Form 974 County Assessor Informal Protest 2024-2026

Understanding the Form 974 County Assessor Informal Protest

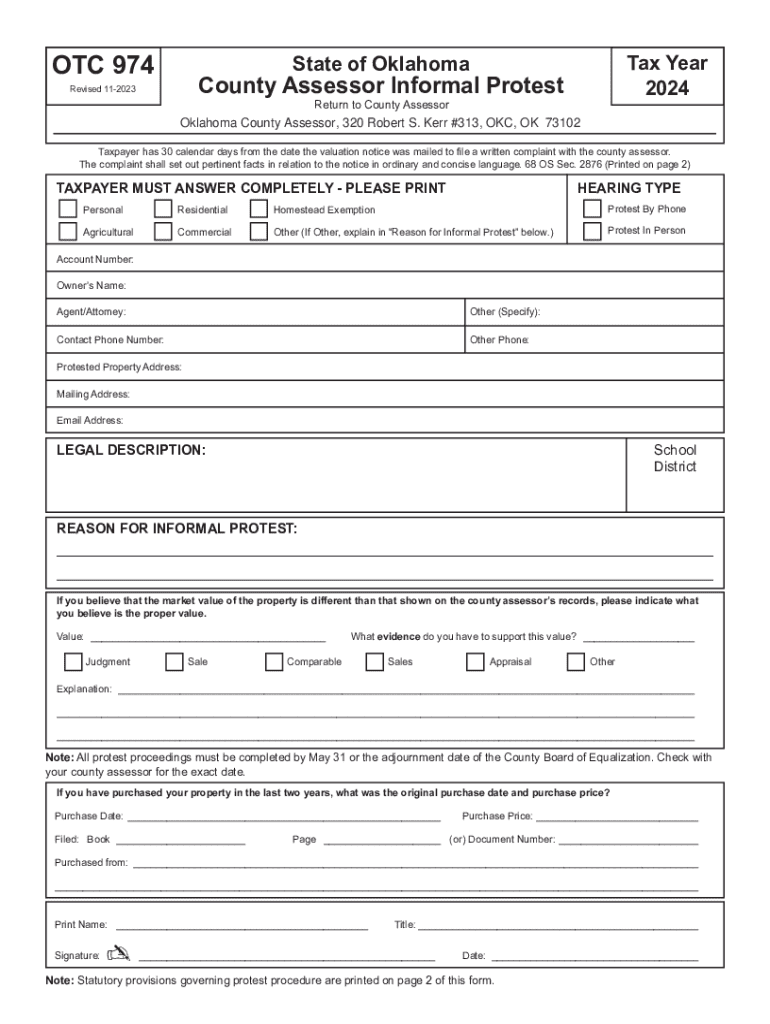

The Form 974 is utilized by property owners in the United States to formally protest the assessed value of their property as determined by the county assessor. This form serves as a means for individuals to express their disagreement with the valuation and seek a reassessment. It is particularly important during the property tax assessment period, allowing taxpayers to ensure they are not overpaying on their property taxes.

Steps to Complete the Form 974 County Assessor Informal Protest

Completing the Form 974 involves several key steps:

- Gather necessary information about your property, including the current assessed value, property details, and any relevant documentation that supports your claim.

- Clearly state the reasons for your protest. This may include evidence of comparable property values or errors in the assessment.

- Fill out the form accurately, ensuring all sections are completed as required. Any omissions can delay the processing of your protest.

- Submit the form by the specified deadline to ensure consideration of your protest.

How to Obtain the Form 974 County Assessor Informal Protest

The Form 974 can typically be obtained from your county assessor's office. Many counties also provide downloadable versions of the form on their official websites. It is advisable to check the specific requirements and availability for your county, as they may vary.

Legal Use of the Form 974 County Assessor Informal Protest

The legal use of the Form 974 is grounded in property tax law, allowing property owners to formally dispute assessments they believe are inaccurate. It is crucial to adhere to local regulations and deadlines when filing this form to ensure that your protest is valid and recognized by the county assessor's office.

Key Elements of the Form 974 County Assessor Informal Protest

When filling out the Form 974, several key elements must be included:

- Your personal information, including name, address, and contact details.

- Details of the property in question, such as the address and parcel number.

- The current assessed value and the value you believe is correct.

- A clear explanation of your reasons for the protest, supported by any relevant documentation.

Filing Deadlines / Important Dates

Filing deadlines for the Form 974 can vary by county, but it is generally required to be submitted within a specific timeframe following the assessment notice. It is important to check with your local county assessor's office to confirm the exact dates and avoid missing the opportunity to protest.

Create this form in 5 minutes or less

Find and fill out the correct form 974 county assessor informal protest

Create this form in 5 minutes!

How to create an eSignature for the form 974 county assessor informal protest

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is otc 974 and how does it relate to airSlate SignNow?

otc 974 refers to a specific feature within airSlate SignNow that enhances document management and eSigning capabilities. This feature allows users to streamline their workflows, making it easier to send and sign documents securely and efficiently.

-

How much does airSlate SignNow cost for users interested in otc 974?

The pricing for airSlate SignNow, including the otc 974 feature, is competitive and designed to fit various business needs. Users can choose from different plans that offer flexibility and scalability, ensuring that they only pay for what they need.

-

What are the key features of airSlate SignNow's otc 974?

The otc 974 feature includes advanced eSigning capabilities, customizable templates, and real-time tracking of document status. These features help businesses improve their efficiency and reduce turnaround times for important documents.

-

How can otc 974 benefit my business?

By utilizing otc 974, businesses can enhance their document workflow, reduce paper usage, and improve compliance with legal standards. This leads to faster transactions and a more environmentally friendly approach to document management.

-

Does airSlate SignNow with otc 974 integrate with other software?

Yes, airSlate SignNow, including the otc 974 feature, offers seamless integrations with various third-party applications. This allows businesses to connect their existing tools and streamline their processes without disruption.

-

Is it easy to use the otc 974 feature in airSlate SignNow?

Absolutely! The otc 974 feature is designed with user-friendliness in mind, making it accessible for users of all technical levels. The intuitive interface ensures that anyone can quickly learn how to send and eSign documents.

-

What types of documents can I manage with otc 974?

With otc 974, users can manage a wide variety of documents, including contracts, agreements, and forms. This versatility makes it an ideal solution for businesses across different industries looking to streamline their document processes.

Get more for Form 974 County Assessor Informal Protest

- Amoeba sisters video recap dihybrid crosses mendelian inheritance form

- Dash diet servings check off form

- Aao transfer form 48000926

- Euthanasia consent form veterinary

- Niu homes house plan pdf form

- Moneygram form pdf

- Child support certification form

- Vat264 second hand goods melwescor melwescor co form

Find out other Form 974 County Assessor Informal Protest

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe