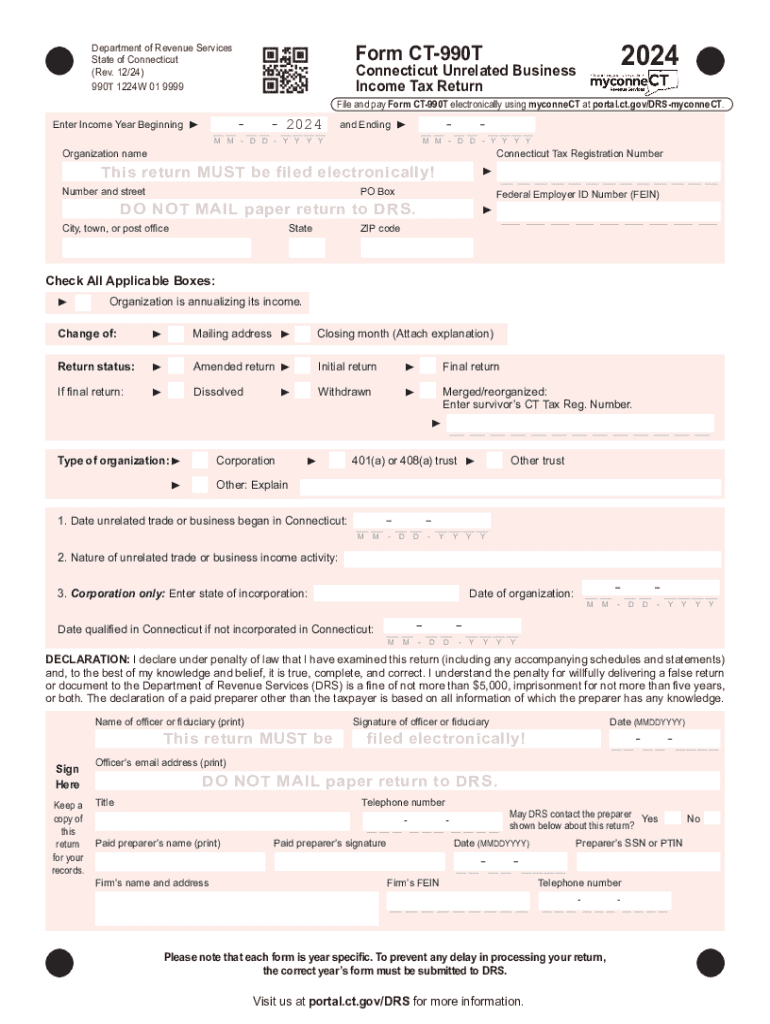

The Unrelated Returns CT form is utilized by organizations to report income that is not substantially related to their exempt purpose. This form is essential for tax-exempt entities, such as charities and non-profits, that engage in activities generating unrelated business income. Understanding this form helps organizations comply with tax regulations while maintaining their tax-exempt status.

Steps to complete the Unrelated Returns CT gov

Completing the Unrelated Returns CT form involves several key steps:

- Gather financial records related to unrelated business income.

- Complete the required sections of the form, detailing income and expenses.

- Ensure all calculations are accurate to avoid penalties.

- Review the completed form for any missing information.

- Submit the form by the appropriate deadline, either online or via mail.

Legal use of the Unrelated Returns CT gov

The legal use of the Unrelated Returns CT form is crucial for maintaining compliance with IRS regulations. Organizations must file this form if they have earned income from activities that are not directly related to their exempt purposes. Proper use ensures that tax-exempt entities do not lose their status due to non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Unrelated Returns CT form are typically aligned with the organization's fiscal year. It is important for entities to be aware of these dates to avoid late filing penalties. Generally, the form is due on the 15th day of the fifth month after the end of the organization's tax year.

Required Documents

To successfully complete the Unrelated Returns CT form, organizations need to gather several documents, including:

- Financial statements detailing unrelated business income.

- Expense documentation related to the unrelated activities.

- Prior year tax returns, if applicable.

- Any correspondence from the IRS regarding unrelated business income.

Penalties for Non-Compliance

Failure to file the Unrelated Returns CT form can lead to significant penalties. Organizations may face fines and potential loss of their tax-exempt status if they do not comply with filing requirements. It is essential to understand these risks and ensure timely and accurate submissions.

Eligibility Criteria

Eligibility to file the Unrelated Returns CT form generally applies to tax-exempt organizations that earn income from activities unrelated to their exempt purposes. This includes various types of entities such as charities, educational institutions, and religious organizations. Understanding the eligibility criteria helps ensure compliance with tax laws.

Create this form in 5 minutes or less

Find and fill out the correct unrelated returns ct gov

Create this form in 5 minutes!

How to create an eSignature for the unrelated returns ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct t and how does it relate to airSlate SignNow?

Ct t refers to the capabilities of airSlate SignNow in streamlining document signing processes. With ct t, businesses can easily send, sign, and manage documents electronically, enhancing efficiency and reducing turnaround times.

-

How much does airSlate SignNow cost?

AirSlate SignNow offers various pricing plans to accommodate different business needs. The cost-effective solutions ensure that you can find a plan that fits your budget while still benefiting from the powerful features associated with ct t.

-

What features does airSlate SignNow offer?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance the ct t experience, making document management and eSigning straightforward and efficient.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document processing. The ct t capabilities allow for faster approvals and improved workflow, ultimately leading to increased productivity and customer satisfaction.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing its ct t functionality. This allows businesses to connect their existing tools and streamline their document workflows without any hassle.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! AirSlate SignNow is designed to be mobile-friendly, allowing users to manage their documents and eSign on the go. This flexibility is a key aspect of ct t, ensuring that you can stay productive from anywhere.

-

What security measures does airSlate SignNow implement?

AirSlate SignNow prioritizes security with features like encryption and secure access controls. These measures ensure that your documents are safe while utilizing ct t for electronic signatures and document management.

Get more for Unrelated Returns CT gov

- Interpretive dance category form

- Brevmall fr frtryckt papper i c4 fnsterkuvert bkiwabbseb form

- Tax receipt form cradles to crayons

- Lmci 0001 application form rev7doc

- Masters fact sheet docx form

- Golf scorecards form

- Domanda per la concessione dellassegno form

- Medical certificate in case of trip cancellation form

Find out other Unrelated Returns CT gov

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney