Unrelated Returns CT Gov 2024-2026

What is the Unrelated Returns CT gov

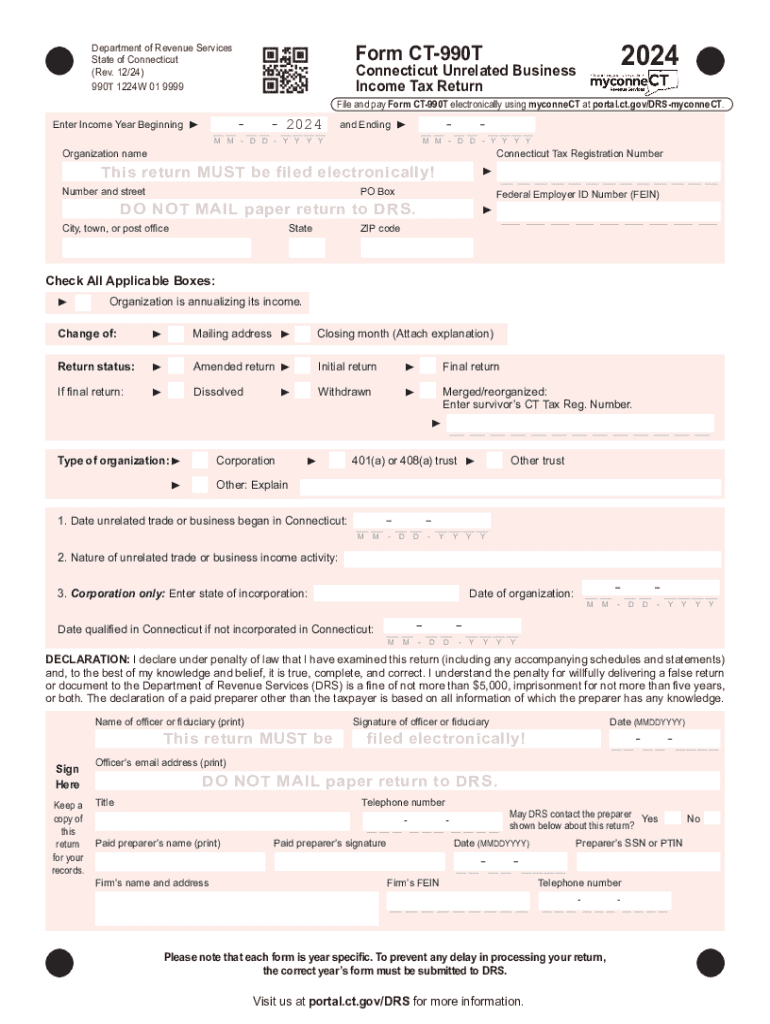

The Unrelated Returns CT form is utilized by organizations to report income that is not substantially related to their exempt purpose. This form is essential for tax-exempt entities, such as charities and non-profits, that engage in activities generating unrelated business income. Understanding this form helps organizations comply with tax regulations while maintaining their tax-exempt status.

Steps to complete the Unrelated Returns CT gov

Completing the Unrelated Returns CT form involves several key steps:

- Gather financial records related to unrelated business income.

- Complete the required sections of the form, detailing income and expenses.

- Ensure all calculations are accurate to avoid penalties.

- Review the completed form for any missing information.

- Submit the form by the appropriate deadline, either online or via mail.

Legal use of the Unrelated Returns CT gov

The legal use of the Unrelated Returns CT form is crucial for maintaining compliance with IRS regulations. Organizations must file this form if they have earned income from activities that are not directly related to their exempt purposes. Proper use ensures that tax-exempt entities do not lose their status due to non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the Unrelated Returns CT form are typically aligned with the organization's fiscal year. It is important for entities to be aware of these dates to avoid late filing penalties. Generally, the form is due on the 15th day of the fifth month after the end of the organization's tax year.

Required Documents

To successfully complete the Unrelated Returns CT form, organizations need to gather several documents, including:

- Financial statements detailing unrelated business income.

- Expense documentation related to the unrelated activities.

- Prior year tax returns, if applicable.

- Any correspondence from the IRS regarding unrelated business income.

Penalties for Non-Compliance

Failure to file the Unrelated Returns CT form can lead to significant penalties. Organizations may face fines and potential loss of their tax-exempt status if they do not comply with filing requirements. It is essential to understand these risks and ensure timely and accurate submissions.

Eligibility Criteria

Eligibility to file the Unrelated Returns CT form generally applies to tax-exempt organizations that earn income from activities unrelated to their exempt purposes. This includes various types of entities such as charities, educational institutions, and religious organizations. Understanding the eligibility criteria helps ensure compliance with tax laws.

Create this form in 5 minutes or less

Find and fill out the correct unrelated returns ct gov

Create this form in 5 minutes!

How to create an eSignature for the unrelated returns ct gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ct t and how does it relate to airSlate SignNow?

Ct t refers to the capabilities of airSlate SignNow in streamlining document signing processes. With ct t, businesses can easily send, sign, and manage documents electronically, enhancing efficiency and reducing turnaround times.

-

How much does airSlate SignNow cost?

AirSlate SignNow offers various pricing plans to accommodate different business needs. The cost-effective solutions ensure that you can find a plan that fits your budget while still benefiting from the powerful features associated with ct t.

-

What features does airSlate SignNow offer?

AirSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to enhance the ct t experience, making document management and eSigning straightforward and efficient.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, businesses can signNowly reduce the time spent on document processing. The ct t capabilities allow for faster approvals and improved workflow, ultimately leading to increased productivity and customer satisfaction.

-

Is airSlate SignNow easy to integrate with other tools?

Yes, airSlate SignNow offers seamless integrations with various applications, enhancing its ct t functionality. This allows businesses to connect their existing tools and streamline their document workflows without any hassle.

-

Can I use airSlate SignNow on mobile devices?

Absolutely! AirSlate SignNow is designed to be mobile-friendly, allowing users to manage their documents and eSign on the go. This flexibility is a key aspect of ct t, ensuring that you can stay productive from anywhere.

-

What security measures does airSlate SignNow implement?

AirSlate SignNow prioritizes security with features like encryption and secure access controls. These measures ensure that your documents are safe while utilizing ct t for electronic signatures and document management.

Get more for Unrelated Returns CT gov

Find out other Unrelated Returns CT gov

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself