Ohio Sales and Use Tax Contractor's Exemption Certificate Form

Understanding the Ohio Sales and Use Tax Contractor's Exemption Certificate

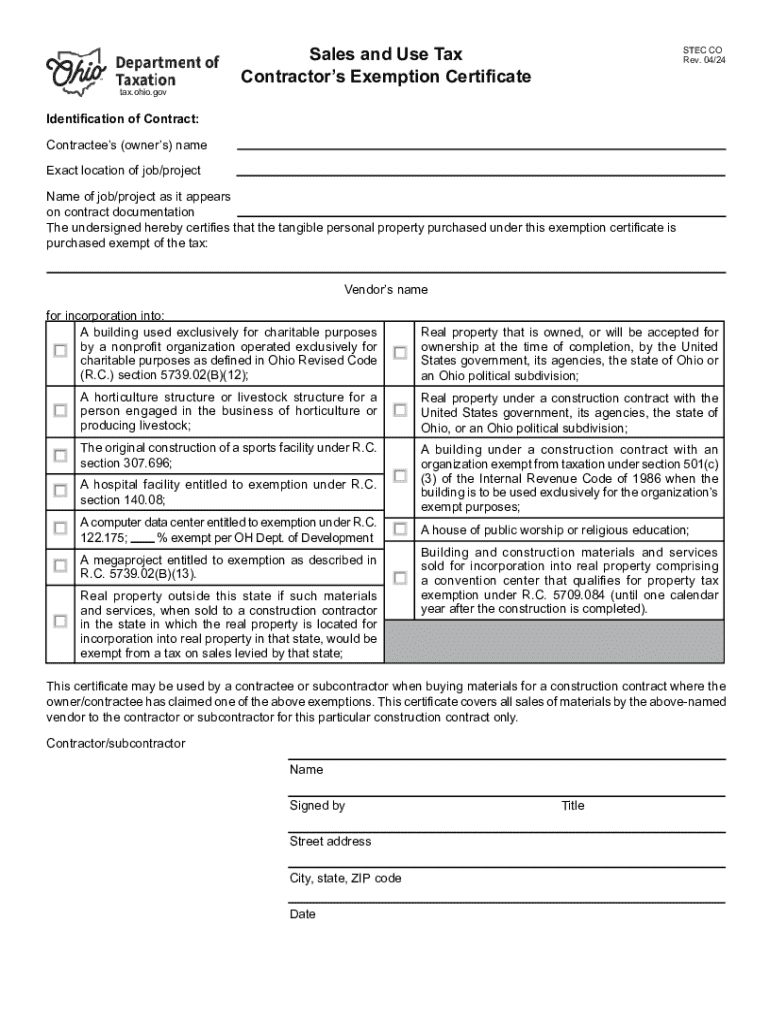

The Ohio Sales and Use Tax Contractor's Exemption Certificate is a crucial document for contractors operating in Ohio. This certificate allows contractors to purchase materials and supplies tax-free when these items are intended for use in construction projects. By using this exemption certificate, contractors can reduce their overall project costs, making it an essential tool for managing finances in the construction industry.

How to Use the Ohio Sales and Use Tax Contractor's Exemption Certificate

To utilize the Ohio Sales and Use Tax Contractor's Exemption Certificate, contractors must present the certificate to suppliers when purchasing materials. It is important to ensure that the certificate is filled out correctly and includes all necessary information, such as the contractor's name, address, and tax identification number. This certificate should only be used for items that will be incorporated into real property as part of a construction project.

Steps to Complete the Ohio Sales and Use Tax Contractor's Exemption Certificate

Completing the Ohio Sales and Use Tax Contractor's Exemption Certificate involves several straightforward steps:

- Obtain the exemption certificate form, which can be found on the Ohio Department of Taxation website.

- Fill in your business name, address, and tax identification number accurately.

- Specify the type of construction work you perform.

- Sign and date the certificate to validate it.

Once completed, provide this certificate to your suppliers when making tax-exempt purchases.

Legal Use of the Ohio Sales and Use Tax Contractor's Exemption Certificate

The legal use of the Ohio Sales and Use Tax Contractor's Exemption Certificate is strictly regulated. Contractors must ensure that they only use the certificate for eligible purchases related to their construction activities. Misuse of the certificate, such as using it for personal purchases or non-qualifying items, can lead to penalties and fines. It is essential for contractors to understand the legal implications and to maintain accurate records of all transactions made using the exemption certificate.

Eligibility Criteria for the Ohio Sales and Use Tax Contractor's Exemption Certificate

To qualify for the Ohio Sales and Use Tax Contractor's Exemption Certificate, contractors must meet specific eligibility criteria. These include being a registered contractor in Ohio and engaging in construction activities that involve the incorporation of materials into real property. Additionally, contractors must have a valid tax identification number and comply with all state regulations regarding sales and use tax. Understanding these criteria is vital for ensuring compliance and avoiding potential issues with tax authorities.

Examples of Using the Ohio Sales and Use Tax Contractor's Exemption Certificate

Contractors can use the Ohio Sales and Use Tax Contractor's Exemption Certificate in various scenarios. For instance, a contractor purchasing lumber, concrete, or roofing materials for a new building project can present the exemption certificate to avoid sales tax on these items. Similarly, if a contractor is buying fixtures and fittings that will be installed in a property, they can use the certificate to ensure that these purchases are tax-exempt. These examples illustrate the practical benefits of the exemption certificate in reducing costs associated with construction projects.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ohio sales and use tax contractors exemption certificate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Ohio contractors certificate?

An Ohio contractors certificate is a legal document that verifies a contractor's qualifications and compliance with state regulations. It is essential for contractors operating in Ohio to obtain this certificate to ensure they can legally perform construction work and protect their clients.

-

How can airSlate SignNow help with obtaining an Ohio contractors certificate?

airSlate SignNow streamlines the process of applying for an Ohio contractors certificate by allowing you to easily fill out and eSign necessary documents. Our platform simplifies document management, ensuring you can submit your application quickly and efficiently.

-

What are the costs associated with obtaining an Ohio contractors certificate?

The costs for obtaining an Ohio contractors certificate can vary based on the type of work you intend to perform and local regulations. Using airSlate SignNow can help reduce administrative costs by providing a cost-effective solution for managing your documentation needs.

-

What features does airSlate SignNow offer for contractors?

airSlate SignNow offers features such as eSigning, document templates, and secure cloud storage, which are essential for contractors managing their Ohio contractors certificate applications. These features enhance efficiency and ensure compliance with state requirements.

-

Are there any benefits to using airSlate SignNow for contractors?

Yes, using airSlate SignNow provides numerous benefits for contractors, including faster document turnaround times and improved organization. This can be particularly advantageous when applying for an Ohio contractors certificate, as it helps you stay on top of deadlines and requirements.

-

Can I integrate airSlate SignNow with other tools I use?

Absolutely! airSlate SignNow offers integrations with various tools and platforms, making it easy to incorporate into your existing workflow. This flexibility is beneficial for contractors managing their Ohio contractors certificate and other documentation.

-

How secure is the document signing process with airSlate SignNow?

The document signing process with airSlate SignNow is highly secure, utilizing encryption and authentication measures to protect your sensitive information. This security is crucial for contractors handling their Ohio contractors certificate and other important documents.

Get more for Ohio Sales And Use Tax Contractor's Exemption Certificate

Find out other Ohio Sales And Use Tax Contractor's Exemption Certificate

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT