Pass through Entity Tax Information CT Gov 2022

Understanding the Pass Through Entity Tax Information

The Pass Through Entity Tax Information in Connecticut is designed for businesses that operate as pass-through entities, such as partnerships, S corporations, and limited liability companies (LLCs). This form allows these entities to report their income and pay taxes at the entity level, rather than passing the tax burden directly to individual owners. Understanding this form is crucial for compliance with state tax laws and ensuring that all necessary taxes are accurately reported and paid.

Steps to Complete the Pass Through Entity Tax Information

Completing the Pass Through Entity Tax Information requires careful attention to detail. Here are the key steps involved:

- Gather all necessary financial documents, including income statements and expense reports.

- Determine the total income for the entity and any applicable deductions.

- Fill out the form accurately, ensuring all information aligns with your financial records.

- Review the completed form for accuracy and completeness before submission.

- Submit the form through the appropriate channels, whether online or via mail.

Legal Use of the Pass Through Entity Tax Information

The legal use of the Pass Through Entity Tax Information is governed by state tax regulations. It is essential for entities to file this form to comply with Connecticut tax laws. Failure to submit the form can result in penalties and interest on unpaid taxes. Therefore, understanding the legal implications and ensuring compliance is vital for all pass-through entities operating in the state.

Filing Deadlines and Important Dates

Filing deadlines for the Pass Through Entity Tax Information are critical for compliance. Typically, the form must be submitted by the due date of the entity's tax return. For most entities, this is the fifteenth day of the fourth month following the close of the tax year. It is important to keep track of these dates to avoid late fees and penalties.

Required Documents for Submission

To complete the Pass Through Entity Tax Information, certain documents are required. These may include:

- Financial statements showing income and expenses.

- Supporting documentation for any deductions claimed.

- Previous tax returns for reference.

Having these documents prepared in advance can streamline the filing process and ensure accuracy.

Examples of Using the Pass Through Entity Tax Information

Examples of using the Pass Through Entity Tax Information can include various business scenarios. For instance, an LLC that generates income from services provided may need to file this form to report its earnings. Similarly, a partnership that shares profits among its partners will also utilize this form to comply with tax obligations. Understanding these examples can help entities recognize the importance of accurate reporting.

Quick guide on how to complete pass through entity tax information ctgov

Accomplish Pass Through Entity Tax Information CT gov effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an excellent environmentally-friendly substitute for traditional printed and signed papers, as you can locate the appropriate form and securely store it in the cloud. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Pass Through Entity Tax Information CT gov on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to adjust and eSign Pass Through Entity Tax Information CT gov effortlessly

- Find Pass Through Entity Tax Information CT gov and click on Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers explicitly for that purpose.

- Create your signature using the Sign feature, which takes only moments and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from a device of your choice. Adjust and eSign Pass Through Entity Tax Information CT gov to ensure excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct pass through entity tax information ctgov

Create this form in 5 minutes!

How to create an eSignature for the pass through entity tax information ctgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

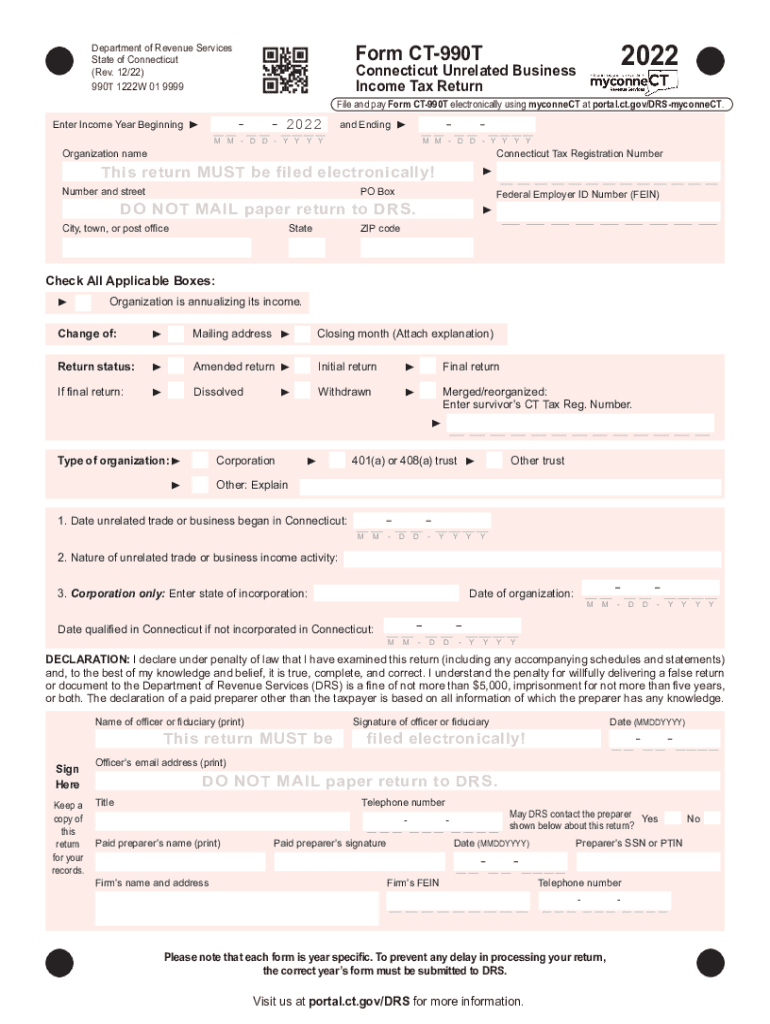

What is the ct 990t and how does it work with airSlate SignNow?

The ct 990t is a powerful tool that integrates seamlessly with airSlate SignNow, allowing users to streamline their document signing process. With this feature, businesses can send, sign, and manage documents efficiently, reducing time and effort. The ct 990t enhances your workflow by providing secure and legally binding eSignatures.

-

What are the pricing options for using the ct 990t with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that include access to the ct 990t functionality. You can choose from various subscription tiers based on your business needs, whether you're a small startup or a large enterprise. Visit our pricing page for detailed information on plans and features included with the ct 990t.

-

What features does the ct 990t offer to enhance document signing?

The ct 990t includes features such as customizable templates, audit trails, and robust security measures. These tools not only improve the efficiency of document signing but also ensure compliance with legal standards. By utilizing the ct 990t, users can accelerate their document workflows and enhance productivity.

-

How does the ct 990t benefit businesses looking to improve their document processes?

The ct 990t provides businesses with signNow advantages, including reduced turnaround times and increased accuracy in document management. By automating the signing process, companies can experience improved customer satisfaction and enhanced operational efficiency. The ct 990t is a cost-effective solution for businesses seeking to optimize their document workflows.

-

Is the ct 990t easy to integrate with existing software systems?

Yes, the ct 990t is designed for easy integration with a variety of software systems and applications. This ensures that businesses can maintain their existing workflows while benefiting from the powerful features of airSlate SignNow. Integration is straightforward, allowing teams to start using the ct 990t without signNow disruption.

-

Can the ct 990t support multiple users and team collaboration?

Absolutely! The ct 990t supports multi-user functionality, making it ideal for teams collaborating on document signing. Each team member can participate seamlessly in the signing process, ensuring that everyone stays informed and engaged. This feature promotes teamwork and enhances overall efficiency in document management.

-

What security measures are in place for the ct 990t?

The ct 990t comes equipped with robust security features, including encryption and secure access controls. This ensures that all documents signed using airSlate SignNow are safe and compliant with industry regulations. Users can trust that their sensitive information is protected when utilizing the ct 990t for document signing.

Get more for Pass Through Entity Tax Information CT gov

- Common carrier form

- Agreement of general contractor for workers compensation tennessee form

- Notice of termination of agreement general contractor for workers compensation tennessee form

- Tennessee workers compensation 497326957 form

- Tennessee annual file form

- Notices resolutions simple stock ledger and certificate tennessee form

- Minutes organizational meeting 497326960 form

- Sample transmittal letter to secretary of states office to file articles of incorporation tennessee tennessee form

Find out other Pass Through Entity Tax Information CT gov

- Can I Sign Utah Executive Summary Template

- Sign Washington Executive Summary Template Free

- Sign Connecticut New Hire Onboarding Mobile

- Help Me With Sign Wyoming CV Form Template

- Sign Mississippi New Hire Onboarding Simple

- Sign Indiana Software Development Proposal Template Easy

- Sign South Dakota Working Time Control Form Now

- Sign Hawaii IT Project Proposal Template Online

- Sign Nebraska Operating Agreement Now

- Can I Sign Montana IT Project Proposal Template

- Sign Delaware Software Development Agreement Template Now

- How To Sign Delaware Software Development Agreement Template

- How Can I Sign Illinois Software Development Agreement Template

- Sign Arkansas IT Consulting Agreement Computer

- Can I Sign Arkansas IT Consulting Agreement

- Sign Iowa Agile Software Development Contract Template Free

- How To Sign Oregon IT Consulting Agreement

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement